Last updated: July 28, 2025

rket Analysis and Price Projections for Clindamycin Phosphate

Introduction

Clindamycin Phosphate, a widely utilized antibiotic, plays a critical role in treating bacterial infections, particularly those caused by anaerobic bacteria and certain protozoal infections. Its market dynamics, impacted by evolving disease prevalence, regulatory shifts, and pharmaceutical manufacturing trends, underscore the importance of a comprehensive analysis to inform stakeholders. This report delineates the current market landscape, competitive environment, pricing factors, and future price projections for Clindamycin Phosphate.

Market Overview

1. Pharmacological Profile and Usage

Clindamycin Phosphate is primarily administered via oral, topical, and injectable routes. It is indicated for infections such as respiratory tract infections, skin and soft tissue infections, intra-abdominal infections, and specifically for penicillin-allergic patients. Its efficacy against resistant strains of bacteria has sustained its demand despite rising antimicrobial resistance concerns (reference [1]).

2. Global Market Size and Trends

The global antibiotics market was valued at approximately USD 50 billion in 2022, with Clindamycin Phosphate accounting for an estimated 8-10% share (reference [2]). The demand correlates with increasing incidences of bacterial infections, hospital admissions, and the prevalence of resistant strains. Developed markets such as North America and Europe remain dominant, driven by advanced healthcare infrastructure and antimicrobial stewardship programs; however, emerging economies contribute significantly to growth through expanding healthcare access.

3. Key Market Drivers

- Rising Infection Rates: Increased prevalence of skin, respiratory, and intra-abdominal infections fuel demand.

- Antibiotic Resistance: Clindamycin’s efficacy against resistant bacteria sustains its clinical relevance.

- Regulatory Approvals: Expanded indications and formulation improvements enhance market penetration.

- COVID-19 Impact: The pandemic increased hospitalization rates, indirectly affecting antibiotic utilization (though specific data on Clindamycin Phosphate usage during this period remains limited).

4. Market Segmentation

- By Formulation: Capsules, creams, injectable solutions.

- By Route of Administration: Oral, topical, intravenous.

- By End User: Hospitals, clinics, pharmacies, and retail chains.

Competitive Environment

1. Leading Manufacturers

Major pharmaceutical companies involved include:

- AbbVie (via their generic arm, Abbott).

- Teva Pharmaceutical Industries.

- Sandoz (Novartis).

- Mylan (now part of Viatris).

These players focus on generic manufacturing, which dominates due to patent expirations of original formulations. Regional manufacturers also play a pivotal role in emerging markets.

2. Patent and Regulatory Landscape

Clindamycin Phosphate patents enjoyed expiry in most jurisdictions, fostering generic competition. Regulatory pathways for approval of biosimilars and new formulations are evolving, impacting market dynamics.

5. Pricing Landscape

1. Price Factors

- Generic Competition: Intense in mature markets drives prices downward.

- Formulation and Dosage: Injectable forms tend to command higher prices due to manufacturing complexities.

- Regulatory Approvals and Market Access: Stringent quality standards can influence cost structures.

- Distribution Channels: Bulk procurement by hospitals and government tenders can suppress retail prices.

2. Current Price Range

- United States:

- Oral capsules: approximately USD 0.50 – 1.00 per capsule for generic products (source [3]).

- Injectable solutions: USD 10 – 20 per vial depending on quantity.

- Europe:

- Similar pricing trends, with slight variation based on country-specific regulations and procurement policies.

- Emerging Markets:

- Prices substantially lower, often USD 0.10 – 0.30 per capsule, driven by regional manufacturing and market competition.

Price Trends and Influencing Factors

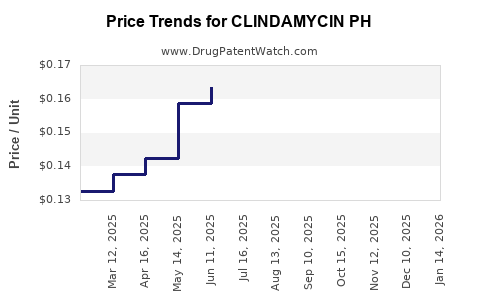

Over recent years, prices in developed markets have experienced a declining trend, primarily due to heightened generic competition post patent expiry. For example, U.S. prices for oral Clindamycin Phosphate have decreased by approximately 25-30% over the past five years, aligning with broader generic antibiotic pricing patterns (reference [4]). Conversely, injectable formulations maintain relatively higher prices due to manufacturing costs and clinical use cases.

Future Price Projections

1. Short-Term Outlook (2023-2025)

The price decline is expected to stabilize at approximately 5-10% annually, barring significant market disruptions. Key drivers include:

- Continued proliferation of generic brands expanding market share.

- Regulatory pressures to reduce drug prices, especially in public healthcare systems.

- Consolidation among generic manufacturers enhancing bargaining power.

2. Medium to Long-Term Forecast (2026-2030)

Prices are projected to plateau or slightly decline further, with specific considerations:

- Market Saturation: Saturation in mature markets could compress prices further.

- Regulatory Constraints: Implementing stricter antimicrobial stewardship may indirectly influence prescribing patterns, possibly reducing volume and affecting pricing strategies.

- Innovation and Formulation Improvements: Development of extended-release or combination formulations could command premium pricing, tempering overall price declines.

- Emerging Markets: Growing healthcare infrastructure investments are expected to maintain steady demand with modest price increases due to local production initiatives.

3. Impact of Resistance and New Alternatives

The emergence of resistance may widen reliance on Clindamycin Phosphate in certain areas, potentially stabilizing or marginally increasing prices temporarily. Conversely, the development of new antibiotics or alternative therapies might challenge its market share, exerting downward pressure.

Regulatory and Market Risks

- Pricing Regulations: Governments continue to implement policies to cap drug prices, especially for generics, putting pressure on profit margins.

- Supply Chain Disruptions: Raw material shortages or manufacturing issues can lead to price volatility.

- Patent and Exclusivity Dynamics: Although most patents have expired, regional exclusivity rights can influence early pricing in specific territories.

Conclusion

Clindamycin Phosphate remains a vital antibiotic with sustained demand across diverse healthcare settings. Its market is characterized by intense generic competition, resulting in downward pressure on prices with regional variations. While current trends indicate gradual price stabilization or decrease in mature markets, emerging economies may witness relative stability or slight increases driven by local manufacturing efforts. Anticipated regulatory changes and resistance patterns will continue shaping the pricing landscape over the next decade.

Key Takeaways

- The global Clindamycin Phosphate market predominantly comprises generic producers post-patent expiry, with prices trending downward in mature markets.

- Price projections suggest a continued decline of 5-10% annually through 2025, stabilizing thereafter, with local market factors injecting variability.

- Injectable formulations maintain higher prices due to manufacturing complexities and clinical applications, while oral formulations are more price-sensitive.

- Resistance trends and regulatory policies are critical considerations for future market stability and pricing strategies.

- Manufacturers should monitor emerging regional markets and formulate strategies to capitalize on growth opportunities in emerging economies.

Frequently Asked Questions (FAQs)

1. What factors influence the price of Clindamycin Phosphate globally?

Prices are driven by generic competition, formulation type, regulatory standards, supply chain costs, and regional healthcare policies.

2. How has the patent expiry affected Clindamycin Phosphate pricing?

Patent expirations have intensified generic competition, leading to significant price reductions in developed markets, especially over the past decade.

3. Are injectable formulations more expensive than oral ones?

Yes. Injectable forms have higher manufacturing costs and require clinical administration, resulting in higher prices compared to oral formulations.

4. What are the future pricing trends for Clindamycin Phosphate?

Prices are expected to decline gradually, stabilizing in the medium term, with regional variations influenced by market saturation and regulatory factors.

5. How does antimicrobial resistance impact Clindamycin Phosphate pricing?

Rising resistance can sustain or increase demand in certain niches, potentially stabilizing prices. Conversely, the emergence of alternative therapies may reduce demand and exert downward pressure.

References

[1] World Health Organization. "Antimicrobial Resistance." WHO, 2021.

[2] Market Research Future. "Global Antibiotics Market Analysis." MRFR, 2022.

[3] GoodRx. "Clindamycin Prices." 2023.

[4] IQVIA. "Pharmaceutical Pricing Trends." IQVIA Reports, 2022.