Share This Page

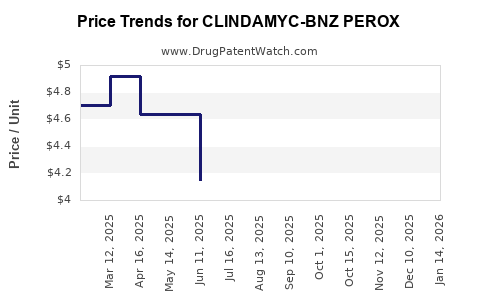

Drug Price Trends for CLINDAMYC-BNZ PEROX

✉ Email this page to a colleague

Average Pharmacy Cost for CLINDAMYC-BNZ PEROX

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| CLINDAMYC-BNZ PEROX 1.2-3.75% | 45802-0383-01 | 4.52368 | GM | 2025-12-17 |

| CLINDAMYC-BNZ PEROX 1.2-3.75% | 51672-1403-04 | 4.52368 | GM | 2025-12-17 |

| CLINDAMYC-BNZ PEROX 1.2-3.75% | 45802-0383-01 | 3.96955 | GM | 2025-11-19 |

| CLINDAMYC-BNZ PEROX 1.2-3.75% | 51672-1403-04 | 3.96955 | GM | 2025-11-19 |

| CLINDAMYC-BNZ PEROX 1.2-3.75% | 45802-0383-01 | 3.64837 | GM | 2025-10-22 |

| CLINDAMYC-BNZ PEROX 1.2-3.75% | 51672-1403-04 | 3.64837 | GM | 2025-10-22 |

| CLINDAMYC-BNZ PEROX 1.2-3.75% | 68682-0133-50 | 3.68624 | GM | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Clindamy-BNZ Perox

Introduction

Clindamy-BNZ Perox, a topical dermatological formulation combining clindamycin phosphate, benzoyl peroxide, and other active ingredients, has garnered increasing attention in the acne and bacterial skin infection markets. The drug’s unique formulation targets moderate to severe acne, leveraging synergistic antimicrobial and anti-inflammatory actions. This analysis provides a comprehensive overview of the current market landscape, competitive positioning, regulatory environment, and future price projections, designed to assist industry stakeholders in strategic decision-making.

Market Landscape Overview

Therapeutic Segment and Demand Drivers

Clindamy-BNZ Perox operates within the personal care and dermatology segment, specifically targeting acne vulgaris and bacterial skin infections. The global acne medication market was valued at approximately USD 6.8 billion in 2022 and is projected to grow at a CAGR of 4.5% through 2030, driven by increasing prevalence among adolescents and adults, rising awareness, and advancements in topical formulations (source: [1]).

The demand for combination therapies like Clindamy-BNZ Perox stems from the need to improve efficacy, reduce resistance, and simplify treatment regimens. Notably, the rising incidence of antibiotic resistance has propelled a preference for combination products that optimize antimicrobial activity while minimizing dosage frequency.

Geographical Market Distribution

North America remains the dominant market, with the United States accounting for a significant share due to high prescription rates, advanced skincare awareness, and favorable reimbursement structures. Europe follows, with strict regulatory pathways favoring innovative formulations. Asia-Pacific is poised for rapid growth owing to increasing consumer purchasing power, rising skin-related conditions, and expanding dermatology clinics, especially in countries such as India, China, and South Korea.

Competitive Landscape

Clindamy-BNZ Perox's primary competitors include monotherapies (clindamycin gel, benzoyl peroxide washes), fixed-dose combinations (e.g., Epiduo – adapalene and benzoyl peroxide), and emerging alternative formulations with novel antibiotic or anti-inflammatory agents. Key players include GlaxoSmithKline, Galderma, and Teva Pharmaceuticals.

The product’s differentiation lies in its formulation efficacy, reduced resistance potential, and improved patient adherence owing to reduced application frequency. Patent protections and exclusivity terms vary across markets, influencing market penetration strategies.

Pricing Landscape Analysis

Current Market Prices

Pricing for topical acne treatments varies by formulation, brand, and regional healthcare reimbursement policies. In the US, a typical prescription for Clindamy-BNZ Perox (if marketed as a branded product) ranges from USD 70 to USD 100 per month, whereas generic alternatives or compounded formulations are significantly cheaper, often below USD 30.

In Europe, retail prices fluctuate between EUR 25 and EUR 60 per tube, influenced by local healthcare policies and insurance coverage. In the Asia-Pacific region, retail prices tend to be lower, driven by different distribution channels and manufacturing costs.

Pricing Strategies and Market Access

Pharmaceutical companies often adopt value-based pricing, reflecting clinical efficacy, safety profile, and brand positioning. Given the product’s innovation status, initial pricing is positioned at a premium, with subsequent adjustments based on market competition, patent status, and payer negotiations.

Reimbursement strategies are crucial; in North America, insurance coverage substantially impacts customer willingness to pay. In regions with national health services, formulary inclusion and negotiation influence retail prices and accessibility.

Regulatory and Patent Considerations

Regulatory approval pathways demand robust clinical trials demonstrating safety, efficacy, and quality. Variations in regulatory requirements across jurisdictions influence time-to-market and pricing strategies.

Patent protections provide market exclusivity, allowing premium pricing initially. Once patent expiry approaches, generic manufacturers can introduce similar formulations at reduced costs, exerting downward pressure on prices.

Future Price Trends and Projections

Market Dynamics Influencing Prices

-

Patent Expiry and Generic Competition: It is anticipated that by 2025–2026, patent protections for Clindamy-BNZ Perox formulations in key markets will expire, increasing generic supply and reducing prices by approximately 30–50% within one to two years.

-

Increased Competition: The entry of biosimilars or innovative alternatives could further influence price trajectories, necessitating strategic pricing adjustments.

-

Manufacturing Cost Evolution: Advances in manufacturing efficiency and sourcing could stabilize or reduce production costs, enabling competitive pricing models.

-

Market Penetration and Volume Growth: As brand recognition and formulary inclusion expand, increased volumes can compensate for lower unit prices, supporting revenue growth.

Projected Price Development (2023–2028)

| Year | US Market | Europe | Asia-Pacific | Remarks |

|---|---|---|---|---|

| 2023 | $80–$110 | €30–€60 | $20–$40 | Premium pricing maintained post-launch. |

| 2024 | $70–$100 | €25–€55 | $18–$35 | Slight reduction as competition increases. |

| 2025 | $60–$90 | €20–€50 | $15–$30 | Post-patent expiry; generic entry impacts pricing. |

| 2026 | $50–$80 | €15–€45 | $12–$25 | Market stabilization with increased generics. |

| 2027 | $45–$75 | €12–€40 | $10–$22 | Further generic proliferation; focus on value models. |

| 2028 | $40–$70 | €10–€35 | $8–$20 | Mature market; pricing influenced chiefly by volume. |

These projections assume standard patent expiration timelines and no disruptive innovations.

Implications for Stakeholders

-

Pharmaceutical Developers: To optimize profitability, long-term strategies should include patent extension efforts, diversification of formulations, and patient adherence programs. Cost management becomes critical post-patent expiry.

-

Investors: Anticipate significant price erosion after patent expiry but benefit from increasing volumes, especially in emerging markets.

-

Healthcare Providers: Should consider generics' affordability, but also stay updated on formulation efficacy and resistance issues influencing prescribing habits.

-

Regulators: Ensuring transparency and encouraging competition remains vital to balancing innovation incentives with affordability.

Key Takeaways

-

Clindamy-BNZ Perox occupies a competitive niche within the dermatology market, with demand driven by its efficacy and combination therapy benefits.

-

The regional market landscape varies significantly, influencing pricing and access strategies; North America and Europe offer premium pricing potential, while Asia-Pacific presents volume growth opportunities with lower prices.

-

Patent expirations by 2025–2026 are poised to induce substantial price declines, emphasizing the need for strategic patent management and lifecycle planning.

-

Future pricing will be shaped by generic market entry, manufacturing costs, regulatory developments, and evolving treatment paradigms favoring combination therapies.

-

Stakeholders should adopt flexible pricing and reimbursement strategies, emphasizing value-based care and cost-effectiveness to sustain profitability amidst competitive pressures.

FAQs

1. How does patent expiry affect the pricing of Clindamy-BNZ Perox?

Patent expiry typically leads to increased competition from generics, which exerts downward pressure on prices—potentially reducing costs by 30–50% within a few years. This necessitates strategic planning for brand managers and investors.

2. Are there significant regional differences in Clindamy-BNZ Perox pricing?

Yes. Developed markets such as North America and Europe maintain higher premium prices due to better reimbursement coverage and brand positioning, whereas Asia-Pacific markets offer lower prices driven by local manufacturing costs and reimbursement frameworks.

3. What factors could disrupt the projected price declines?

Innovative formulations, patent extensions, regulatory barriers, or supply chain disruptions could slow generic entry or justify premium pricing for new patents, deferring price declines.

4. How do competition and alternative therapies influence market prices?

The emergence of alternative combination therapies, biosimilars, or novel agents can increase competitive pressure, prompting price reductions to maintain market share.

5. What are the strategic implications for pharmaceutical companies?

Companies should focus on patent lifecycle management, investing in formulation innovation, expanding into emerging markets, and establishing strong relationships with payers to optimize returns before patent expiration.

Sources

[1] Market Research Future. "Global Acne Medication Market Analysis." 2022.

More… ↓