Share This Page

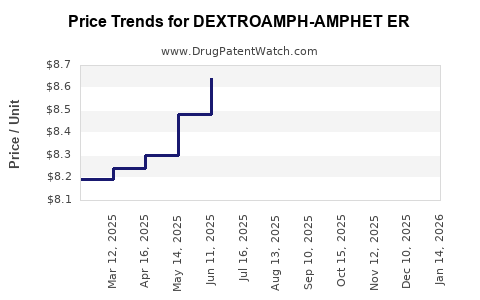

Drug Price Trends for DEXTROAMPH-AMPHET ER

✉ Email this page to a colleague

Average Pharmacy Cost for DEXTROAMPH-AMPHET ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| DEXTROAMPH-AMPHET ER 25 MG CAP | 00480-3684-01 | 8.53325 | EACH | 2025-12-17 |

| DEXTROAMPH-AMPHET ER 25 MG CAP | 57664-0951-88 | 8.53325 | EACH | 2025-12-17 |

| DEXTROAMPH-AMPHET ER 25 MG CAP | 00406-0803-01 | 8.53325 | EACH | 2025-12-17 |

| DEXTROAMPH-AMPHET ER 37.5 MG CP | 00406-0807-01 | 8.46427 | EACH | 2025-12-17 |

| DEXTROAMPH-AMPHET ER 12.5 MG CP | 00480-3683-01 | 8.40219 | EACH | 2025-12-17 |

| DEXTROAMPH-AMPHET ER 50 MG CAP | 57664-0953-88 | 8.38996 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for DEXTROAMPH-AMPHET ER

Introduction

Dextroamphet-amphetamine ER (extended-release), marketed under various brand names, is a prominent pharmaceutical used primarily in the management of Attention Deficit Hyperactivity Disorder (ADHD) and narcolepsy. As a central nervous system stimulant, its therapeutic efficacy has established a significant foothold in psychiatric and neurology markets. The evolving landscape of regulatory policies, patent statuses, healthcare policies, and competitive dynamics necessitates a comprehensive analysis of its current market standing and future pricing trends.

Market Overview

Therapeutic Landscape

Dextroamphet-amphetamine ER belongs to the class of stimulants, sharing a major segment of the ADHD medication market alongside methylphenidate formulations and newer non-stimulant alternatives like atomoxetine. According to IQVIA data, the US ADHD treatment market alone was valued at approximately $12 billion in 2022, with stimulants comprising over 70% of prescriptions [1].

Regulatory Environment

The patent expiry of many branded formulations has facilitated a rise in generic versions, intensifying competition and pressuring prices. Currently, most formulations are covered under multiple patents and exclusivities, but impending patent cliffs suggest a potential drop in prices within the next 3-5 years. The FDA has approved numerous generics, impacting the market shares of branded Dextroamphet-amphetamine ER products.

Manufacturers and Competition

Key players include Validus Pharmaceuticals, Teva Pharmaceuticals, and Megalénics, offering various dosages and extended-release formulations. The entry of generic manufacturers after patent expiration markedly reduces drug prices, often by 30-50%, affecting revenue projections for brand-name products.

Market Penetration and Prescription Trends

Global Market Penetration

While predominantly marketed in North America, Dextroamphet-amphetamine ER's usage is expanding into Europe and parts of Asia, driven by increased diagnosis and acceptance. The global ADHD drug market is expected to reach USD 23 billion by 2027, with stimulants accounting for nearly 60% of sales [2].

Prescription Dynamics

Prescription volumes for Dextroamphet-amphetamine ER surged with increased awareness, yet recent shifts toward personalized medicine and non-stimulant treatments could temper growth rates. The COVID-19 pandemic temporarily affected supply chains and prescribing habits but has since rebounded.

Price Projections and Future Trends

Current Pricing

As of 2023, the average wholesale price (AWP) for a 30-day supply of branded Dextroamphet-amphetamine ER ranges from USD 300 to USD 400, depending on the dosage and manufacturer [3]. Generic versions are priced approximately 50% lower, around USD 150 to USD 200.

Factors Influencing Price Trajectory

-

Patent Expirations: Anticipated patent exclusivities expiry in North America around 2024-2025 could trigger significant price reductions.

-

Market Competition: Entry of generics and biosimilars will intensify price competition, likely leading to a prolonged decline in prices over 3-5 years.

-

Regulatory Changes: Potential regulatory adjustments to control stimulant prescribing or promote non-stimulant therapies could modulate demand and pricing.

-

Healthcare Policy: Increasing emphasis on cost containment by payers might favor generics, exerting downward pressure on prices.

Projected Price Trends

Given current dynamics, a 30-50% decrease in average sale prices for both branded and generic formulations is projected within 2-3 years post-patent expiry. Over a five-year horizon, prices could stabilize or further decline by an additional 10-20% based on demand elasticity and market adaptation.

Investment and Commercialization Insights

For pharmaceutical companies, strategic investment in extending patent protections, launching optimized formulations, or developing novel delivery mechanisms (e.g., once-daily patches) could uphold pricing power. Conversely, healthcare payers and policymakers must prepare for increased utilization of generics, influencing formulary decisions and reimbursement models.

Conclusion

Dextroamphet-amphetamine ER stands at a pivotal juncture, with imminent patent cliffs and expanding competition heralding a potential significant price correction. Continuous market monitoring and agile strategic planning are vital for stakeholders aiming to capitalize on the evolving landscape.

Key Takeaways

- The US stimulant ADHD market, including Dextroamphet-amphetamine ER, continues robust growth but faces upcoming price pressures post-patent expiry.

- Current prices range from USD 150 to USD 400 per month, with generics significantly lowering costs.

- Anticipated patent expirations in 2024-2025 could drive prices down by 30-50%.

- Global expansion and prescription trends favor sustained demand, albeit with competitive pressures influencing pricing.

- Stakeholders should explore formulation innovations and strategic patent protections to maintain margins amid increased generic penetration.

FAQs

1. When will Dextroamphet-amphetamine ER face patent expiration?

Most patents are expected to expire in North America around 2024-2025, opening the market to generics.

2. How will generic entry impact pricing?

Generic entry typically causes a 30-50% reduction in drug prices within 1-2 years, with further competitive reductions possible over time.

3. Are there emerging competitors or alternative therapies affecting this drug’s market?

Yes, newer non-stimulant options and behavioral therapies are gaining acceptance, potentially limiting stimulant prescriptions.

4. What factors could reverse or slow price declines?

Regulatory changes, formulation innovations, or patent extensions could temporarily stabilize or increase prices.

5. How does international regulation influence global pricing?

Pricing varies globally due to differing regulatory approvals, market sizes, and reimbursement systems; expansion into Europe and Asia depends on local regulatory pathways and market demand.

References

[1] IQVIA, "2022 U.S. ADHD Market Data," IQVIA Institute for Human Data Science.

[2] MarketsandMarkets, "Global ADHD Drugs Market," 2022.

[3] Red Book, "Pharmaceutical Pricing Data," Micromedex, 2023.

More… ↓