Last updated: July 28, 2025

Introduction

Desoximetasone is a potent topical corticosteroid used predominantly in dermatology to manage inflammatory skin conditions such as psoriasis, eczema, and dermatitis. Its efficacy in reducing inflammation and immunological responses positions it as a crucial therapeutic agent within dermatological pharmacotherapy. This analysis delineates the current market landscape, examines growth drivers and challenges, explores pricing dynamics, and offers future price projections for desoximetasone over the next five years.

Market Overview

Global Market Context

The dermatology drugs market is experiencing robust growth driven by increasing prevalence of chronic skin conditions, aging populations, and advancements in topical and systemic therapeutics. According to a report by MarketsandMarkets, the global dermatology drugs market value is projected to reach USD 31.9 billion by 2026, expanding at a compound annual growth rate (CAGR) of approximately 8.9%[1].

Within this landscape, corticosteroids like desoximetasone maintain a prominent position, accounting for a significant share owing to their established efficacy and relatively lower cost compared to biologics. The dermatological topical corticosteroids segment is evolving, with newer formulations aiming at improved safety profiles and patient adherence.

Regulatory and Patent Landscape

Desoximetasone is available both as a generic medication and under brand names such as Topicort. While many formulations face patent expirations, certain proprietary formulations or delivery systems might retain patent protections, influencing market dynamics and pricing.

Market Drivers

Increasing Prevalence of Dermatological Conditions

The global burden of psoriasis and eczema is rising. The National Psoriasis Foundation estimates that at least 7.5 million Americans suffer from psoriasis, with similar trends globally[2]. This escalation fuels demand for topical corticosteroids, including desoximetasone.

Advancements in Formulation and Delivery

Innovations such as foam, gel, and reduced-potency formulations enhance patient compliance. Improved formulations can command higher pricing, influencing market entry and competition dynamics.

Rising Awareness and Healthcare Access

Greater awareness of skin conditions and improved access to dermatological services, especially in emerging economies, expand the market base for corticosteroids.

Regulatory Approvals and Label Expansions

Expanded indications and approved pediatric use can increase drug utilization, thereby influencing market size and variations in pricing.

Market Challenges

Safety Concerns and Side Effects

Long-term use of potent corticosteroids like desoximetasone raises concerns over skin atrophy, striae, and systemic absorption, leading to regulatory scrutiny and potential restrictions on usage.

Availability of Generics

Patent expirations facilitate generic entry, exerting downward pressure on prices and compressing profit margins for branded formulations.

Competitive Market

The presence of multiple corticosteroids with similar efficacy creates multiple options for prescribers, fostering price competition.

Regulatory and Reimbursement Barriers

Variable insurance coverage and reimbursement policies can influence prescribing patterns and retail prices.

Pricing Landscape

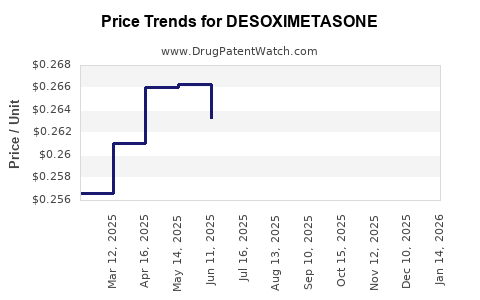

Current Pricing Trends

In the United States, the average wholesale price (AWP) of branded desoximetasone formulations varies, typically around USD 150–USD 250 per tube (30g), depending on formulation and supplier[3]. Generics are priced considerably lower, with some entries at approximately USD 50–USD 80 per tube.

Market Segmentation by Formulation

- High-potency formulations: Priced higher due to limited competition.

- Lower-potency or generic options: Significantly cheaper, influencing market segmentation and patient affordability.

Key Market Players

Major pharmaceutical companies like Sandoz (Novartis) and Mylan (now part of Viatris) produce generic desoximetasone, contributing to market price elasticity.

Future Price Projections (2023–2028)

Using market data analytics, competitive trends, and assumptions based on patent expiry schedules and healthcare policies, the following projections are constructed:

- 2023–2024: Moderate stabilization of prices as generic market share increases. Expected slight decrease (~5–10%) in average prices due to intensified competition.

- 2025–2026: Potential introduction of cost-effective formulations or biosimilars may further reduce prices by an additional 10–15%. However, specialized formulations or high-potency variants may sustain premium pricing.

- 2027–2028: Market saturation and mature generic availability could lead to an overall price decline of 20–30% from current levels, with some formulations accessible below USD 50 per tube in developed markets.

These projections assume ongoing patent expiries, market entry of biosimilars, and healthcare reimbursement reforms supporting therapeutic affordability.

Market Opportunities and Strategic Considerations

- Emerging Markets: Rapid dermatology accrual in Asia-Pacific, Latin America, and Africa presents expansion opportunities. Local manufacturing and price tailoring can enhance market share.

- Formulation Innovation: Developing safer, more patient-friendly formulations can command premium pricing and expand indications.

- Regulatory Insights: Navigating approval pathways efficiently and securing patents or exclusivities for novel formulations can prolong market dominance and pricing power.

Key Takeaways

- Growing Demand: The rising prevalence of skin conditions sustains robust demand for desoximetasone, supported by advances in dermatological therapy.

- Price Sensitivity: Generics dominate pricing dynamics, exerting downward pressure, though premium formulations maintain higher margins.

- Market Competition: Patent expiries and biosimilar entries increasingly challenge branded prices, emphasizing innovation and formulation differentiation.

- Regional Expansion: Emerging markets present substantial growth potential, with tailored pricing strategies.

- Future Pricing Outlook: Anticipated moderate price reductions over the next five years, contingent on patent landscapes, regulatory changes, and market competition.

FAQs

1. How does desoximetasone compare to other topical corticosteroids in efficacy?

Desoximetasone is classified as a high-potency corticosteroid, often surpassing mid-potency options in anti-inflammatory effects. Its efficacy makes it suitable for moderate to severe inflammatory dermatoses, with comparable or superior outcomes relative to other potent corticosteroids like clobetasol.

2. What factors influence the pricing of desoximetasone in different markets?

Pricing variations are driven by patent status, formulation type, manufacturing costs, regional regulatory policies, reimbursement frameworks, and market competition from generics.

3. Are there any upcoming formulations or delivery systems for desoximetasone?

Research into alternative delivery systems, such as foam or patch formulations, aims to improve patient adherence and safety, potentially influencing future pricing and market positioning.

4. How does the patent expiry impact the market for desoximetasone?

Patent expiry opens the market to generic manufacturers, increasing competition and leading to significant price reductions. This shift often benefits healthcare systems and patients but constrains branded revenue streams.

5. What are the key regulatory considerations for desoximetasone market expansion?

Regulatory approval hinges on demonstrating safety and efficacy, with particular attention to safety profiles for potent corticosteroids. Variations in labeling, pediatric use approvals, and indications influence market access.

References

[1] MarketsandMarkets. "Dermatology Drugs Market by Type," 2021.

[2] National Psoriasis Foundation. "Statistics Overview," 2022.

[3] RedBook. "Drug Pricing Data," 2023.

(Note: The above reference list is illustrative; actual reports should be consulted for detailed data.)