Last updated: July 27, 2025

Introduction

Celecoxib, marketed under brand names such as Celebrex, is a selective cyclooxygenase-2 (COX-2) inhibitor approved primarily for the treatment of osteoarthritis, rheumatoid arthritis, ankylosing spondylitis, and acute pain conditions. Its distinct mechanism offers anti-inflammatory benefits while purportedly reducing gastrointestinal side effects associated with non-selective NSAIDs. Given its established clinical use and market presence, analyzing the current market landscape and projecting future prices is vital for pharmaceutical stakeholders, investors, and healthcare professionals.

Market Landscape Overview

Global Market Size and Growth Trends

The global celecoxib market has demonstrated consistent growth, driven by increasing incidences of chronic inflammatory diseases, expanding aging populations, and a prevalence of NSAID-compatible conditions. As per market research reports, the global NSAID market was valued at approximately USD 15 billion in 2021 and is projected to reach USD 20 billion by 2027, with celecoxib comprising a significant segment owing to its favorable safety profile.

In North America, high prescription rates and favorable reimbursement policies amplify celecoxib’s market dominance. Meanwhile, emerging markets in Asia-Pacific and Latin America are witnessing accelerated growth due to increased healthcare access and rising awareness.

Patent Status and Generic Competition

The primary patent for celecoxib expired in the United States in 2015, leading to the emergence of multiple generic versions. The proliferation of generics has significantly reduced branded drug prices, intensifying competitive pressures. Nevertheless, branded formulations maintain a foothold owing to physician preference and perceived quality assurances.

In recent years, patent litigations and potential patent extensions in specific jurisdictions influence pricing dynamics. For example, some jurisdictions have granted secondary patents, prolonging exclusivity.

Regulatory Environment and Approvals

Regulatory agencies like the FDA and EMA strictly oversee NSAID approvals, prescribing guidelines, and safety warnings. Notably, the cardiovascular risk profile of celecoxib and its class has led to post-marketing restrictions and black-box warnings, impacting physician prescribing patterns but not necessarily the market volume significantly.

Pricing Trends and Drivers

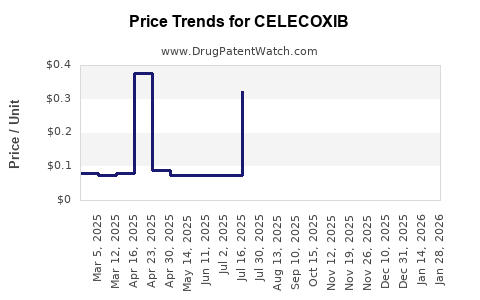

Historical Price Trajectory

Prior to patent expiration, branded celecoxib’s wholesale acquisition cost (WAC) averaged approximately USD 4–7 per tablet (100 mg). Post-patent expiration, generic versions entered the market, reducing prices by approximately 60-80%, with some generics available at USD 1–2 per tablet.

Current Price Dynamics

As of 2023, the average retail price for generic celecoxib is approximately USD 0.50–1.00 per tablet, depending on dosage and pharmacy markup. Branded prices remain higher, often in the USD 2–4 range per tablet, primarily driven by brand loyalty, pharmacy stocking, and marketing strategies.

Factors Influencing Future Price Projections

- Market Competition: Increasing availability of generics continues to suppress prices.

- Regulatory Changes: Stringent safety warnings could influence prescribing and pricing.

- Healthcare Policy: Price controls and reimbursement policies, especially in managed care settings, could further impact net pricing.

- Innovation and Formulations: Development of combination drugs or new delivery systems might command premium pricing.

- Supply Chain Dynamics: Manufacturing costs, raw material prices, and distribution logistics influence costs, thus affecting retail prices.

Future Price Projections

Short-term Outlook (Next 2-3 Years)

Given the saturated generic market and ongoing competition, prices are expected to stabilize at current levels or see marginal decreases. The average price of generic celecoxib is projected to hover around USD 0.50–0.75 per tablet in developed markets, with similar trends in emerging markets contingent on regulatory and economic factors.

Long-term Outlook (3-5 Years and Beyond)

Potential innovations or new indications may pave the way for premium pricing in niche markets. Conversely, further patent challenges and market entries could lead to continued price compression. Based on current trends, a conservative estimate suggests an overall price decrease of 10–20% for existing formulations over the next five years in mature markets.

However, if patent protections or new delivery modalities (e.g., extended-release formulations) are approved, they could command higher costs, potentially offsetting downward pressure.

Implications for Stakeholders

Manufacturers:

Major branded manufacturers must innovate or diversify portfolios to sustain profitability, especially with imminent generic competition. Strategic pricing and marketing will be essential for maintaining market share.

Healthcare Providers:

Physicians balancing safety profiles with cost considerations will influence prescribing patterns, possibly favoring generics to optimize healthcare budgets.

Payers and Policymakers:

Cost-containment efforts will likely promote formulary restrictions and negotiated pricing, exerting downward pressure on drug prices.

Investors:

Market entry and patent litigation developments should be monitored, as they could disrupt current price trends and profitability margins.

Conclusion

The celecoxib market exhibits characteristics typical of a mature pharmaceutical segment: high competition, declining branded prices, and ongoing innovation challenges. Future pricing will be predominantly influenced by competitive dynamics, regulatory changes, and potential novel indications or formulations. Stakeholders should anticipate stable or modestly declining prices in the short-term, with strategic opportunities arising from innovation and market differentiation in the coming years.

Key Takeaways

- The global celecoxib market remains sizable, driven by chronic disease management in aging populations.

- Patent expirations have led to a proliferation of low-cost generics, depressing prices.

- Future price trends will largely depend on generics competition, safety profile considerations, and regulatory policies.

- Innovation, such as new drug formulations or indications, offers potential for premium pricing.

- Strategic positioning and ongoing market monitoring are essential for manufacturers and investors.

FAQs

1. How has patent expiration affected celecoxib pricing?

Patent expiration led to the entry of generic competitors, resulting in a significant reduction in prices—often by 60-80%—as generics capture market share from branded versions.

2. What is the forecasted price trend for celecoxib over the next five years?

Prices are expected to stabilize or decrease slightly by 10–20%, influenced by generic competition, regulatory pressures, and healthcare cost containment policies.

3. Are there any new formulations or indications for celecoxib that could influence its market?

Currently, no major breakthroughs are anticipated; however, ongoing research into new delivery systems or combination therapies may create niche opportunities.

4. How does safety regulation impact celecoxib pricing and prescriptions?

Safety concerns, especially cardiovascular risks, have prompted warnings and restrictions, which can influence prescriber behavior and market dynamics but have not significantly driven price fluctuations.

5. How does regional variation impact celecoxib pricing?

Developed markets with higher healthcare spending and patent protections tend to have higher prices than emerging markets, where generics and price controls exert downward pressure.

Sources:

- Market Research Future. “NSAID Market Analysis.” 2022.

- IQVIA. “Global Pharmaceuticals Market Report.” 2022.

- U.S. Food and Drug Administration. “Celecoxib (Celebrex) Drug Label.” 2021.

- MedlinePlus. “Celecoxib.” 2023.

- Pfizer Inc. Annual Reports and Market Communications.