Last updated: July 30, 2025

Introduction

Colesevelam HCl, marketed under brand names including Welchol, is a bile acid sequestrant primarily prescribed for hyperlipidemia and type 2 diabetes management. Approved by the FDA in 2000, its unique mechanism of binding bile acids in the gastrointestinal tract positions it as a critical component in treating lipid abnormalities and glycemic control, especially among patients intolerant to statins or with complex metabolic disorders. This analysis explores the current market landscape, competitive positioning, regulatory influences, and future pricing projections for Colesevelam HCl, providing insights relevant for stakeholders across pharmaceutical companies, healthcare providers, and investors.

Market Landscape Overview

Current Market Size and Growth Dynamics

The global market for lipid-lowering agents, extending to drugs like statins, PCSK9 inhibitors, fibrates, and bile acid sequestrants such as Colesevelam HCl, was valued at approximately USD 25 billion in 2022. Analysts project a compound annual growth rate (CAGR) of around 2.5% through 2028, driven by increasing prevalence of dyslipidemia, evolving treatment guidelines, and expanding indications for lipid-modifying therapies [1].

Within this domain, bile acid sequestrants constitute a niche segment but are gaining renewed attention due to their utility in managing concomitant dyslipidemia and type 2 diabetes. The global market for Colesevelam specifically was estimated at around USD 300 million in 2022, with growth propelled by rising metabolic syndrome cases and expanding insurance reimbursement.

Geographical and Demographic Considerations

North America holds a dominant position owing to high diagnosis rates, insurance coverage, and acceptance of novel therapies. The U.S. accounts for nearly 60% of the global Colesevelam market, with Asia-Pacific emerging as a significant growth region, fueled by urbanization and rising healthcare infrastructure.

The aging global population, alongside increasing prevalence of obesity and type 2 diabetes, indicates a sustainable and possibly expanding demand for bile acid sequestrants, including Colesevelam. The aging demographic is particularly responsive to combination therapies where Colesevelam demonstrates dual benefits (lipid and glycemic control).

Pipeline and Evolving Competition

While Colesevelam maintains a niche position, it faces competition from several classes. Statins remain first-line due to efficacy and familiarity, with PCSK9 inhibitors gradually capturing market share in high-risk groups. Fibrates and niacin, once popular, are declining in use due to side effect profiles.

Emerging therapies, such as bempedoic acid and novel oral agents targeting incretin pathways, may influence future demand. However, Colesevelam's favorable side effect profile, low systemic absorption, and dual efficacy keep it relevant, especially in specific patient cohorts.

Regulatory and Reimbursement Factors

Approval Status and Indications

Colesevelam HCl is approved for primary hyperlipidemia and as an adjunct to diet and exercise, with additional approval for glycemic control in type 2 diabetes. The breadth of indications positions it favorably within personalized medicine.

Regulatory bodies like the FDA and EMA have supported its enduring presence through continuous post-marketing surveillance, facilitating broad access.

Pricing and Reimbursement Landscape

In the U.S., Colesevelam's average wholesale price (AWP) hovers around USD 250–300 per month based on typical dosing. Insurance coverage tends to be favorable, especially after formulary inclusion due to its clinical utility and cost-effectiveness in specific contexts.

In emerging markets, pricing strategies and reimbursement vary, often reflecting local healthcare policies and economic capacity. Gaining formulary acceptance in payers remains critical for volume expansion.

Price Projections and Future Trends

Factors Influencing Pricing Dynamics

- Market Penetration and Competition: As newer, more convenient therapies enter markets, price competition could intensify, exerting downward pressure.

- Regulatory Incentives and Patent Life: Patent protections, initially granted in the early 2000s, are approaching expiration in several jurisdictions, potentially leading to generic competition and significantly lower prices.

- Manufacturing Costs: Advances in synthesis and scale efficiencies could reduce production costs, potentially enabling more competitive pricing.

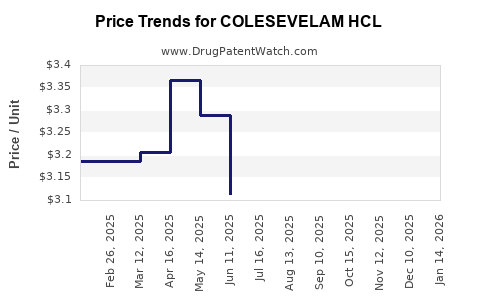

Projected Price Trajectory (2023-2030)

Given recent patent expirations and increasing generic availability, Colesevelam HCl prices are expected to decline gradually, with a CAGR of about –3% to –5%. Price erosion is anticipated most prominently in mature markets such as the U.S. and Europe, where generics are becoming prominent.

However, specialized formulations or combination therapies could sustain higher prices in niche segments. Reimbursement policies favoring cost-effective, dual-utility agents may bolster stable or slightly reduced prices through negotiated discounts.

Potential Impact of Biosimilars and Generics

The entry of biosimilar and generic versions is imminent, especially as patent protections lapse. This could reduce prices by 50–70%, depending on market competitiveness. Industry players must monitor patent litigation and exclusivity timelines closely to forecast exact timing.

Future Market Opportunities

Incorporating Colesevelam HCl into combination therapies for metabolic syndrome, or developing sustained-release or formulation-specific modifications, may offer avenues for premium pricing. Additionally, partnerships with healthcare systems to promote broader adoption could sustain demand.

Conclusion

Colesevelam HCl maintains a valuable niche within lipid and glycemic management, supported by its safety profile and dual efficacy. While market growth is modest, imminent patent expirations suggest prices will decline over the next decade. Stakeholders must navigate the balance between pricing strategies, competitive dynamics, and emerging therapeutic landscapes to optimize value.

Key Takeaways

- The global Colesevelam HCl market is estimated at USD 300 million (2022), with slow but steady growth driven by metabolic disease prevalence.

- Patent expirations forecast significant price declines (~50-70%) due to generic competition, particularly in mature markets.

- Formulary acceptance and reimbursement policies are primary determinants of revenue stability and growth.

- Opportunities exist in developing combination formulations and targeting niche patient populations.

- Maintaining competitive pricing and forming strategic partnerships will be essential for sustained market presence amid emerging therapies.

FAQs

1. What are the primary therapeutic indications for Colesevelam HCl?

Colesevelam HCl is approved for primary hyperlipidemia and as an adjunct therapy for glycemic control in type 2 diabetes mellitus.

2. How does patent expiration influence the pricing of Colesevelam HCl?

Patent expiration allows generic manufacturers to enter the market, significantly reducing drug prices through increased competition and often leading to a 50–70% decrease in costs.

3. Are there any emerging therapies that could threaten Colesevelam’s market share?

Yes. Novel agents like bempedoic acid, PCSK9 inhibitors, and incretin-based therapies are expanding options for lipid and diabetes management, potentially reducing Colesevelam’s market share.

4. What demographic groups are the main consumers of Colesevelam?

Primarily adults with hyperlipidemia or type 2 diabetes managing lipid levels and glycemic control; the aging population contributes significantly to demand, especially in North America.

5. How can manufacturers maintain profitability amid declining prices?

By diversifying indications, developing combination therapies, optimizing manufacturing costs, establishing strong payer relationships, and focusing on niche patient populations that benefit most from Colesevelam.

References

[1] Global Market Insights. "Lipid-Lowering Agents Market Size, Share & Industry Analysis." 2022.