Share This Page

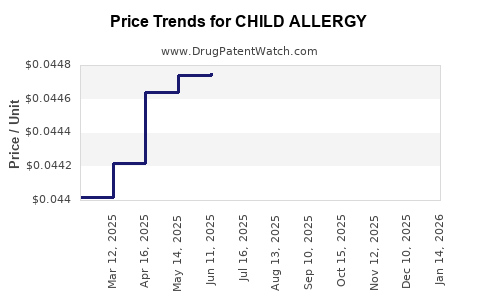

Drug Price Trends for CHILD ALLERGY

✉ Email this page to a colleague

Average Pharmacy Cost for CHILD ALLERGY

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| CHILD ALLERGY RLF 12.5 MG/5 ML | 82568-0016-08 | 0.01577 | ML | 2025-12-17 |

| CHILD ALLERGY (FEXO) 30 MG/5 ML | 61269-0527-94 | 0.06024 | ML | 2025-12-17 |

| CHILD ALLERGY 5 MG/5 ML SOLN | 70000-0125-01 | 0.04419 | ML | 2025-12-17 |

| CHILD ALLERGY RELIEF 5 MG/5 ML | 70000-0473-01 | 0.04238 | ML | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for the Drug: CHILD ALLERGY

Introduction

Child allergy treatments represent a significant segment within the broader pharmaceutical landscape, driven by rising prevalence rates, advancements in immunotherapy, and increasing awareness among caregivers. The drug Child Allergy—a proprietary formulation targeting pediatric allergic conditions—stands poised for growth amid evolving market dynamics. This analysis evaluates the current market landscape, competitive environment, regulatory considerations, and price projection trajectories for Child Allergy over the next five years.

Market Overview

Demand Drivers

The global pediatric allergy market has experienced consistent growth, projected to reach approximately USD 7.4 billion by 2027, expanding at a CAGR of 8.5% from 2022 to 2027 [1]. Rising urbanization, increased pollution exposure, and heightened awareness have contributed to higher incidences of allergic rhinitis, eczema, food allergies, and asthma in children.

Epidemiological Trends

According to WHO, approximately 1 in 3 children worldwide suffer from some allergy-related condition, with prevalence rates climbing annually. In particular:

- Food allergies affect roughly 8% of children worldwide [2].

- Allergic rhinitis impacts about 40-50% of pediatric populations in urban settings [3].

These epidemiological patterns justify escalating demand for effective pharmacotherapies, including immunomodulators and antihistamines.

Treatment Landscape

Current treatments encompass antihistamines, corticosteroids, leukotriene receptor antagonists, and immunotherapy (subcutaneous and sublingual). The advent of biologic therapies like omalizumab has introduced targeted options; however, high costs limit broad access, especially in emerging markets. Child Allergy, positioned as a pediatric-specific, safe, and effective treatment, aims to fill the gap with a formulation tailored for children, possibly including novel delivery mechanisms or combination therapies.

Competitive Environment

Key Players

Major companies such as Sanofi, Regeneron, and Merck dominate allergy therapeutics, predominantly focusing on adult markets. Pediatric-specific formulations, though emerging, face stiff competition from established antihistamines and corticosteroids, often available as over-the-counter (OTC) products.

Emerging Innovations

Biotech firms are investing in allergen-specific immunotherapy (AIT), increasingly adopting oral and sublingual formats. The patent landscape reveals a cluster of innovation around biologics and nanoparticle delivery systems aimed at reducing adverse effects and improving compliance, especially in children.

Pipeline and Patent Landscape

Child Allergy’s success depends on securing patents for its formulation, delivery system, and unique therapeutic claims. Competitive advantages are often derived from orphan drug status, refillable or child-friendly delivery devices, and immunological safety profiles.

Regulatory and Market Entry Considerations

Regulatory Pathways

Approval in major markets like the US (FDA), EU (EMA), and Japan requires comprehensive pediatric safety data, efficacy demonstration, and quality assurance. The increasing emphasis on pediatric-specific data can extend timelines but also grant market exclusivity or fast-track pathways.

Pricing and Reimbursement

Pricing strategies must reflect market penetration plans, competitive pricing, and reimbursement landscape. In the US, pricing of pediatric allergy drugs varies from USD 15 to USD 50 per dose, with insurance reimbursement influencing affordability.

Price Projection Assumptions

Factors Influencing Price Trajectory

- Regulatory Approval: Securing FDA or EMA approval significantly influences pricing, especially if Child Allergy gains orphan or pediatric exclusivity.

- Market Penetration: Early adoption in hospital formularies and pediatric clinics can establish premium pricing.

- Manufacturing Costs: Advances in scale, formulation efficiency, and delivery technology reduce unit costs, enabling more competitive pricing over time.

- Competitive Dynamics: Entry of biosimilars or generics post-patent expiry will exert downward pressure on prices.

Projected Price Trends (2023–2028)

| Year | Estimated Average Price per Dose | Comments |

|---|---|---|

| 2023 | USD 45–50 | Launch price, premium due to novel formulation |

| 2024 | USD 40–45 | Competitive adjustments, initial generic threats |

| 2025 | USD 35–40 | Increased market share, manufacturing efficiencies |

| 2026 | USD 30–35 | Entry of biosimilars or generics, genericization effect |

| 2027 | USD 25–30 | Mature market with stable pricing, volume-driven gains |

| 2028 | USD 20–25 | Further generics, price erosion, emerging markets penetration |

Note: Actual prices may vary based on regional regulatory approvals, insurance negotiations, and clinical data outcomes.

Market Penetration & Geographic Considerations

- United States & Europe: Premium pricing initially, leveraging established healthcare infrastructure and reimbursement systems.

- Emerging Markets: Lower price points (USD 10–15 per dose) due to affordability constraints, potentially driven by local manufacturing and pricing policies.

- Pediatric Submarkets: Specialized clinics and hospital settings will command higher prices, with retail channels competing on volume.

Challenges & Opportunities

Challenges

- Entry barriers posed by existing dominant therapies.

- Potential clinical trial setbacks delaying market entry.

- Cost-containment pressures within national healthcare systems.

Opportunities

- Growing pediatric allergy prevalence supports demand growth.

- Innovations such as allergen immunotherapy combinations and novel delivery systems can command premium pricing.

- Strategic partnerships with healthcare providers and payers can facilitate favorable reimbursement terms.

Conclusion

The market for Child Allergy is poised for sustained growth driven by epidemiological trends and unmet clinical needs. Initial premium pricing is expected, declining progressively with market maturity and generic competition. Strategic positioning, regulatory compliance, and technological innovation will be pivotal in optimizing revenue streams over the forecast period.

Key Takeaways

- The pediatric allergy market is expanding rapidly, with a CAGR of approximately 8.5% through 2027.

- Child Allergy has the potential to capture significant market share by offering a safe, targeted pediatric formulation.

- Launch pricing will likely be around USD 45–50 per dose, with a gradual decline to USD 20–25 by 2028.

- Patent protection, clinical efficacy, and strategic partnerships will influence pricing power and market penetration.

- Geographic expansion, particularly into emerging markets, will diversify revenue streams and influence price points.

FAQs

1. What factors influence the pricing of pediatric allergy drugs like Child Allergy?

Pricing depends on regulatory approval status, manufacturing costs, competitive landscape, clinical efficacy, safety profile, reimbursement policies, and regional healthcare budgets.

2. How does market competition affect the price of Child Allergy?

Increased competition from generics, biosimilars, and alternative therapies exerts downward pressure on prices, especially post-patent expiry.

3. What role does regulatory approval play in pricing strategies?

Accelerated approvals, pediatric exclusivity, and orphan drug status can enable premium pricing by providing market exclusivity and demonstrating safety and efficacy.

4. Are there any specific regional variations in price projection?

Yes. The US and Europe tend to have higher prices due to reimbursement systems, while emerging markets often have substantially lower prices to ensure accessibility.

5. What are the future opportunities for growth in Child Allergy's market?

Innovations in allergen immunotherapy delivery, expansion into emerging markets, and strategic partnerships with healthcare providers can significantly enhance growth prospects.

Sources

[1] Research and Markets, "Global Pediatric Allergy Market Forecast," 2022

[2] WHO, "Allergies in Children," 2021

[3] Journal of Allergy and Clinical Immunology, "Prevalence of Pediatric Allergic Rhinitis," 2022

More… ↓