Share This Page

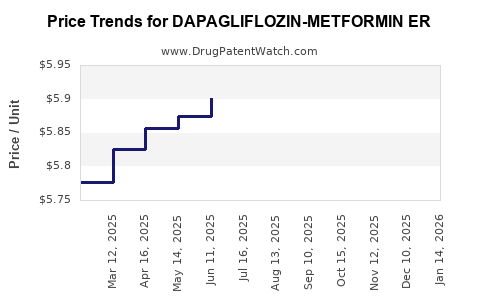

Drug Price Trends for DAPAGLIFLOZIN-METFORMIN ER

✉ Email this page to a colleague

Average Pharmacy Cost for DAPAGLIFLOZIN-METFORMIN ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| DAPAGLIFLOZIN-METFORMIN ER 5-1,000 MG TABLET | 66993-0361-60 | 5.84991 | EACH | 2025-12-17 |

| DAPAGLIFLOZIN-METFORMIN ER 10-1,000 MG TABLET | 66993-0362-30 | 11.67303 | EACH | 2025-12-17 |

| DAPAGLIFLOZIN-METFORMIN ER 5-1,000 MG TABLET | 66993-0361-60 | 5.83598 | EACH | 2025-11-19 |

| DAPAGLIFLOZIN-METFORMIN ER 10-1,000 MG TABLET | 66993-0362-30 | 11.60856 | EACH | 2025-11-19 |

| DAPAGLIFLOZIN-METFORMIN ER 5-1,000 MG TABLET | 66993-0361-60 | 5.87105 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Dapagliflozin-Metformin ER

Introduction

Dapagliflozin-Metformin Extended Release (ER) represents a combination oral anti-diabetic medication targeting type 2 diabetes mellitus (T2DM). This fixed-dose combination (FDC) integrates dapagliflozin, a sodium-glucose co-transporter 2 (SGLT2) inhibitor, with metformin extended release, a widely used biguanide. As the global diabetes epidemic intensifies, the pharmacological landscape remains dynamic, with significant implications for market growth, drug pricing, and reimbursement strategies.

This analysis evaluates current market dynamics, competitive positioning, regulatory environment, and offers price projection insights for dapagliflozin-metformin ER.

Market Overview

Prevalence of Type 2 Diabetes

T2DM affects over 537 million adults globally, a figure expected to reach 783 million by 2045 [1]. The escalating prevalence underscores sustained demand for combination therapies, particularly in regions with high diabetes burdens such as North America, Europe, and Asia-Pacific.

Therapeutic Rationale and Advantages

Combination therapies like dapagliflozin-metformin ER streamline treatment regimens, improve compliance, and offer synergistic glycemic control. Dapagliflozin’s SGLT2 inhibition reduces glucose reabsorption, promoting glycosuria, while metformin enhances insulin sensitivity. The ER formulation reduces gastrointestinal side effects and dosing frequency, further boosting adherence.

Market Segmentation

The market is segmented across:

- Geographies: North America leads, driven by high prevalence and reimbursement, followed by Europe and Asia-Pacific.

- Patient Demographics: Primarily adults with moderate to advanced T2DM, often as second-line therapy after initial metformin monotherapy.

- Healthcare Settings: Outpatient clinics, primary care, and endocrinology specialty clinics.

Competitors and Market Penetration

The primary market players include:

- Janssen Pharmaceuticals: Dapagliflozin as a monotherapy or combination therapy.

- Merck & Co.: Their SGLT2 inhibitors and fixed-dose combinations.

- Others: Novo Nordisk, Eli Lilly, and Pfizer offer various T2DM medications, including SGLT2 inhibitors and metformin formulations.

Existing branded formulations such as Xigduo XR (dapagliflozin/metformin ER) have established market presence, suggesting a tiered competitive landscape with premium pricing for branded versions.

Regulatory and Reimbursement Landscape

Approval Status

Dapagliflozin-metformin ER is approved in multiple jurisdictions, including the U.S., EU, and Japan. Regulatory agencies emphasize evidence of efficacy, safety, and quality in the FDC.

Pricing and Reimbursement Trends

In North America and Europe, reimbursement policies for combination drugs depend upon formulary assessments, clinical guidelines, and comparative effectiveness data. Generally, branded products command higher prices, though biosimilar and generic introducing pressures.

Pricing Dynamics and Projection Model

Historical Pricing Trends

Since approval of similar SGLT2-metformin formulations, pricing has ranged approximately between $200–$300 per month in the U.S. market [2]. The price varies by manufacturer, exclusive of discounts and rebates.

Factors Influencing Future Prices

- Patent Status: Patent expiration and exclusivity periods dictate launch of generics or biosimilars, potentially reducing prices.

- Market Penetration: Increased volume sales can support premium pricing strategies.

- Competitive Innovations: Novel formulations, fixed-dose combinations, or alternative delivery systems influence market pricing.

- Regulatory and Reimbursement Policies: Shifts toward value-based pricing and formulary restrictions affect prices.

Projected Price Range (2023–2030)

Given current competitive and patent landscapes, we anticipate the following trend:

| Year | Estimated Price Range (USD/month) | Rationale |

|---|---|---|

| 2023 | $250–$300 | Brand dominance; high initial prices, with discounts. |

| 2025 | $200–$250 | Potential entry of generics post-patent expiry (~2024–2027). Incentivizes cost reduction. |

| 2027 | $150–$200 | Broader generic adoption; increased market access. |

| 2030 | $120–$180 | Mature market with higher generic penetration, price competition, and biosimilar emergence. |

Key Market Drivers and Challenges

Drivers

- Increasing global T2DM prevalence requiring combination therapy.

- Rising preference for fixed-dose regimens improving compliance.

- Growing acceptance of SGLT2 inhibitors for cardiovascular and renal benefits.

Challenges

- Patent expiry and proliferation of generics.

- Price sensitivity in emerging markets.

- Stringent regulatory requirements around safety and efficacy.

Strategic Implications

- Manufacturers: Focus on patent protections, lifecycle management, and differentiated formulations to sustain pricing power.

- Payers: Emphasize cost-effectiveness analyses to negotiate favorable reimbursement.

- Investors: Monitor patent timelines and regulatory approvals for new formulations or indications that can impact market share and pricing.

Key Takeaways

- The dapagliflozin-metformin ER market is projected to grow steadily, driven by rising diabetes prevalence and preference for combination therapies.

- Current premium pricing (~$250–$300/month) may decline to ~$120–$180/month by 2030 following patent expiries, increased generic competition, and market maturation.

- Strategic positioning requires balancing patent protections, clinical differentiation, and cost management to optimize profitability.

- Payers and healthcare systems prioritize value-based assessments, influencing reimbursement and access strategies.

- Continuous innovation in formulations and indications will sustain market competitiveness and pricing stability.

FAQs

1. When is the patent for dapagliflozin-metformin ER expected to expire?

Patent expiration is projected around 2024–2026, after which generic versions are likely to enter the market, pressuring branded prices.

2. How does the price of dapagliflozin-metformin ER compare to other combination therapies?

It generally commands a premium over generic metformin monotherapy due to added SGLT2 inhibitor benefits and branded formulation costs, but competitive with other branded fixed-dose combinations.

3. Are biosimilars impacting the dapagliflozin-metformin ER market?

Biosimilar competition is limited, as biosimilars are primarily applicable to biologics, but generic small-molecule versions will significantly influence pricing post-patent expiry.

4. What factors could accelerate price declines?

Patent expiry, faster approval of generics, and increased market penetration of cost-effective alternatives could accelerate price reductions.

5. How significant is the role of regulatory approvals in shaping the market?

Regulatory approvals determine market access, indications, and safety standards, directly impacting pricing strategies and market share.

References

[1] International Diabetes Federation. IDF Diabetes Atlas, 9th Edition, 2019.

[2] IQVIA. National Prescription Audit Data, 2022.

More… ↓