Share This Page

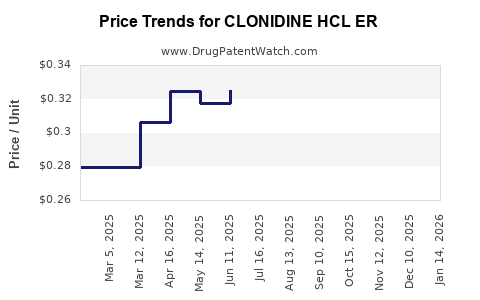

Drug Price Trends for CLONIDINE HCL ER

✉ Email this page to a colleague

Average Pharmacy Cost for CLONIDINE HCL ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| CLONIDINE HCL ER 0.17 MG TAB | 52817-0375-30 | 14.54507 | EACH | 2025-12-17 |

| CLONIDINE HCL ER 0.1 MG TABLET | 00228-4241-06 | 0.26001 | EACH | 2025-12-17 |

| CLONIDINE HCL ER 0.1 MG TABLET | 27241-0108-06 | 0.26001 | EACH | 2025-12-17 |

| CLONIDINE HCL ER 0.1 MG TABLET | 50742-0247-60 | 0.26001 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Clonidine HCl ER

Introduction

Clonidine Hydrochloride Extended-Release (HCl ER) is a pharmacological agent primarily prescribed for hypertension management, ADHD, and certain withdrawal syndromes. As a centrally acting alpha-2 adrenergic agonist, its unique mechanism of action and established therapeutic profile make it a critical component in multiple treatment regimens. This analysis examines current market dynamics and forecasts pricing trajectories for Clonidine HCl ER, considering competitive, regulatory, technological, and economic factors shaping its future landscape.

Market Overview

Therapeutic Use and Market Penetration

Clonidine HCl ER's formulary versatility stems from its efficacy in reducing blood pressure and managing other central nervous system disorders. In 2022, the global antihypertensive drugs market was valued at approximately USD 26 billion, with central acting agents like clonidine comprising a significant share due to its lower cost and ease of administration [1]. Moreover, its off-label use in managing opioid withdrawal and ADHD extends its utilization, particularly in North America and Europe, where healthcare systems favor multi-purpose medications.

Competitive Landscape

Clonidine HCl ER faces competition from other antihypertensive agents, including beta-blockers, ACE inhibitors, and ARBs, which dominate market share owing to superior side effect profiles and patient tolerability. Nevertheless, clonidine's affordability and utility in specific niches, such as refractory hypertension and pediatric ADHD, preserve its relevance.

Key market players include Novartis, Teva Pharmaceuticals, and Mylan, which manufacture various generic formulations, along with newer branded products targeting niche markets. Patent expirations of branded clonidine products over the last five years have further increased generic availability, fueling price competition.

Patent Status and Regulatory Landscape

While initial patents on clonidine compounds have expired globally, the extended-release formulations remain under patent protection in certain jurisdictions until 2025-2028, influencing pricing and market exclusivity. Regulatory bodies like the FDA have approved multiple generic versions, facilitating market entry and price reductions, especially in mature markets.

Price Dynamics and Projections

Current Pricing Trends

The current wholesale acquisition cost (WAC) for Clonidine HCl ER varies by formulation, dosage, and manufacturer. Generic 0.1 mg tablets are priced in the range of USD 0.10–0.20 per tablet, reflecting high price elasticity and competitive pressures [2]. Branded formulations tend to be approximately 1.5–2 times more expensive.

Factors Influencing Price Movements

-

Generic Competition: The proliferation of generic versions has historically driven prices downward. The entry of multiple manufacturers has led to a stable, competitive market environment with modest pricing margins.

-

Regulatory Exclusivity: Patent protections for certain formulations may temporarily sustain higher prices. The expiration of these patents is anticipated to catalyze further price erosion.

-

Manufacturing Costs: Advancements in manufacturing technology and economies of scale continue to lower production costs, further pressuring retail and wholesale prices.

-

Market Demand: Rising prevalence of hypertension and ADHD, especially in aging populations, sustains steady demand. However, emerging alternatives and changing prescribing habits could moderate growth.

Future Price Projections (2023–2028)

Based on recent trends and market dynamics:

- Short Term (2023–2024): Prices are expected to stabilize, with slight reductions (~5–8%) as new generics enter the market post-patent expiry.

- Mid Term (2025–2026): Further declines (~10–15%) as market saturation increases, and manufacturing efficiencies expand.

- Long Term (2027–2028): Prices could decline an additional 20–25%, particularly if biosimilar or alternative formulations gain acceptance. Any regulatory or patent litigations might cause temporary price fluctuations.

Impact of Market and Policy Developments

Healthcare policies favoring cost savings, such as increased insurance coverage of generics, will sustain downward pressure. Conversely, price stabilization may occur if novel extended-release formulations with improved pharmacokinetics enter the market, matching or surpassing branded price points.

Strategic Considerations for Stakeholders

- Manufacturers: Focus on optimizing production efficiencies and expanding formulations to prolong market share amidst patent expirations.

- Payers: Leverage generic availability to negotiate lower prices, influencing market dynamics further.

- Investors: Monitor patent statuses and new formulation developments for strategic positioning, as patent cliffs could present acquisition or divestment opportunities.

Conclusion

Clonidine HCl ER operates within a highly competitive and price-sensitive environment. Its future value hinges on patent expirations, generic competition, and emerging therapeutic alternatives. Market forecasts project continued price declines driven by generics, with stabilization occurring by 2026. Stakeholders should align strategies accordingly, emphasizing cost containment and innovation.

Key Takeaways

- The clonidine HCl ER market is mature, with significant generic competition leading to sustained price reductions.

- Patent expiry timelines (2025–2028) are critical in shaping near-term pricing strategies.

- Demand driven by hypertension and ADHD prevalence maintains steady market requirements, supporting continuous generic penetration.

- Technological advancements and potential new formulations may influence pricing stability and therapeutic offerings.

- Stakeholders should prioritize cost-effective procurement, monitor patent and regulatory developments, and consider formulation innovations.

FAQs

1. What factors most significantly influence clonidine HCl ER pricing?

The primary factors include patent status, generic competition, manufacturing costs, regulatory approvals, and market demand in specific therapeutic niches.

2. When will patent protections on current clonidine ER formulations expire?

Patent protections are generally set to expire between 2025 and 2028, varying by jurisdiction and specific formulation.

3. How does generic entry impact the clonidine HCl ER market?

Generic entry leads to increased competition, driving prices downward, improving accessibility, and exerting pressure on branded formulations.

4. Are there emerging formulations of clonidine HCl ER that could affect prices?

Yes, innovative extended-release formulations with improved compliance or novel delivery systems could influence future pricing and market share.

5. What is the outlook for clonidine HCl ER in the next five years?

Prices are expected to decline gradually due to generic competition, with stabilization anticipated once the patent landscape stabilizes and market saturation occurs.

References

[1] MarketsandMarkets. (2022). Global antihypertensive drugs market report.

[2] IQVIA. (2023). National Drug Price Trends Analysis.

More… ↓