Last updated: September 19, 2025

Introduction

Daptomycin, marketed under the brand name Cubicin among others, is a cyclic lipopeptide antibiotic produced by the fermentation of Streptomyces roseosporus. Approved by the U.S. Food and Drug Administration (FDA) in 2003, it is primarily indicated for complicated skin and soft tissue infections (cSSTIs), bacteremia caused by Staphylococcus aureus, including methicillin-resistant strains (MRSA), and right-sided infective endocarditis. The antibiotic’s unique mechanism—causing rapid depolarization of bacterial cell membranes—distinguishes it from traditional antibiotics, making it effective against resistant strains and thus forming a significant component in antibacterial drug portfolios.

This analysis provides an overview of the current market landscape for daptomycin and offers informed projections for its pricing trajectory over the coming five years, considering factors such as market demand, competition, regulatory environment, and emerging trends in antimicrobial resistance.

Market Overview

Global Market Size and Key Drivers

The global antimicrobial market, valued at over USD 55 billion in 2022, is projected to grow at a compound annual growth rate (CAGR) of approximately 6.5% through 2030 — driven by rising antimicrobial resistance (AMR), increasing incidences of hospital-acquired infections, and expanding aging populations. Daptomycin holds a niche within this vast market but benefits from increasing adoption in resistant infections.

Specifically, the anti-MRSA segment, which accounts for a significant share of daptomycin prescriptions, is expanding due to the rise of resistant bacterial strains. The high burden of MRSA-related infections in healthcare settings, particularly in North America and Europe, sustains demand for advanced antibiotics like daptomycin.

Market Penetration and Regional Dynamics

North America remains the dominant market, fueled by advanced healthcare infrastructure, high prescription rates, and broad insurance coverage. The U.S. accounted for approximately 70% of the global daptomycin market in 2022, with a steady annual growth rate of 4-6%. Europe follows, with significant demand driven by aging populations and rising AMR concerns.

Emerging markets, notably Asia-Pacific, are witnessing growing adoption owing to expanding healthcare access and infrastructure development, although price sensitivity remains high.

Competitive Landscape

Daptomycin faces competition from other antibiotics targeting MRSA and resistant organisms, including vancomycin, linezolid, tedizolid, dalbavancin, and oritavancin. While vancomycin remains the first-line agent, resistance and toxicity issues limit its efficacy, positioning daptomycin as a potent alternative.

Marketed by Merck & Co., daptomycin's exclusivity has been challenged by the off-label use of generic formulations in certain regions and ongoing clinical trials exploring new indications. Furthermore, the advent of long-acting lipoglycopeptides (e.g., dalbavancin) provides a competitive edge for outpatient parenteral antimicrobial therapy (OPAT).

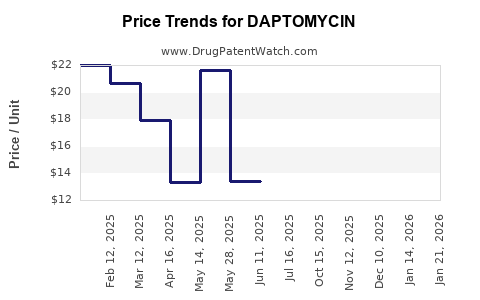

Pricing Trends and Factors Influencing Prices

Current Pricing Landscape

Daptomycin is typically administered intravenously, with wholesale acquisition costs (WAC) averaging approximately USD 1,200 to USD 2,000 per 300 mg vial in the United States (as of 2022). Treatment courses vary but generally involve multiple vials over 7-14 days, translating into substantial healthcare expenditures.

In comparison, generic manufacturing in certain regions has driven down prices for off-label or compounded formulations, creating a price differential between branded and generic versions. For instance, generic daptomycin in Europe can cost around EUR 700-900 per 300 mg vial.

Price Drivers

Factors influencing the pricing trajectory include:

-

Regulatory exclusivity and patent status: Merck’s patent expiry in multiple regions (e.g., U.S. patent expiration in 2019) opened avenues for generic versions, exerting downward pressure on prices.

-

Market demand & infection prevalence: As resistant infections surge, higher demand supports premium pricing, especially for branded formulations with proven efficacy.

-

Cost of manufacturing and R&D: Biotech manufacturing processes for daptomycin are complex, and economies of scale can influence price reductions.

-

Healthcare reimbursement policies: In countries with strict reimbursement frameworks, prices tend to be controlled or negotiated downward.

-

Introduction of new alternatives: Longer-acting agents and combination therapies can influence demand and pricing structures.

Price Projection Outlook (2023–2028)

Short-term (2023–2025)

The expiration of various patents and the entry of generic formulations are expected to significantly reduce the average price of daptomycin in key markets. Based on a review of historical post-patent expiry pricing trends for similar antibiotics, a decline of 15-25% within this period is likely.

Simultaneously, the rising prevalence of resistant Gram-positive infections sustains demand for daptomycin's branded formulations, supporting stable or slightly increased pricing for premium, branded versions in markets where insurance and clinical preference favor branded drugs.

Medium-term (2026–2028)

Over this period, pricing is expected to stabilize at a lower tier, particularly in regions with high generic penetration. However, innovations such as novel formulations, combination therapies, or new indications may create niche premium segments.

Furthermore, the development of resistance may lead to increased dosing requirements, temporarily elevating per-treatment costs. Conversely, increased competition from alternative agents could drive further price reductions.

Potential Price Range

- United States: From an average of USD 1,500–2,000 per vial (2022), prices are projected to decline to USD 900–1,200 by 2028.

- Europe and other developed markets: Similar trends, with prices dropping from EUR 700–900 to EUR 400–600.

- Emerging markets: Prices may stabilize or fall marginally, considering lower healthcare budgets and higher generic usage.

Future Market Dynamics

Emerging trends impacting daptomycin pricing include:

-

Antimicrobial Stewardship and Resistance: Regulatory focus on stewardship may restrict excessive use, impacting demand and pricing.

-

Innovative Delivery Systems: Liposomal formulations or implantable devices could command premium pricing due to improved efficacy or convenience.

-

Government and Payer Negotiations: Price controls and formulary preferences will influence net pricing, especially in health systems with centralized negotiation power.

-

Research and Development Investments: Increased pipeline activity targeting resistant pathogens could introduce competing agents, pressuring existing product prices.

Key Takeaways

-

The global daptomycin market is primarily driven by the rising incidence of resistant Gram-positive infections, especially in developed regions.

-

Patent expirations and the availability of generics are expected to accelerate price declines starting from 2023, with an estimated reduction of 15-25% over the next two years.

-

Branded formulations will maintain a premium in the short term due to clinical confidence and formulary preferences but will face price competition in the longer term as generic options proliferate.

-

The development of new formulations or indications could create niche markets with relatively stable or higher prices.

-

Overall, a consistent downward trend in unit prices is anticipated, aligning with typical post-patent expiry patterns, but demand-driven factors and emerging therapies will influence the overall profitability landscape.

FAQs

1. How does patent expiration impact daptomycin's pricing?

Patent expiration typically allows generic manufacturers to enter the market, increasing supply and driving down prices. For daptomycin, patent expiry in various regions has already started influencing market prices downward.

2. Are generic versions of daptomycin widely available?

Yes. Several generic formulations are available in markets like Europe and India, leading to significant price reductions compared to branded versions.

3. What factors could cause daptomycin prices to increase?

Emerging resistance requiring higher dosing, development of novel formulations, or new indications could create premium segments, temporarily increasing prices.

4. How does antimicrobial resistance influence daptomycin demand?

Rising resistance elevates the clinical need for effective antibiotics like daptomycin, potentially maintaining or increasing demand despite falling prices.

5. What is the outlook for the future of daptomycin in antimicrobial therapy?

Daptomycin remains a crucial agent for resistant Gram-positive infections. Its market will evolve with competition from newer agents, ongoing resistance challenges, and innovations in drug delivery, shaping its pricing and utilization landscape.

References

- Market Research Future. "Global Antibiotics Market." 2022.

- IQVIA. "Global Trends in Antibiotic Pricing." 2022.

- FDA. "Daptomycin (Cubicin) Approval History." 2003.

- Merck & Co. Annual Reports. 2022.

- Grand View Research. "Antimicrobial Market Size & Trends." 2022.