Share This Page

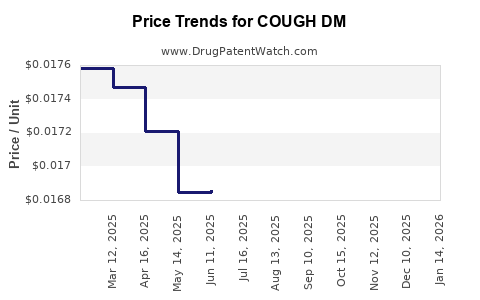

Drug Price Trends for COUGH DM

✉ Email this page to a colleague

Average Pharmacy Cost for COUGH DM

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| COUGH DM ER 30 MG/5 ML SUSP | 00904-6312-56 | 0.06550 | ML | 2025-12-17 |

| COUGH DM ER 30 MG/5 ML SUSP | 46122-0141-25 | 0.04942 | ML | 2025-12-17 |

| COUGH DM ER 30 MG/5 ML SUSP | 70000-0187-01 | 0.06550 | ML | 2025-12-17 |

| COUGH DM ER 30 MG/5 ML SUSP | 46122-0141-21 | 0.06550 | ML | 2025-12-17 |

| COUGH DM ER 30 MG/5 ML SUSP | 70000-0302-01 | 0.06550 | ML | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for COUGH DM

Introduction

COUGH DM, a combination cough suppressant and decongestant, has established a notable presence within the over-the-counter (OTC) cold and cough remedy market. This article provides a comprehensive analysis of the current market landscape, competitive positioning, regulatory environment, and projected pricing trends. Understanding these factors is crucial for stakeholders assessing investment, development, and strategic marketing opportunities in the cough and cold segment.

Market Landscape for COUGH DM

Historical and Current Market Size

The global OTC cough and cold remedy market was valued at approximately USD 10 billion in 2022, demonstrating consistent growth driven by increasing consumer preference for self-medication and convenience. North America continues to dominate with about 45% market share, attributed to high healthcare awareness, mature distribution channels, and extensive OTC product availability. The Asia-Pacific region is projected to grow at the fastest CAGR (~6%) over the next five years, reflecting expanding healthcare infrastructure and rising disposable incomes.

Product Position and Consumer Demand

COUGH DM, typically marketed as a multi-symptom relief formulation combining dextromethorphan (DM) with other agents such as guaifenesin or phenylephrine, aligns with consumer demand for multi-functional OTC medicines. Its popularity stems from perceived efficacy, convenience, and affordability.

Key Competitors

Leading competitors include iconic brands like Robitussin, Delsym, and Mucinex, each offering various formulations with similar active ingredients. Generic equivalents, driven by patent expirations, intensify price competition. Notably, the resurgence of natural and herbal alternatives also influences consumer choices, impacting traditional formulations like COUGH DM.

Regulatory Environment and Patent Status

Regulatory Considerations

In the United States, the Food and Drug Administration (FDA) oversees OTC cough and cold products, requiring pre-market approval and adherence to labeling standards. Recent regulatory focus has been on safety concerns related to dextromethorphan misuse, prompting stricter regulations and warnings.

Patent and Formulation Exclusivity

COUGH DM formulations often rely on standard active ingredients like dextromethorphan and guaifenesin, with some formulations protected through formulation patents, packaging, or delivery mechanisms. Patent expirations typically lead to generic proliferation, impacting market prices and margins.

Pricing Analysis: Present and Future Trends

Current Pricing Landscape

Market prices for COUGH DM products vary based on formulation, brand, and distribution channel:

- Branded formulations: USD 8–12 for a 120 mL bottle or equivalent pack.

- Generic equivalents: USD 4–8, offering similar efficacy at substantially lower prices.

Price sensitivity remains significant among consumers, with many opting for generics to reduce healthcare expenditure.

Factors Influencing Pricing

- Patent Iability & Generic Entry: Expiration of patents leads to increased competition, driving prices downward.

- Manufacturing Costs: Raw material costs, especially for active ingredients like dextromethorphan, influence pricing margins.

- Regulatory Compliance: Stricter safety regulations increase complexity and costs, potentially impacting consumer prices.

- Distribution and Retail Markup: Pharmacy and online platforms add variable margins to wholesale prices.

Projected Price Trends (2023–2028)

Based on current market dynamics and historical data:

- Short-term (1–2 years): Prices for genuine branded COUGH DM products are expected to stabilize or slightly increase (~2%) due to inflationary pressures and regulatory compliance costs.

- Mid-term (3–5 years): As patent expirations accelerate and generics flood the market, prices are projected to decline sharply, by approximately 15–25%, making multi-ingredient OTC formulations increasingly affordable.

- Impact of New Entrants: Entry of niche or natural alternative formulas could fragment market shares, further compressing prices.

Advanced formulations incorporating bioavailability enhancements or novel delivery systems may command premium pricing initially but will face commoditization over time as patents expire.

Market Drivers and Challenges

Drivers

- Consumer Self-Medication Trends: Growing preference for OTC solutions reduces reliance on healthcare professionals for minor ailments.

- Product Innovation: Incorporation of natural ingredients, improved taste, and convenient delivery formats increase consumer appeal.

- Regulatory Support: Clear labeling and safety profiling enhance consumer confidence, bolstering demand.

Challenges

- Safety Concerns: Reports of abuse or adverse effects related to dextromethorphan usage may lead to stricter regulations, impacting supply and pricing.

- Market Saturation: High competition and generic proliferation suppress margins.

- Alternative Therapies: Natural and herbal products exert competitive pressure, potentially shifting consumer preferences.

Strategic Outlook and Recommendations

- Pricing Strategies: Companies should optimize pricing by balancing regulatory compliance costs with consumer demand elasticity. Emphasis on providing value through quality and safety can justify premium pricing where appropriate.

- Market Segmentation: Focus on online channels and emerging markets where price sensitivity is highest. Tailoring formulations to regional preferences can capture additional market share.

- Innovation Focus: Developing formulations with proprietary delivery technology or combining natural ingredients could allow for differentiation and premium pricing.

Key Takeaways

- Market dominance remains with established brands, but generic entry significantly pressures prices.

- Pricing for COUGH DM is expected to see a downward trend over the next five years, driven primarily by patent expiry and increased competition.

- Regulatory risks related to safety concerns will influence both product formulation and pricing, necessitating proactive compliance.

- Consumer preferences favor multi-symptom, natural, and affordable OTC options, guiding product development and marketing strategies.

- Proactive innovation and strategic pricing are vital for capturing emerging market segments and maintaining profitability amid competitive pressures.

FAQs

1. What factors most influence the pricing of COUGH DM?

Pricing is primarily affected by patent status, competition from generics, manufacturing costs, regulatory compliance, and distribution margins.

2. How does patent expiration impact COUGH DM prices?

Patent expirations enable the proliferation of generic versions, intensifying competition and leading to significant price reductions.

3. Are natural alternatives affecting COUGH DM’s market share?

Yes, increasing consumer preference for herbal and natural remedies is challenging traditional formulations and may compress prices and margins.

4. What regulatory changes could influence future pricing trends for COUGH DM?

Stricter safety warnings, abuse deterrent regulations, or new ingredient safety assessments could increase compliance costs, potentially raising consumer prices or limiting market availability.

5. Which markets present the most growth opportunity for COUGH DM?

Emerging markets in Asia-Pacific and Latin America offer rapid growth due to expanding healthcare infrastructure and rising disposable incomes.

Sources

[1] Grand View Research. “OTC Cold & Cough Remedies Market Size & Trends,” 2022.

[2] U.S. FDA. “Guidance for Industry: Nonprescription Drug Labeling,” 2021.

[3] Statista. “Over-the-counter (OTC) cold and cough remedies - Market Size Worldwide,” 2022.

[4] IBISWorld. “Pharmaceuticals in the US Market Research Report,” 2022.

[5] Deloitte. “Healthcare Market Trends and Consumer Preferences,” 2022.

Disclaimer: The data provided reflects the current market conditions as of early 2023 and is subject to change with future regulatory and market developments.

More… ↓