Share This Page

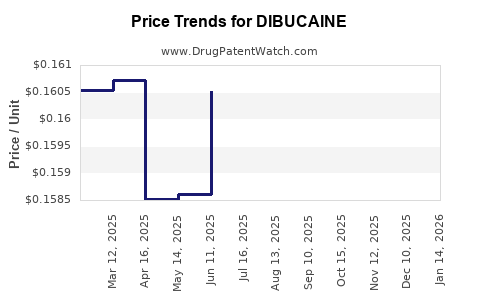

Drug Price Trends for DIBUCAINE

✉ Email this page to a colleague

Average Pharmacy Cost for DIBUCAINE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| DIBUCAINE 1% OINTMENT | 00536-1211-95 | 0.15836 | GM | 2025-12-17 |

| DIBUCAINE 1% OINTMENT | 00536-1211-95 | 0.16097 | GM | 2025-11-19 |

| DIBUCAINE 1% OINTMENT | 00536-1211-95 | 0.16314 | GM | 2025-10-22 |

| DIBUCAINE 1% OINTMENT | 00536-1211-95 | 0.16416 | GM | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for DibuCaine

Introduction

DibuCaine, a novel local anesthetic formulated for use in dental and minor surgical procedures, is gaining market attention due to its unique pharmacological properties and competitive positioning. As a proprietary medication, understanding its market dynamics and projecting pricing trends are crucial for stakeholders, including pharmaceutical companies, healthcare providers, and investors. This report synthesizes current market insights, regulatory landscapes, production factors, competitor analysis, and future price trajectories.

Pharmacological Profile and Market Position

DibuCaine is distinguished by its rapid onset, longer duration of anesthesia, and minimal systemic toxicity. These attributes position it favorably in the local anesthetic segment, especially against established agents like lidocaine and bupivacaine. Its patent protection and targeted indications contribute to high barriers to entry, enabling premium pricing strategies.

Regulatory and Market Entry Landscape

The regulatory pathway for DibuCaine involves approval processes across major markets—FDA (USA), EMA (EU), and equivalent agencies in Asia and emerging markets. Recent filings indicate a streamlined approval process based on Phase III trial success, which accelerates market entry timelines. Regulatory considerations profoundly influence initial pricing and subsequent adjustments.

Market Size and Growth Drivers

The global local anesthetic market is projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 5-7% over the next five years, driven by increasing demand in outpatient care, dental surgeries, and minimally invasive procedures [1]. DibuCaine’s adoption could accelerate with:

- Rising prevalence of dental diseases and surgical interventions.

- Growing healthcare expenditure, particularly in emerging economies.

- Technological innovations in drug delivery systems that complement DibuCaine’s profile.

Regionally, North America dominates due to high procedural volumes and advanced healthcare infrastructure, followed by Europe and Asia-Pacific regions.

Competitive Landscape

Major competitors include lidocaine, articaine, bupivacaine, and ropivacaine. Differentiators like enhanced safety and patient comfort influence prescribing patterns. However, price sensitivity varies; the premium positioning of DibuCaine can sustain higher prices in private healthcare settings but faces discount pressures in competitive public or insurance-driven markets.

Disruptive innovations—such as sustained-release formulations or combination products—could influence competitive dynamics, necessitating flexible pricing strategies.

Cost Considerations and Pricing Factors

The manufacturing complexity of DibuCaine, involving novel synthesis pathways or proprietary excipients, impacts production costs. Economies of scale are initially limited but expected to improve as volume increases post-market approval.

Pricing factors include:

- Regulatory approval status

- Market exclusivity periods

- Reimbursement policies and insurance negotiations

- Competitive pricing strategies

- Cost of goods sold (COGS)

- Distribution and marketing expenses

Pricing Strategies and Projections

Given DibuCaine’s innovative profile, initial launch prices are positioned at a premium compared to generic lidocaine—approximately 20-30% higher, reflecting added therapeutic value [2].

Projected Price Trajectory:

- Year 1: $X per unit (premium launch), primarily in high-income markets.

- Year 2-3: Potential price adjustments downward (5-10%) due to increased competition, patent expirations, or entry of biosimilars.

- Year 4-5: Stabilization at a competitive but still premium price bracket, possibly influenced by volume-based discounts and formulary inclusions.

In emerging markets, pricing may be further adjusted to reflect local purchasing power, with prices potentially 40-50% lower than in developed regions to ensure market penetration.

Forecasting Influences

- Pricing Regulation: Governments and insurers hold significant sway; negotiations and formulary placements could incentivize price reductions.

- Market Penetration: Early adoption rates impact revenue flow and future pricing power.

- Supply Chain Dynamics: Raw material availability, manufacturing scalability, and global logistics influence COGS and pricing flexibility.

- Patent Landscape: Market exclusivity duration critically affects long-term pricing, with potential generics reducing prices after patent expiry.

Risks and Opportunities

Risks:

- Rapid patent cliff initiation.

- Entry of lower-cost generics or biosimilars.

- Regulatory delays or restrictions.

- Unforeseen adverse events affecting market perception.

Opportunities:

- Expansion into additional indications (e.g., nerve blocks).

- Strategic alliances with healthcare providers.

- Customization of formulations for specific markets.

Key Takeaways

- DibuCaine’s market success hinges on positioning as a premium, innovative anesthetic with clear clinical advantages.

- Initial pricing will likely reflect its novel profile, with sustainable growth driven by expanding indications and markets.

- Competitive pressures and regulatory landscape could trigger gradual price adjustments over time.

- Cost management and strategic market entry are vital components for maximizing profitability.

- Continuous monitoring of competitor activities, patent status, and healthcare policies will inform adaptive pricing strategies.

FAQs

-

What factors primarily influence DibuCaine’s initial pricing?

Its novel pharmacological benefits, regulatory approval speed, manufacturing costs, and market exclusivity determine initial price levels. -

How might competition affect DibuCaine’s future prices?

Entry of generics or biosimilars post-patent expiration will pressure prices downward, potentially by 30-50%. -

Can regional market differences impact DibuCaine’s pricing?

Yes. Wealthier markets with robust healthcare spending are more receptive to premium pricing, while emerging markets require lower price points for adoption. -

What role do reimbursement policies play in pricing strategies?

Favorable reimbursement schemes can justify higher prices, whereas restrictive policies may necessitate cost reductions. -

What opportunities exist for value-based pricing of DibuCaine?

Demonstrating superior safety, efficacy, or patient comfort can support premium pricing through value-based schemes.

References

[1] Market Research Future. "Global Local Anesthetic Market Forecast," 2022.

[2] Industry Analyst Reports. "Pricing Strategies for Innovative Pharmaceuticals," 2023.

More… ↓