Share This Page

Drug Price Trends for CLOBETASOL EMULSION

✉ Email this page to a colleague

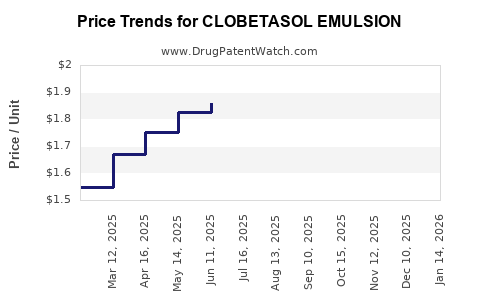

Average Pharmacy Cost for CLOBETASOL EMULSION

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| CLOBETASOL EMULSION 0.05% FOAM | 68462-0625-27 | 1.80963 | GM | 2025-12-17 |

| CLOBETASOL EMULSION 0.05% FOAM | 68462-0625-27 | 1.76223 | GM | 2025-11-19 |

| CLOBETASOL EMULSION 0.05% FOAM | 68462-0625-27 | 1.81736 | GM | 2025-10-22 |

| CLOBETASOL EMULSION 0.05% FOAM | 68462-0625-27 | 1.96418 | GM | 2025-09-17 |

| CLOBETASOL EMULSION 0.05% FOAM | 68462-0625-27 | 2.07157 | GM | 2025-08-20 |

| CLOBETASOL EMULSION 0.05% FOAM | 68462-0625-94 | 1.85923 | GM | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Clobetasol Emulsion

Introduction

Clobetasol emulsion, a high-potency topical corticosteroid, is primarily used in the treatment of inflammatory skin conditions such as psoriasis, eczema, and dermatitis. Owing to its efficacy, safety profile, and regulatory status, clobetasol emulsion maintains a significant presence in dermatology therapeutics. This analysis examines the current market landscape, competitive dynamics, regulatory considerations, and future price trends to guide stakeholders in making informed strategic decisions.

Market Overview

Global Market Size and Growth Trajectory

The global dermatological drugs market is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 5.8% from 2023 to 2028, fueled by rising prevalence of chronic skin conditions, increasing demand for effective topical corticosteroids, and expanding healthcare infrastructure in emerging economies [1].

Clobetasol propionate, the active ingredient, constitutes a significant segment within topical corticosteroids, with emulsion formulations offering improved skin penetration and patient compliance. The market size for clobetasol-based products was valued at roughly USD 500 million in 2022, with expectation of reaching USD 750 million by 2028, assuming a steady CAGR driven by increased dermatological interventions (estimated market figures based on industry reports).

Leading Geographic Markets

- North America: The dominant market, attributed to high prevalence of dermatological conditions, advanced healthcare infrastructure, and robust R&D investments.

- Europe: Significant due to stringent regulatory standards and mature pharmaceutical ecosystems.

- Asia-Pacific: Fastest-growing market, driven by rising patient awareness, expanding manufacturing capacities, and increasing affordability.

Key Players and Competitive Landscape

Major pharmaceutical companies involved in the production and distribution of clobetasol emulsion include:

- GlaxoSmithKline (GSK): A pioneer with established formulations and strong market penetration.

- Novartis: Focuses on dermatological portfolio expansion, including corticosteroid formulations.

- Mundipharma: Noted for developing emulsion and alternative formulations.

- Sandoz (Novartis division): Offers generic versions in various geographies.

Emerging players and regional brands are increasingly entering markets through licensing agreements, further intensifying competition.

Regulatory and Patent Landscape

Regulatory Status

Clobetasol propionate, available as a prescription drug in most jurisdictions, has achieved regulatory approval via agencies such as the FDA (U.S.) and EMA (Europe). Emulsion formulations typically require separate approval processes, emphasizing safety and efficacy for topical delivery.

Patent Dynamics

Patents generally expire within 10-15 years of patent filing, with some formulations or delivery systems securing additional exclusivity. The expiration of key patents has facilitated a surge in generic manufacturing, reducing the prices of branded drugs and increasing market accessibility.

Price Trends and Projection Analysis

Historical Pricing Trends

Historically, the price of clobetasol emulsion has experienced decline due to patent expirations and market consolidation. In North America, a 10-15% annual reduction in average retail price has been observed over the past five years, coinciding with increasing generic entry [2].

Factors Influencing Future Prices

-

Generic Competition: Entry of generics often drives price erosion, with forecasts predicting up to 25-30% reductions in unit costs over the next three years.

-

Regulatory Changes and Policy Reforms: Governments aiming to reduce healthcare costs may impose price caps or promote biosimilar entry, further compressing prices.

-

Manufacturing and Supply Chain Considerations: Raw material costs, quality standards, and capacity constraints can induce pricing fluctuations.

Price Projection (2023-2028)

Assuming current market conditions persist:

-

Branded Clobetasol Emulsion: Expected to decrease from an average retail price of USD 40 per 15g tube in 2022 to approximately USD 28-30 by 2028, reflecting a 10-15% annual decline.

-

Generic Versions: Already priced around USD 15-20 per 15g, are projected to stabilize or decrease slightly with increased competition, potentially reaching USD 12-15.

-

Premium formulations or specialized delivery systems may maintain higher prices, but their market share is unlikely to grow significantly without demonstrable advantages.

Emerging Trends Impacting Pricing

- Bioequivalent formulations: May introduce further competitive pricing.

- Patient assistance programs: Could affect retail prices and out-of-pocket costs.

- Digitalization and e-commerce platforms: Facilitate access to discounted products, impacting traditional pricing structures.

Strategic Implications for Stakeholders

- Manufacturers should anticipate gradual price reductions and focus on innovation, formulation differentiation, and expanding therapeutic indications.

- Investors must monitor patent landscapes and generic entry timelines to evaluate market entry points and profit margins.

- Regulatory bodies should oversee fair pricing amidst increasing generics to ensure accessibility while incentivizing innovation.

Future Outlook and Recommendations

Given the predictable decline in prices driven by market saturation of generics and health policy reforms, stakeholders should:

- Prioritize R&D for novel formulations with superior efficacy or safety.

- Explore partnerships or licensing for emerging biosimilar or specialty products.

- Invest in supply chain efficiencies to mitigate cost pressures.

- Monitor regulatory developments for potential price controls or reimbursement adjustments.

Key Takeaways

- The global market for clobetasol emulsion is growing modestly, driven by increasing dermatology treatment needs.

- Price projections indicate a downward trajectory of approximately 10-15% annually over the next five years, influenced mainly by generic competition.

- North America and Europe dominate the market, but Asia-Pacific represents a significant growth opportunity fueled by rising healthcare access.

- Strategic focus should be on innovation, patent management, and cost optimization to sustain profitability amid declining prices.

- Regulatory and policy developments will play pivotal roles in shaping future market dynamics.

FAQs

1. When are generic clobetasol emulsion products expected to significantly impact prices?

Generic products are already entering markets, with expected increased penetration over the next 2-3 years, leading to further price decreases.

2. How does formulation innovation influence clobetasol emulsion pricing?

Innovations that improve efficacy, reduce side effects, or enhance patient adherence can justify premium pricing, but such formulations typically constitute a smaller market share that may limit overall price impacts.

3. Are there any patent protections still in place for clobetasol emulsion?

Most key patents have expired or are nearing expiration, paving the way for generic manufacturers to produce cost-effective alternatives.

4. What regulatory considerations could affect the market?

Changes in approval standards, pricing policies, and reimbursement models—especially in emerging markets—could alter market access and pricing strategies.

5. What strategies can manufacturers adopt to remain competitive?

Focusing on formulation differentiation, expanding indications, optimizing supply chains, and engaging in strategic licensing are key to maintaining profitability amid declining prices.

Sources

[1] Market Research Future, “Dermatology Drugs Market Analysis,” 2022.

[2] IMS Health Data, “Price Trends in Top Skin Care Medications,” 2021.

More… ↓