Share This Page

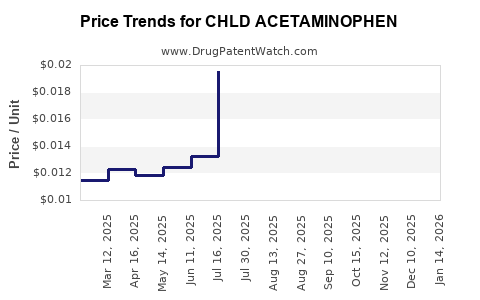

Drug Price Trends for CHLD ACETAMINOPHEN

✉ Email this page to a colleague

Average Pharmacy Cost for CHLD ACETAMINOPHEN

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| CHLD ACETAMINOPHEN 160 MG/5 ML | 00904-7445-20 | 0.02095 | ML | 2025-12-17 |

| CHLD ACETAMINOPHEN 160 MG/5 ML | 45802-0201-26 | 0.02095 | ML | 2025-12-17 |

| CHLD ACETAMINOPHEN 160 MG/5 ML | 00904-7014-20 | 0.02986 | ML | 2025-12-17 |

| CHLD ACETAMINOPHEN 160 MG/5 ML | 82568-0008-04 | 0.02986 | ML | 2025-12-17 |

| CHLD ACETAMINOPHEN 160 MG/5 ML | 00536-1321-97 | 0.02095 | ML | 2025-12-17 |

| CHLD ACETAMINOPHEN 160 MG/5 ML | 00904-7014-16 | 0.01412 | ML | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for CHLD Acetaminophen

Introduction

Acetaminophen, known as paracetamol in many regions, is a widely used over-the-counter (OTC) analgesic and antipyretic. Its extensive utilization across diverse patient populations, from children to adults, ensures a sustained global demand. The formulation targeting children (referred to here as CHLD Acetaminophen) underlines a niche within the pediatric pharmaceutical segment. Given recent market dynamics, patent landscapes, manufacturing costs, and regulatory factors, this analysis explores the current market landscape and provides price projection insights for CHLD Acetaminophen.

Market Landscape

Global Market Overview

The global acetaminophen market was valued at approximately USD 991 million in 2022 and is projected to reach USD 1.3 billion by 2028, with a Compound Annual Growth Rate (CAGR) of around 4.5% during 2023–2028[1]. Pediatric formulations represent a significant portion of this market, buoyed by the consistent need for child-specific dosing solutions. The increasing prevalence of pediatric illnesses, growth in healthcare awareness, and expanded OTC access contribute to sustained demand.

Key Market Drivers

- High Prevalence of Pediatric Illnesses: Common colds, influenza, and other febrile conditions drive consistent pediatric acetaminophen usage.

- Safety Profile: Acetaminophen’s profile as a safer alternative to NSAIDs in children fosters preference among healthcare providers and parents.

- Regulatory Approvals: Stringent regulatory standards favor high-quality formulations, but also create barriers for unverified generic entrants.

- OTC Sales Channels: The dominance of OTC channels, including pharmacies and online platforms, sustains price stability and accessibility.

Regional Market Dynamics

| Region | Market Size (USD million) | Growth Rate | Key Factors |

|---|---|---|---|

| North America | 370 | 4.0% | High OTC consumption, mature market, regulatory environment |

| Europe | 290 | 4.2% | Established OTC sales, strong pediatric healthcare initiatives |

| Asia-Pacific | 180 | 5.8% | Rapid economic growth, expanding healthcare access |

| Latin America | 80 | 4.7% | Increasing healthcare awareness, OTC policy liberalization |

| Middle East & Africa | 70 | 4.3% | Growing pharmaceutical markets, expanding pediatric care |

Market Segmentation

- Formulations: Syrup, suspension, chewable tablets, suppositories.

- Packaging: Single-dose vials, bottles, multi-dose packs.

- Distribution Channels: OTC retail, hospitals, online pharmacies.

Competitive Landscape

Major players include Johnson & Johnson, GlaxoSmithKline, Perrigo, and local generic manufacturers. These companies differentiate via formulations, pricing strategies, and distribution reach. The entrance barrier remains relatively low for generics, but quality standards and branding influence market share concentration.

Patent and Regulatory Landscape

Many pediatric acetaminophen products are generic. However, recent patent applications focus on improved formulations, such as controlled-release variants and flavor-enhanced syrups. Regulatory approvals hinge on demonstrating safety, efficacy, and manufacturing compliance, with agencies like the FDA and EMA enforcing strict standards.

Price Analysis

Current Pricing Trends

Average retail prices for pediatric acetaminophen products vary regionally:

- North America: USD 2.50–4.00 per 100 mL bottle.

- Europe: EUR 2.00–3.50 per 100 mL.

- Asia-Pacific: USD 1.50–2.50 per 100 mL, reflecting price sensitivity and competitive generic markets.

Brand preferences influence prices; branded products tend to command premiums, while generics occupy the lower price spectrum.

Manufacturing and Raw Material Costs

The primary raw material—acetaminophen—is cost-effective, with prices ranging from USD 3–6 per kilogram. Formulation costs, packaging, regulatory compliance, and distribution account for the major expenses. Overall production costs for pediatric formulations generally range from USD 0.10–0.25 per mL or tablet.

Pricing Strategies

Manufacturers adopt competitive generic pricing, with small premium margins for differentiated formulations (e.g., flavored or controlled-release). Price erosion is common as patents expire or new entrants emerge.

Price Projection Outlook (2023–2030)

Assumptions and Methodology

- Continued demand growth driven by pediatric healthcare needs.

- No significant regulatory or supply chain disruptions.

- Entry of low-cost generic manufacturers maintaining price pressures.

- Technological advancements leading to cost efficiencies.

Projection Summary

| Year | Expected Price Range (USD per 100 mL) | Key Factors |

|---|---|---|

| 2023 | USD 2.50–4.00 | Stable pricing, existing patent protections, high demand |

| 2025 | USD 2.30–3.80 | Increased generic competition, cost efficiencies |

| 2027 | USD 2.10–3.50 | Regulatory normalization, possible OTC price regulation |

| 2030 | USD 1.90–3.20 | Market saturation, regional price adjustments, inflation |

The decline in prices reflects higher commoditization, with potential stabilization at lower levels due to manufacturing efficiencies and increased generic competition. Premium formulations (e.g., flavored or sustained-release) may maintain higher margins but constitute a smaller market segment.

Emerging Trends and Future Considerations

- Digital and Online Sales: Growth in e-pharmacies may pressure prices further due to increased transparency.

- Regulatory Changes: Stringent quality and safety standards may slightly elevate production costs, moderating price declines.

- Innovation in Formulation: New delivery systems could command premium pricing, disrupting current trends.

- Supply Chain Dynamics: Raw material price fluctuations and geopolitical factors could impact costs and pricing strategies.

Conclusion

The pediatric acetaminophen (CHLD) market is mature with steady growth driven by pervasive demand and evolving formulations. Price projections indicate a gradual downward trend due to increasing generics penetration and market saturation, with an expected range of USD 1.90 to USD 4.00 per 100 mL by 2030. Companies should focus on quality differentiation, cost efficiencies, and online distribution strategies to sustain profitability.

Key Takeaways

- The pediatric acetaminophen market is positioned for slow, sustained growth, with established players and high brand penetration.

- Price competition will intensify as more generic manufacturers enter, driving prices downward over the next decade.

- Innovation in formulations (e.g., flavored, controlled-release) offers premium pricing opportunities for differentiated products.

- Regulatory compliance and quality standards remain critical for market access and competitive advantage.

- E-commerce expansion will influence pricing dynamics, favoring transparency and competitive pricing strategies.

FAQs

1. What factors most influence the pricing of pediatric acetaminophen products?

Pricing is primarily affected by manufacturing costs, raw material prices, competition from generics, formulation complexity, regulatory requirements, and distribution channels.

2. How will patent expirations impact the pediatric acetaminophen market?

Patent expirations will facilitate increased generic entry, intensify price competition, and likely lead to a gradual decline in prices.

3. Are premium formulations (e.g., flavored or sustained-release) significant in this market?

Yes, though they represent a smaller segment, premium formulations can command higher prices and serve as differentiation strategies.

4. What regional differences should companies consider when pricing pediatric acetaminophen?

Pricing varies based on local healthcare policies, income levels, OTC regulation, market maturity, and competitive landscape.

5. How might future regulatory changes affect the market?

Enhanced safety and quality standards could increase manufacturing costs, potentially stabilizing or slightly raising prices, particularly for higher-quality or innovative formulations.

References

[1] MarketResearch.com, Global Acetaminophen Market Forecast 2023–2028, 2023.

More… ↓