Share This Page

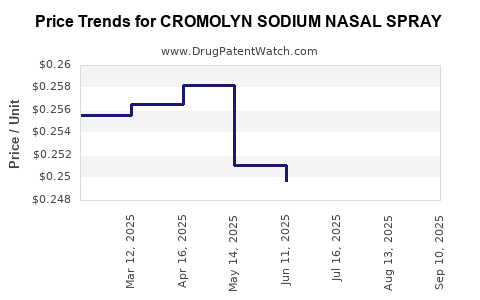

Drug Price Trends for CROMOLYN SODIUM NASAL SPRAY

✉ Email this page to a colleague

Average Pharmacy Cost for CROMOLYN SODIUM NASAL SPRAY

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| CROMOLYN SODIUM NASAL SPRAY | 57782-0397-26 | 0.24771 | ML | 2025-09-17 |

| CROMOLYN SODIUM NASAL SPRAY | 57782-0397-26 | 0.24692 | ML | 2025-08-20 |

| CROMOLYN SODIUM NASAL SPRAY | 57782-0397-26 | 0.24493 | ML | 2025-07-23 |

| CROMOLYN SODIUM NASAL SPRAY | 57782-0397-26 | 0.24973 | ML | 2025-06-18 |

| CROMOLYN SODIUM NASAL SPRAY | 57782-0397-26 | 0.25108 | ML | 2025-05-21 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Cromolyn Sodium Nasal Spray

Introduction

Cromolyn sodium nasal spray is a mast cell stabilizer used primarily for allergic rhinitis and other allergic airway conditions. Its established safety profile, over-the-counter (OTC) availability in many regions, and positioning as a non-steroidal alternative make it an attractive candidate within the allergy management segment. This analysis evaluates the current market landscape, growth drivers, competitive environment, and future price dynamics for cromolyn sodium nasal spray.

Market Overview

Historical Market Performance

The global allergy medications market, valued at approximately $23.8 billion in 2022, continues to expand driven by increasing prevalence of allergic diseases, heightened awareness, and broader OTC access [1]. Within this sector, nasal sprays account for a substantial segment, owing to their localized efficacy and ease of use. Cromolyn sodium nasal spray, a first-generation medication marketed under brands like Nasalcrom, possesses a moderate market penetration, primarily in North America and parts of Europe.

Key Therapeutic Segment Applications

Cromolyn sodium nasal spray is primarily indicated for allergic rhinitis (both seasonal and perennial). Its non-sedating profile and safety make it suitable for pediatric and elderly populations. Despite its age, it remains relevant due to its prescription and OTC availability, especially as an alternative to corticosteroids and antihistamines.

Market Penetration and User Demographics

The drug's customer base comprises allergy sufferers seeking a non-systemic, drug-free approach with minimal side effects. It tends to be popular among children, pregnant women, and patients with contraindications to steroids. However, the relatively lower efficacy compared to newer antihistamines limits its widespread adoption, keeping market share modest.

Competitive Landscape and Market Drivers

Key Competitors

- Allergy-specific nasal sprays: Fluticasone, mometasone (steroids), and antihistamines like azelastine dominate due to superior efficacy.

- Alternative mast cell stabilizers: Nedocromil, although less prevalent, represents a niche segment.

- Emerging biologics: Targeted therapies like omalizumab are transforming allergy treatment but are mostly injectable and targeted at severe cases.

Market Drivers

- Rising allergy prevalence: Estimated at 30-40% globally, increasing environmental allergen exposure drives demand [2].

- Consumer preference for OTC medications: Growing preference for self-managed, non-prescription options supports cromolyn sodium nasal spray sales.

- Safety profile: Very low systemic absorption and adverse effects underpin its recommendation for sensitive groups.

- Shift from invasive treatments: Non-steroidal options gain favor as patients seek drug-free or steroid-sparing options.

Market Challenges

- Limited efficacy compared to steroids: The slower onset and potentially lower symptom relief reduce competitive advantage.

- Brand awareness: Lower marketing investment compared to newer therapies hampers market expansion.

- Availability of alternatives: Oral antihistamines and nasal steroids are often preferred, further constraining growth.

Price Dynamics and Projections

Current Pricing Landscape

- United States: Cromolyn sodium nasal spray (e.g., Nasalcrom) retails for approximately $15–$25 per 30 mL bottle OTC [3].

- Europe: Similar formulations are priced between €12–€20, with regional variations.

- Emerging markets: Price sensitivity prevails; formulations may be generic and priced below $10 per unit.

Factors Influencing Price Trends

- Generic Entry: Patent expirations or lack thereof for older formulations encourage generic manufacturing, driving prices downward.

- Market consolidation: Larger pharmaceutical companies acquiring or partnering with OTC brands may stabilize or slightly elevate prices.

- Regulatory changes: Potential reclassification or new indications could impact pricing strategies.

- Manufacturing costs: Slight inflation-adjusted changes are expected; however, manufacturing efficiencies for generics tend to suppress prices.

Forecasted Price Trends (2023–2030)

- Short-term (2023–2025): Prices are projected to remain stable or decline marginally (2-4%) due to generic competition, with OTC retail prices averaging around $12–$18 per 30 mL bottle.

- Mid-term (2026–2028): Slight price stabilization is expected as competition fully stabilizes, with regional price variations influenced by healthcare policies.

- Long-term (2029–2030): Potential minor price increases (1-3%) anticipated if new indications or formulations emerge or if supply chain disruptions occur.

Market Impact on Pricing

In mature markets, the entry of generics and OTC products is expected to exert downward pressure, maintaining accessible pricing. Conversely, in developing regions, where patent protections persist and OTC access varies, prices could remain higher, especially for branded formulations.

Strategic Implications for Stakeholders

Pharmaceutical companies aiming to expand or maintain market share should focus on:

- Differentiation: Highlighting safety and non-steroid profile to target sensitive patient groups.

- Formulation Innovation: Developing combination therapies or improved delivery systems could command premium pricing.

- Market Expansion: Investing in emerging markets where allergy prevalence and OTC access are growing.

Regulatory and Policy Outlook

In regions where nasal sprays are classified as OTC medications, regulatory frameworks will influence pricing and marketing strategies. Notably, regulatory agencies may tighten labeling or usage guidelines to optimize safety and efficacy, impacting adoption and pricing.

Conclusion

The cromolyn sodium nasal spray market remains stable but modest, constrained by competition from more efficacious newer agents. Its entrance into generic markets and OTC sectors suggests decreasing prices, maintaining affordability but limiting profit margins for manufacturers. Price projections indicate a downward trend in the short to medium term, with potential stabilization subject to market and regulatory developments.

Key Takeaways

- Market Position: Cromolyn sodium nasal spray maintains relevance as a safe, OTC option, primarily serving patients seeking non-steroidal allergy relief.

- Growth Potential: Limited by efficacy perceptions; future growth hinges on demographic shifts and formulation improvements.

- Pricing Trends: Dominated by generic competition; prices are expected to decline modestly in the short term, stabilizing in the medium term.

- Strategic Focus: Differentiation through safety profile and targeting niche patient segments can sustain market presence.

- Regulatory Impact: Changes in OTC classifications and formulations can influence market dynamics and pricing.

FAQs

-

Is cromolyn sodium nasal spray still effective compared to newer allergy medications?

While effective for mild to moderate allergic rhinitis, cromolyn sodium generally has a slower onset and lower efficacy compared to newer antihistamines and nasal steroids, influencing its market share. -

What is the typical price range for cromolyn sodium nasal spray?

Currently, prices range from approximately $12 to $25 per 30 mL bottle in developed markets, with prices potentially lower in regions where generics dominate. -

Can I purchase cromolyn sodium nasal spray OTC?

Yes, in many regions including the United States and Europe, cromolyn sodium nasal spray is available OTC, making it accessible for self-medication. -

Are there any recent innovations or formulations in cromolyn sodium nasal spray?

Most formulations remain unchanged, though research into combination delivery systems and new delivery devices may improve user experience and efficacy in the future. -

What is the outlook for the cromolyn sodium nasal spray market in the next decade?

The market is expected to remain stable with slight price declines due to generic competition, though growth opportunities may arise from expanding allergy prevalence and demographic shifts.

References

[1] Grand View Research. "Allergy Treatment Market Size, Share & Trends Analysis Report." 2022.

[2] World Allergy Organization. "Global Trends in Allergic Disease." 2021.

[3] GoodRx. "Cromolyn sodium nasal spray prices and availability." 2023.

More… ↓