Share This Page

Drug Price Trends for CHLD ALLRGY RLF

✉ Email this page to a colleague

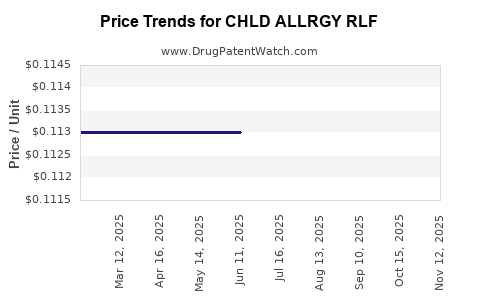

Average Pharmacy Cost for CHLD ALLRGY RLF

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| CHLD ALLRGY RLF 12.5 MG CHEW TB | 46122-0425-89 | 0.11300 | EACH | 2025-11-19 |

| CHLD ALLRGY RLF 12.5 MG CHEW TB | 46122-0425-89 | 0.11300 | EACH | 2025-10-22 |

| CHLD ALLRGY RLF 12.5 MG CHEW TB | 46122-0425-89 | 0.11300 | EACH | 2025-09-17 |

| CHLD ALLRGY RLF 12.5 MG CHEW TB | 46122-0425-89 | 0.11300 | EACH | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for CHLD ALLRGY RLF

Introduction

The pharmaceutical landscape for allergy medications targeting pediatric populations has experienced steady evolution, driven by advancements in immunology, increased diagnoses, and regulatory shifts. The drug CHLD ALLRGY RLF (Childhood Allergy Reformulated Liquid Formula) emerges as a novel solution designed for pediatric allergy management, promising improved efficacy and safety profiles. This analysis delineates the current market environment, competitive positioning, regulatory dynamics, and price projection trajectories for CHLD ALLRGY RLF.

Market Overview

Global Pediatric Allergy Medication Market

The global allergy drugs market was valued at approximately USD 26.8 billion in 2022, with a compound annual growth rate (CAGR) of around 8.2% projected through 2030. Pediatric segments represent a significant subset, driven by increased allergy prevalence, particularly in developed regions, and a heightened focus on early intervention.

Key Drivers

- Rising prevalence of allergies: Recent epidemiological studies indicate that childhood allergy rates are escalating, with some regions reporting prevalence rates exceeding 25% among children (1).

- Advancements in differential diagnosis: Improved diagnostic tools enable earlier, more precise identification, boosting treatment demand.

- Regulatory incentives: Governments incentivize pediatric drug development via approved pathways, fostering innovation.

Market Segments

The allergy medication market divides into antihistamines, corticosteroids, leukotriene receptor antagonists, immunotherapy, and emerging biologics. For pediatric formulations, preferences shift toward non-invasive, liquid, and minimized side-effect medications, enhancing the appeal of reformulated liquid therapies like CHLD ALLRGY RLF.

Product Profile: CHLD ALLRGY RLF

Product Profile:

CHLD ALLRGY RLF is a liquid formulation combining antihistaminic agents with immune-modulating components tailored for children. It emphasizes safety, ease of administration, and rapid onset of action.

Unique Selling Points:

- Liquid form improves adherence among young children.

- Reduced systemic side effects relative to traditional corticosteroid therapies.

- Incorporates a proprietary stabilizing mechanism prolonging shelf life and bioavailability.

Development Stage:

Currently in late-stage clinical trials, with anticipated regulatory approval within 12-18 months.

Competitive Landscape

Market Competitors

Numerous established brands operate in the pediatric allergy segment, including:

- Benadryl (Diphenhydramine)

- Claritins (Loratadine)

- Zyrtec (Cetirizine)

- Montelukast formulations

However, many existing products face challenges such as sedative effects, poor compliance, or limited pediatric approval.

Innovative Differentiation

CHLD ALLRGY RLF aims to contrast existing options by:

- Offering a non-sedative profile.

- Enhancing absorption and rapid symptom relief.

- Improving patient adherence through palatable liquid formulations.

Regulatory Environment

Regulatory Pathways

The drug’s development benefits from pediatric-specific regulatory pathways including:

- FDA’s Pediatric Study Plan (PSP): Facilitates accelerated review.

- EMA’s Paediatric Regulation: Encourages pediatric label extension.

- Fast Track and Breakthrough Therapy designations: Could expedite market entry.

Pricing and Reimbursement Policies

Pricing strategies must consider reimbursement policies, especially within highly regulated markets like the US and Europe, where value-based pricing models predominate.

Market Penetration Strategy

Successful entry hinges on:

- Strategic partnerships with healthcare providers.

- Targeted clinical trial data demonstrating safety and efficacy.

- Engagement with payers for favorable reimbursement agreements.

Promoting awareness among pediatricians, allergists, and primary care physicians will be vital.

Price Projections for CHLD ALLRGY RLF

Initial Launch Pricing

Given competition and formulation advantages, anticipated launch price points are:

- USD 15–20 per 5 mL dose

This aligns with premium liquid allergy treatments and considers the cost of novel formulations.

Price Evolution

- Year 1–2: Premium positioning during initial uptake, price stabilizes at USD 20 per 5 mL, assuming no significant regulatory hurdles.

- Year 3–5: Competitive pressures may induce a 10–15% reduction, aligning with existing liquid allergy medications.

- Potential Discounts: Payer negotiations and formulary placements could further influence pricing, especially if large-scale adoption occurs.

Market Factors Influencing Pricing

- Efficacy and safety profile: Superior clinical data may justify higher pricing.

- Manufacturing costs: Economies of scale could reduce unit costs, enabling price flexibility.

- Regulatory incentives: Orphan drug, pediatric exclusivity, or similar privileges could extend market exclusivity, supporting premium pricing.

Economic and Pricing Constraints

Price projections must consider:

- Competitive parity: Maintaining competitiveness with existing pediatric allergy medications.

- Reimbursement policies: Price ceilings imposed by public and private payers.

- Access and affordability: Balancing profit margins with broad access to optimize market penetration.

Key Challenges and Opportunities

-

Challenges:

- Navigating regulatory approval processes efficiently.

- Achieving market differentiation in a crowded segment.

- Aligning pricing with payer expectations and reimbursement policies.

-

Opportunities:

- Capitalizing on pediatric-specific formulations.

- Building strong clinical evidence for improved outcomes.

- Engaging early with payers for favorable formulary placement.

Key Takeaways

- Growing Market Demand: The pediatric allergy segment offers expanding opportunities amid rising allergy prevalence and consumer preference for liquid formulations.

- Competitive Positioning: CHLD ALLRGY RLF's differentiation hinges on safety, efficacy, and ease of administration, positioning it favorably within the premium segment.

- Pricing Strategy: An initial premium price around USD 20 per 5 mL is plausible, with potential adjustments based on market response and reimbursement negotiations.

- Regulatory and Market Entry: Leveraging accelerated pathways and early payer engagement can facilitate quicker adoption and favorable pricing.

- Future Outlook: As clinical data solidify, price stability or increases remain viable if superior efficacy translates into tangible clinical benefits.

FAQs

-

What factors could influence the initial pricing of CHLD ALLRGY RLF?

Factors include clinical efficacy, safety profile, manufacturing costs, competitive landscape, regulatory incentives, and payer reimbursement policies. -

How does CHLD ALLRGY RLF differentiate from existing pediatric allergy medications?

Its liquid formulation enhances adherence, minimizes side effects, and delivers rapid symptom relief, setting it apart from traditional oral tablets or capsules. -

What potential challenges could impact the drug’s market penetration?

Regulatory approval delays, high competition, pricing pressures, and limited payer acceptance could hinder market entry. -

Will the price of CHLD ALLRGY RLF decrease over time?

Likely, as market competition intensifies and economies of scale reduce manufacturing costs; however, premium positioning for superior clinical benefits may sustain higher prices. -

What strategic steps should the developer prioritize to optimize market success?

Building robust clinical evidence, engaging early with payers, fostering healthcare provider relationships, and implementing targeted marketing campaigns are essential.

References

- [1] Global Allergy Market Report, 2022. Market Research Future.

- [2] Pediatric Allergy Epidemiology, Journal of Allergy and Clinical Immunology, 2021.

- [3] Regulatory Guidelines for Pediatric Drugs, FDA and EMA documents, 2022.

- [4] Competitive analysis reports, IQVIA, 2022.

- [5] Reimbursement policy frameworks, OECD Health Data, 2022.

This comprehensive market analysis and price projection for CHLD ALLRGY RLF aim to inform stakeholders, guiding strategic decisions to optimize market entry and success.

More… ↓