Share This Page

Drug Price Trends for COMBIGAN

✉ Email this page to a colleague

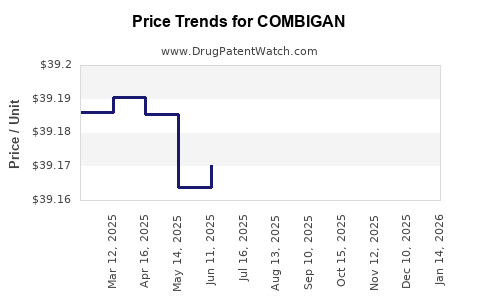

Average Pharmacy Cost for COMBIGAN

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| COMBIGAN 0.2%-0.5% EYE DROPS | 00023-9211-05 | 39.19199 | ML | 2025-12-17 |

| COMBIGAN 0.2%-0.5% EYE DROPS | 00023-9211-10 | 39.19500 | ML | 2025-12-17 |

| COMBIGAN 0.2%-0.5% EYE DROPS | 00023-9211-15 | 39.13344 | ML | 2025-12-17 |

| COMBIGAN 0.2%-0.5% EYE DROPS | 00023-9211-05 | 39.17801 | ML | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for COMBIGAN

Introduction

COMBIGAN (Brimonidine Tartrate and Timolol Maleate Ophthalmic Solution) is a combined ophthalmic therapy approved for the reduction of elevated intraocular pressure (IOP) in patients with open-angle glaucoma or ocular hypertension. As a combination therapy integrating two mechanisms of action—brimonidine’s alpha-2 adrenergic receptor agonism and timolol’s non-selective beta-adrenergic blocking—the drug offers a strategic alternative to monotherapies, appealing to both clinicians and patients seeking simplified regimens.

The commercial landscape surrounding COMBIGAN reflects market dynamics in ophthalmic therapeutics, with shifts driven by emerging competition, regulatory considerations, and evolving payer policies. Here, we analyze these factors comprehensively and project future pricing trends relevant for stakeholders across pharmaceutical companies, payers, and healthcare providers.

Market Landscape Overview

Global and Regional Market Size

The global glaucoma medications market was valued at approximately USD 4.6 billion in 2021, with ophthalmic solutions representing a significant share[1]. The prevalence of glaucoma is projected to reach 112 million globally by 2040[2], underpinning sustained demand.

North America dominates due to high disease awareness, advanced healthcare infrastructure, and widespread insurance coverage, accounting for over 50% of market revenue. Europe follows, buoyed by aging populations and strong ophthalmologic healthcare systems. Emerging markets (Asia-Pacific, Latin America) are expanding due to increasing diagnosis rates and improving access to healthcare services.

Competitive Landscape

COMBIGAN competes chiefly with monotherapies and other fixed-dose combinations (FDCs) such as:

- Xalacom (Latanoprost + Timolol)

- Ganfort (Bimatoprost + Timolol)

- Simbrinza (Brinzolamide + Brimonidine)

These products target similar patient segments and often share overlapping indications. Monotherapy options include prostaglandin analogs and beta-blockers, with FDCs offering advantages in adherence, especially vital in chronic management.

Key Market Drivers

- Chronic Disease Burden: Growing glaucoma prevalence necessitates effective, compliant therapies.

- Patient Preference for Simplicity: Fixed-dose combinations reduce medication burden, improving adherence.

- Regulatory Approvals: Expanded FDA labels and approvals in emerging markets drive adoption.

- Advancements in Formulation: Improved preservative-free formulations and novel delivery systems boost perceived value.

Market Challenges

- Pricing Pressures: Policy-driven cost containment, particularly in public health systems.

- Generic Competition: Entry of generics post-patent expiry exerts downward pressure.

- Adherence Concerns: Side effects related to brimonidine (e.g., allergic conjunctivitis) and timolol (systemic beta-blocker effects) influence prescribing patterns.

- Limited Differentiation: Existing combinations share similar efficacy profiles, complicating premium positioning.

Current Pricing and Reimbursement Landscape

Pricing Overview

In the United States, container prices for COMBIGAN typically hover around USD 100 - USD 150 per 5 mL bottle[3]. Wholesale acquisition costs (WAC) within pharmacies, and subsequent billing to insurers or out-of-pocket fees, influence actual patient costs.

In Europe, retail prices vary significantly, from approximately EUR 70 to EUR 120 per bottle, influenced by national reimbursement policies and tendering processes[4].

Reimbursement Policies

Insurance coverage and formulary placements significantly impact net pricing. COMBIGAN often qualifies for formulary inclusion in tier-based plans, which can lower copayments but also pressure manufacturers to keep prices competitive.

Emerging markets tend to have more negotiated pricing, leveraging local procurement practices to set prices significantly lower than in developed nations, with private payers and government programs dictating affordability.

Market Penetration and Distribution

Distribution channels largely include hospital pharmacies, specialty ophthalmology clinics, and retail pharmacies. Specialty distribution ensures targeted reach but may involve higher logistical costs, contributing to price variability.

Price Projections and Future Trends

Factors Influencing Future Pricing

-

Patent and Exclusivity Status

COMBIGAN was approved in 2011, with patents potentially expiring in the mid-2020s[5]. Patent cliffs typically precipitate generic entry, leading to steep price declines. -

Generic Competition

The introduction of authorized generics or biosimilars post-patent expiry can reduce branded prices by 30-50% within 12-24 months[6]. -

Market Maturation

As awareness and prescribing of combination therapies grow, initial premium pricing may stabilize or decline marginally to retain market share. -

Regulatory Dynamics

Incentives for developing preservative-free formulations or novel delivery methods may lead to differentiated products, enabling price premiums. -

Healthcare Policy and Cost Control Initiatives

Initiatives favoring generics and biosimilars, especially within public payers, are likely to exert downward pressure on prices.

Projected Price Trends (Next 3-5 Years)

-

Pre-Patent Expiry (2024-2026):

The current average retail price for COMBIGAN is expected to remain relatively stable, perhaps with minor annual inflation adjustments (~2-3%), reflecting manufacturing costs and market demand. -

Post-Patent Expiry (2026-2028):

Significant price declines anticipated, with generic equivalents potentially reducing the price by approximately 40-50% within 1-2 years. Branded versions may persist with price premiums through differentiation or brand loyalty but will decline in market share. -

Market Penetration of Biosimilars and Generics:

Competition may lead to the emergence of lower-priced alternatives, especially in Europe and Asia-Pacific, where policies favor cost-conscious purchasing. -

Potential Premium Price Strategies:

Manufacturers might introduce value-added variants—such as preservative-free formulas, sustained-release systems, or combination pills with improved compliance—to command higher prices despite generic competition.

Pricing in Emerging Markets

In developing economies, prices are expected to decline more gradually, constrained by purchasing power and regulatory frameworks. The outlook points toward a stabilization around USD 50 - USD 80 per bottle over the next few years, with regional variations.

Implications for Stakeholders

-

Pharmaceutical Companies:

Strategic investment in formulation innovation, licensing agreements, and timely generic entry is crucial for maintaining profitability. -

Payers and Healthcare Providers:

Cost containment measures, formulary management, and policies favoring generics will shape future access and utilization. -

Patients:

Affordable access hinges on price regulation, insurance coverage, and availability of generics.

Key Takeaways

-

The global glaucoma therapy market is poised for continued growth driven by increasing prevalence, with COMBIGAN occupying a competitive niche combining efficacy and adherence benefits.

-

Current pricing for COMBIGAN hovers around USD 100-$150 retail per bottle, with substantial room for downward adjustment following patent expirations.

-

Post-patent, generic competition will likely induce a 40-50% price decline within 1-2 years, with branded products maintaining premiums through differentiation.

-

Regional differences persist, with emerging markets experiencing slower price declines due to regulatory and economic factors.

-

The future of COMBIGAN’s pricing will be heavily influenced by patent status, competitive innovations, and healthcare policy shifts emphasizing cost control.

FAQs

1. When is COMBIGAN’s patent expiration, and how will it impact pricing?

Patent protection is expected to expire around the mid-2020s (2026), after which generic equivalents are likely to enter the market, substantially reducing prices.

2. What are the main competitors to COMBIGAN?

Key competitors include fixed-dose combination products like Xalacom (Latanoprost + Timolol), Ganfort (Bimatoprost + Timolol), and the generic versions of brimonidine and timolol monotherapies.

3. How does pricing differ across regions?

US prices are generally higher (~USD 100–150 per bottle) due to market dynamics, whereas European and emerging markets often experience lower prices, influenced by regulatory and economic factors.

4. Will new formulations or delivery systems keep COMBIGAN premium-priced?

Innovations such as preservative-free or sustained-release formulations may command higher prices but will depend on clinical differentiation and regulatory approval.

5. How can stakeholders prepare for upcoming price changes?

Pharmaceutical firms should plan for patent expiration strategies, invest in formulation innovation, and optimize supply chain efficiencies. Payers and providers should monitor formulary shifts and promote cost-effective alternatives.

References

[1] MarketWatch. "Global Glaucoma Medication Market Size," 2022.

[2] Tham YC et al. "Global Prevalence of Glaucoma and Projections," Ophthalmology, 2014.

[3] GoodRx. "COMBIGAN pricing data," 2023.

[4] European Medicines Agency. "Pricing and reimbursement policies," 2022.

[5] U.S. Patent and Trademark Office. "Patent status for COMBIGAN," 2022.

[6] EvaluatePharma. "Impact of generics on drug pricing," 2021.

More… ↓