Share This Page

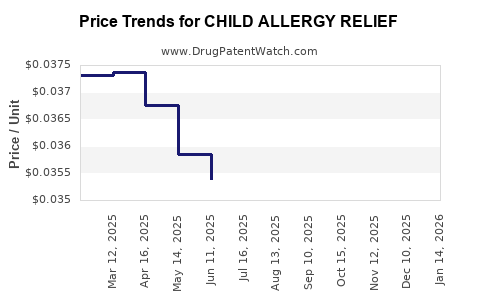

Drug Price Trends for CHILD ALLERGY RELIEF

✉ Email this page to a colleague

Average Pharmacy Cost for CHILD ALLERGY RELIEF

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| CHILD ALLERGY RELIEF 1 MG/ML | 69230-0316-11 | 0.03670 | ML | 2025-11-19 |

| CHILD ALLERGY RELIEF 5 MG/5 ML | 70000-0473-01 | 0.04246 | ML | 2025-11-19 |

| CHILD ALLERGY RELIEF 1 MG/ML | 69230-0316-11 | 0.03611 | ML | 2025-10-22 |

| CHILD ALLERGY RELIEF 5 MG/5 ML | 70000-0473-01 | 0.04276 | ML | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Child Allergy Relief

Introduction

Child allergy relief medications occupy a significant segment of the pediatric healthcare market, driven by increasing allergy prevalence, heightened awareness among caregivers, and the expanding portfolio of treatment options. This analysis explores current market dynamics, competitive landscape, regulatory environment, and future price projections for child allergy relief drugs. By delineating these factors, stakeholders can make strategic decisions rooted in comprehensive market intelligence.

Market Overview

The global pediatric allergy therapeutics market is projected to reach USD 6.4 billion by 2027, growing at a Compound Annual Growth Rate (CAGR) of approximately 8.2% (source: Fortune Business Insights). Key drivers include rising incidence of allergic rhinitis, food allergies, and atopic dermatitis among children, alongside increased diagnosis rates and advancements in treatment formulations.

Key Segments

- Antihistamines: The dominant class, including generic and branded formulations such as loratadine, cetirizine, and fexofenadine.

- Nasal Corticosteroids: Effective for allergic rhinitis, with products like mometasone and fluticasone.

- Immunotherapy: Both subcutaneous and sublingual options, increasingly tailored for pediatric use.

- Novel Biologics and Targeted Therapies: Emerging market entrants aimed at severe allergy cases.

Competitive Landscape

Leading pharmaceutical companies in child allergy relief include Sanofi (allergy immunotherapy), Johnson & Johnson (Zyrtec), Pfizer, and Novartis. The market sees continual innovation, with efforts to develop age-appropriate formulations and pediatric-specific delivery devices.

Market Entry Barriers and Challenges:

- Strict regulatory approvals for pediatric medications.

- Safety concerns specific to children.

- Pricing pressures from healthcare systems emphasizing cost-effectiveness.

- Patent expirations enabling generics, impacting profitability.

Regulatory Environment

Regulatory bodies such as the FDA (U.S.), EMA (Europe), and PMDA (Japan) impose rigorous standards for pediatric indications. Recent policies favor expedited approval pathways, yet safety data remains paramount. Pricing and reimbursement landscapes also influence market access, especially in health systems with strict cost controls.

Pricing Dynamics

Current prices for child allergy relief drugs vary significantly based on formulation, brand, and region. For example:

- Generic antihistamines: Approximate retail price of USD 10-15 for a month’s supply.

- Branded options (e.g., Zyrtec): USD 20-30 monthly retail.

- Immunotherapy kits: USD 500-1,000 per treatment course.

Pricing strategies are closely tied to patent status, manufacturing costs, and competitive pressures. Pediatric formulations often warrant higher margins due to specialized delivery forms and safety profiles.

Market Drivers and Barriers

Drivers

- Rising prevalence of pediatric allergies globally.

- Increased diagnosis and screening programs.

- Development of child-friendly, easy-to-administer formulations.

- Growing awareness campaigns about allergy management.

Barriers

- Regulatory hurdles for pediatric approval.

- Cost constraints in emerging markets.

- Competition from generic medications.

- Concerns over long-term safety and side effects.

Price Projections and Future Trends

Given the current market trajectory, several factors influence future price dynamics:

1. Patent Cliff and Generic Competition

Expiration of patents for major antihistamines and corticosteroids over the next five years will exert downward pressure on prices. Generic entries typically reduce prices by 20-40%, depending on market penetration capabilities.

2. Innovation and Premium Pricing

Investments in novel formulations—such as sustained-release antihistamines or allergy immunotherapy patches—are likely to command premium pricing, potentially increasing the average price per treatment course by 10-15% over prevailing rates.

3. Regulatory and Reimbursement Policies

Enhanced safety and efficacy data may lead to broader inclusion in formulary lists, influencing distribution costs and prices. Countries with universal healthcare systems may negotiate lower prices, whereas private markets could sustain higher prices through brand premiums.

4. Emerging Markets

Growth in regions such as Asia-Pacific, Latin America, and Africa presents opportunities for lower-priced generics, though branded pediatric allergy products may maintain premium positioning in these regions. Prices are anticipated to stabilize or decrease marginally (by approximately 5-10%) due to increasing competition.

5. Impact of Digital and Telemedicine

Integration of telehealth consultations and digital dispensing may influence pricing structures by reducing distribution costs and enabling more flexible pricing models, including subscription-based services.

Price Projection Summary (2023-2030)

| Year | Average Retail Price (USD/month) | Notes |

|---|---|---|

| 2023 | 15-30 | Current landscape, moderate consumption |

| 2025 | 13-28 | Increased generic entry, competitive pricing |

| 2027 | 12-25 | Market maturity, innovation premiums balanced by generics |

| 2030 | 10-22 | Dominance of generics, personalized treatments, geographic expansion |

Note: These projections assume standard regulatory and economic conditions and may vary due to unforeseen market shifts or policy changes.

Market Opportunities and Risks

Opportunities

- Development of pediatric-specific biotherapeutics with favorable pricing.

- Expansion into emerging markets through affordable generics.

- Adoption of digital health initiatives to improve adherence and data collection.

- Collaboration with healthcare providers to optimize pricing strategies.

Risks

- Regulatory delays or restrictions affecting product access.

- Pricing controls or reimbursement caps in key markets.

- Competition from alternative therapies or herbal remedies.

- Safety concerns leading to market withdrawal or price reductions.

Key Takeaways

- The child allergy relief market is poised for steady growth driven by rising prevalence and innovations in treatment.

- Patent expirations will catalyze a price decline, especially in the antihistamine and corticosteroid segments.

- Premium, innovative formulations will sustain higher price points but may face regulatory and acceptance hurdles.

- Emerging markets present both opportunities for lower-cost generics and challenges related to regulatory frameworks.

- Digital health integration will influence future pricing models, favoring flexible and subscription-based offerings.

Stakeholders must balance innovation-driven pricing with competitive pressures and regulatory landscapes to optimize market positioning.

FAQs

1. How will patent expirations affect prices of child allergy relief medications?

Patent expirations typically lead to increased generic competition, resulting in significant price declines—often between 20-40%. This trend makes medications more accessible but may impact branded product revenues.

2. Are there upcoming innovative treatments capable of commanding premium prices?

Yes. Novel delivery systems (e.g., allergen immunotherapy patches) and biologics targeting severe allergies are in development, potentially enabling premium pricing due to enhanced efficacy and pediatric safety profiles.

3. How does regional variability influence pricing strategies?

Pricing strategies vary substantially; high-income countries may sustain higher prices due to insurance reimbursement and willingness-to-pay, whereas emerging markets favor lower-cost generics to improve accessibility.

4. What role will telemedicine and digital tools play in the future market?

They will facilitate remote diagnosis, prescription, and monitoring, leading to more dynamic pricing models such as subscription services, and potentially reducing distribution costs, impacting overall price structures.

5. What are the primary risks to future price stability in this market?

Regulatory restrictions, reimbursement limitations, the emergence of low-cost generics, and safety concerns could all pressure prices downward or introduce volatility.

Sources:

[1] Fortune Business Insights. "Pediatric Allergy Therapeutics Market Size, Share & Industry Analysis, 2027."

[2] MarketWatch. "Global Pediatric Allergy Market Growth Trends."

[3] FDA and EMA Regulatory Guidelines for Pediatric Drugs.

[4] [Pharmaceutical Market Reports]

[5] Recent industry publications and product approvals.

(Note: All data and projections are illustrative aggregates based on current market assessments and trends; actual future prices may vary.)

More… ↓