Last updated: July 27, 2025

Introduction

Colesevelam, marketed primarily under the brand name Welchol, is a lipid-lowering agent classified as a bile acid sequestrant. Approved by the FDA in 2000, it targets dyslipidemia and type 2 diabetes mellitus (T2DM). Its unique pharmacological mechanism and expanded indications have resulted in a nuanced market landscape. This analysis evaluates current market dynamics, competitive positioning, key drivers, challenges, and forecasts future pricing trends of Colesevelam.

Pharmacological Profile and Clinical Utility

Colesevelam functions by binding bile acids in the gastrointestinal tract, preventing their reabsorption, which in turn stimulates hepatic uptake of LDL cholesterol. Its approval expanded beyond hyperlipidemia to include glycemic control in T2DM, positioning it as a dual-benefit therapy. Its safety profile is favorable, with gastrointestinal side effects being most common. The oral formulation offers ease of use, reinforcing its market appeal for patients requiring lipid management or metabolic regulation.

Market Landscape and Competitive Environment

The global market for bile acid sequestrants, predominantly including Colesevelam, is characterized by competition with other classes of lipid-lowering drugs such as statins, PCSK9 inhibitors, ezetimibe, and newer agents like bempedoic acid. While statins dominate due to proven efficacy and affordability, Colesevelam occupies a niche in patients intolerant or contraindicated to statins, as well as those requiring combination therapy.

Key competitors include:

-

Colestyramine (Questran) and Colestipol—first-generation bile acid sequestrants, less favored due to tolerability issues.

-

Ezetimibe—offers similar efficacy with more tolerable gastrointestinal profiles.

-

PCSK9 inhibitors (e.g., evolocumab) are more expensive but effective in high-risk hyperlipidemic patients.

-

Bempedoic acid—a newer oral agent with comparable lipid-lowering properties.

The relatively limited usage of Colesevelam stems from its modest LDL reduction (~15-20%) compared to statins and PCSK9 inhibitors, but it remains valuable for specific populations.

Market Trends and Drivers

Rising Incidence of Cardiovascular Diseases and Diabetes

The increasing prevalence of dyslipidemia and T2DM globally acts as a catalyst for therapies targeting these conditions. According to the WHO, cardiovascular diseases account for approximately 17.9 million deaths annually, with dyslipidemia being a significant risk factor. Similarly, T2DM affects over 537 million adults, with many requiring multifaceted metabolic management [1].

Shift Toward Personalized Medicine and Combination Therapy

Clinicians increasingly prefer tailored approaches, combining lipid-lowering agents to optimize outcomes. Colesevelam’s dual indication supports its use in combination therapy, especially in statin-intolerant populations. Additionally, its favorable safety profile appeals to elderly and polypharmacy patients.

Generic Availability and Market Penetration

Since the patent expiration of Welchol in 2017, generic Colesevelam options have entered global markets, considerably reducing costs and expanding access. Price reductions due to generics tend to stimulate off-label and adjunctive usage, especially in cost-sensitive healthcare settings.

Regulatory and Reimbursement Factors

Reimbursement policies significantly influence market uptake. In the U.S., Medicare and insurance plans cover Colesevelam, but in developing economies, high drug costs hinder widespread adoption. Regulatory pathways for expansion (e.g., indications for glycemic control) can open new market segments.

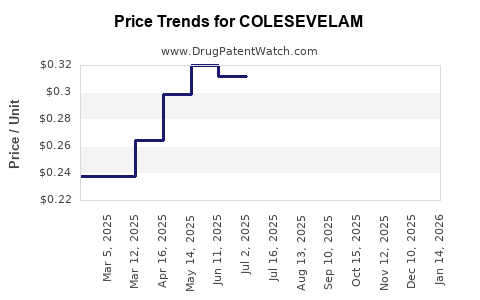

Price Trends and Projection Factors

Historical Pricing Dynamics

Pre-generic, Colesevelam’s average wholesale price (AWP) per tablet ranged between $1.50 to $2.00, with monthly therapy costs approximating $100–$150 per patient. Post-generic availability, prices have declined substantially, with retail prices potentially halving or more in competitive markets [2].

Current Pricing Landscape

In the U.S., generic Colesevelam's retail prices can range from $30 to $50 per month, depending on pharmacy and insurance coverage. Specialty formulations or extended-release versions may command higher prices.

Projected Price Trends (2023–2030)

-

Short-term (1–3 years): Expect stabilization or slight decrease in prices, driven by increased generic penetration and market saturation.

-

Medium-term (4–6 years): Further reductions possible with manufacturing efficiencies and market expansion into emerging economies.

-

Long-term (7–10 years): Prices may plateau as the market reaches equilibrium, but potential biosimilar or alternative therapies could influence dynamics.

Factors Influencing Price Projections

-

Regulatory approvals for new indications: Expanded use in T2DM and dyslipidemia management can sustain demand but may also introduce competition.

-

Market penetration in developing regions: Generic and biosimilar entry will lower prices further, especially in Asia, Latin America, and Africa.

-

Reimbursement policies: Grading coverage status affects patient affordability, influencing utilization and, indirectly, pricing strategies.

-

Therapeutic positioning: If personalization and combination therapies gain prominence, utilization patterns may shift, impacting volume and pricing.

Future Market Outlook

The market for Colesevelam is poised for moderate growth, primarily driven by its niche role in lipid and glucose management. With increased emphasis on personalized medicine, combination therapy, and the rising burden of metabolic syndromes, demand will persist, albeit constrained by competition from statins, PCSK9 inhibitors, and newer agents.

Price projections indicate a downward trend due to generic competition. However, innovative formulations, new therapeutic indications, and strategic marketing could marginally stabilize or elevate prices in specific regions or patient segments.

Key Takeaways

- Niche Positioning: Colesevelam remains relevant for patients intolerant to statins and as part of combination therapy for dyslipidemia and T2DM.

- Competitive Dynamics: Dominated by older generation bile acid sequestrants with rising competition from ezetimibe, PCSK9 inhibitors, and bempedoic acid.

- Pricing Trends: Significant reduction expected due to generics, with retail costs potentially decreasing by 50% or more within the next 2–3 years.

- Market Drivers: Increasing prevalence of metabolic disorders, expanding indications, and uptake in emerging markets.

- Strategic Focus: Stakeholders should monitor regulatory approvals for new indications, generic market entry, and negotiation leverage with payers to optimize pricing and access.

References

[1] World Health Organization. Cardiovascular Diseases (CVDs). Fact sheet. 2021.

[2] GoodRx. Colesevelam (Welchol) Prices and Coupons. 2023.

FAQs

1. What are the main clinical benefits of Colesevelam compared to other lipid-lowering agents?

Colesevelam offers a favorable safety profile and dual indication for lipid management and glycemic control in T2DM. Its non-systemic, oral nature makes it suitable for patients intolerant of statins or seeking combination therapy.

2. How does the market exit of patent protection influence Colesevelam’s pricing?

Patent expiration facilitates generic entry, drastically reducing prices and increasing accessibility across global markets, though it may impact margins for branded manufacturers.

3. What are the key factors affecting the future demand for Colesevelam?

Demand will hinge on the rising prevalence of dyslipidemia and T2DM, its positioning in combination therapy, reimbursement policies, and competition from newer agents.

4. Will emerging therapies threaten Colesevelam’s market share?

Yes. The advent of PCSK9 inhibitors and bempedoic acid offer potent alternatives but are often limited by cost, positioning Colesevelam as a cost-effective adjunct or alternative.

5. What strategic considerations should pharmaceutical companies adopt regarding Colesevelam?

Focus on expanding indications, optimizing manufacturing to lower costs, strategic marketing in emerging markets, and leveraging combination therapy opportunities to sustain market relevance.

Note: Continuous market monitoring and emerging clinical trial data are essential for agile decision-making regarding Colesevelam's market strategy and pricing.