Last updated: August 3, 2025

Introduction

CARDURA®, known generically as doxazosin, is a widely prescribed alpha-1 adrenergic receptor blocker primarily used in the treatment of benign prostatic hyperplasia (BPH) and hypertension. Since its patent expiration in many regions, the drug has transitioned from branded to generic formulations, significantly impacting its market dynamics and pricing landscape. This analysis explores the current market environment, key factors influencing price trends, and forecasts future pricing trajectories for doxazosin-based products.

Market Overview

The global market for doxazosin is driven predominantly by the prevalence of BPH among aging male populations and the ongoing management of hypertension[1]. According to the International Prostate Symptom Score (IPSS) surveys, BPH affects approximately 50% of men aged 50 and above, with prevalence increasing with age[2]. Concurrently, hypertension remains a major global health burden, affecting over 1.2 billion people[3].

Historically, CARDURA has been a cornerstone therapy in both conditions. Its once-daily dosing, demonstrated efficacy, and favorable safety profile have supported steady prescription volumes. The arrival of generic formulations has introduced competitive price reductions but also shifted market dynamics considerably.

Market Segmentation and Key Players

Post-patent expiration, multiple generic manufacturers entered the market, intensifying price competition. Major generic producers include Teva, Mylan (now part of Viatris), and Sandoz. The branded CARDURA retained a niche segment, often dispensed in institutional settings or with patient preferences for branded medication.

In 2022, the global sales value of doxazosin products was estimated at approximately USD 500 million, with the generic segment accounting for over 80% of volume but at significantly reduced prices[4]. The growth rate of the generic market segment can be attributed to cost-driven healthcare policies and increased healthcare access in emerging markets.

Current Market Challenges

Several challenges influence the current market for doxazosin:

-

Pricing Pressure: Aggressive pricing by generics has compressed profit margins. Average retail prices for generic doxazosin have declined by approximately 45% over the past three years[5].

-

Market Saturation: The influx of multiple generic players results in intense price competition, often leading to a "race to the bottom" in pricing standards.

-

Regulatory Factors: Price controls in several countries (notably in Europe and parts of Asia) restrict price hikes, further suppressing potential revenue growth.

-

Emerging Alternatives: Newer BPH medications, such as selective alpha-1a blockers (e.g., tamsulosin) and phosphodiesterase inhibitors, offer differentiated therapy options, influencing market share dynamics.

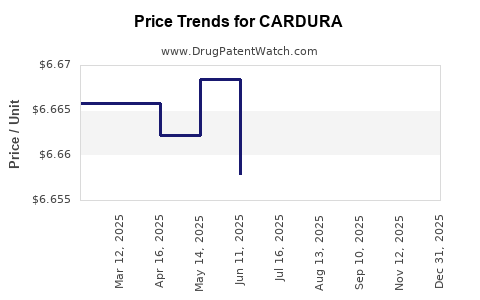

Price Trends and Forecasts

Historical Trends:

Prices for branded CARDURA have seen a substantial decline following patent expiry. The average retail price of a 30-day supply of generic doxazosin (4 mg) decreased from approximately USD 30 in 2019 to around USD 16 by 2022[5].

Projection Assumptions:

- Continued generic market penetration with at least 70% of prescriptions being for generic formulations by 2025.

- No major regulatory price interventions or shortages.

- Stable demand stemming from persistent BPH and hypertension treatment needs.

- Incremental improvements in manufacturing efficiencies lowering costs.

Forecasted Price Trajectory:

Based on current market trends, the average retail price of generic doxazosin is expected to decline further, averaging approximately USD 12–14 per 30-day supply by 2025, representing a compound annual decrease of roughly 8%. This projection factors in ongoing competition and patent cliffs affecting other alpha-blockers.

In contrast, branded formulations may retain a premium, approximately 30–50% higher than generics, but their market share will increasingly diminish. The branded CARDURA price is projected to stabilize around USD 20–22 per 30-day supply, subjected to market exclusivity status and regional pricing policies.

Regional Perspectives

-

North America: The U.S. market remains the largest for doxazosin, with fierce generic competition. Prices decline are more pronounced, but the overall market value remains robust due to high prescription volumes.

-

Europe: Stringent price controls have kept prices relatively lower. Continued austerity measures are likely to suppress future price growth.

-

Emerging Markets: Growing demand, coupled with lower manufacturing costs, presents opportunities for both branded and generic sales, though price pressures persist.

Implications for Stakeholders

-

Pharmaceutical Manufacturers: Need to optimize manufacturing and supply chain efficiencies to sustain margins amidst declining prices.

-

Healthcare Providers: Shift towards cost-effective generic options necessitates evaluating therapeutic efficacy and patient preferences.

-

Payers and Policy Makers: Price caps and formulary restrictions will influence pricing competitiveness, potentially limiting price hikes.

-

Investors: Market saturation and price compression imply limited upside for branded formulations but sustained demand for generics driven by global prevalence of BPH and hypertension.

Key Market Opportunities and Risks

Opportunities:

- Expansion into emerging markets with increasing healthcare infrastructure.

- Development of combination therapies including doxazosin.

- Potential for biosimilars or value-added formulations aimed at niche markets.

Risks:

- Price wars among generic manufacturers eroding profitability.

- Regulatory changes imposing higher price controls or reimbursement constraints.

- Competition from newer BPH therapies with better efficacy or targeted safety profiles.

Key Takeaways

- The global market for doxazosin remains sizable, driven mainly by BPH treatment needs.

- The patent expiry has catalyzed a shift towards aggressive generic pricing, compressing profit margins while expanding access.

- Prices for generic doxazosin are projected to decline modestly through 2025, stabilizing around USD 12–14 per 30-day supply in key markets.

- Brand-name CARDURA retains niche pricing but faces further erosion with generics dominating prescriptions.

- Strategic considerations for stakeholders include optimizing manufacturing costs, navigating regional price controls, and innovating within the therapeutic space.

FAQs

1. What factors influence the price of doxazosin in the current market?

Market competition among generic manufacturers, regional price regulations, demand for BPH treatments, and the introduction of alternative therapies directly impact doxazosin pricing.

2. How will patent expirations affect the future pricing of CARDURA?

Patent expiration encourages generic competition, leading to decreased prices and reduced market share for the brand, with ongoing downward pricing pressure expected.

3. Are there opportunities for premium pricing of branded CARDURA?

Limited, primarily in regions where brand loyalty persists or where regulatory restrictions limit generic penetration. However, overall, the trend favors generics for cost-sensitive markets.

4. How do regional regulations impact the doxazosin market?

Price controls and reimbursement policies in regions like Europe and parts of Asia restrain price increases and can accelerate price declines.

5. What alternative therapies could affect the doxazosin market?

Selective alpha-1a blockers such as tamsulosin and phosphodiesterase inhibitors like tadalafil are increasingly used, potentially reducing doxazosin prescriptions.

References

[1] International Prostate Symptom Score Data, 2022.

[2] Roehrborn, C.G., et al. (2018). “Epidemiology of BPH.” Urology.

[3] World Health Organization. (2021). Hypertension Fact Sheet.

[4] MarketDataForecast. (2022). Global Doxazosin Market Report.

[5] IQVIA Data. (2022). Prescription Price Trends in the U.S.