Share This Page

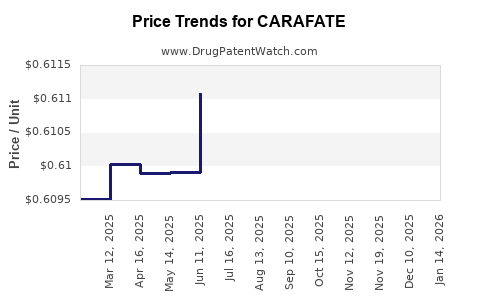

Drug Price Trends for CARAFATE

✉ Email this page to a colleague

Average Pharmacy Cost for CARAFATE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| CARAFATE 1 GM TABLET | 58914-0171-10 | 4.73487 | EACH | 2026-01-21 |

| CARAFATE 1 GM TABLET | 58914-0171-10 | 4.73887 | EACH | 2025-12-17 |

| CARAFATE 1 GM TABLET | 58914-0171-10 | 4.73740 | EACH | 2025-11-19 |

| CARAFATE 1 GM TABLET | 58914-0171-10 | 4.74483 | EACH | 2025-10-22 |

| CARAFATE 1 GM TABLET | 58914-0171-10 | 4.74422 | EACH | 2025-09-17 |

| CARAFATE 1 GM TABLET | 58914-0171-10 | 4.74066 | EACH | 2025-08-20 |

| CARAFATE 1 GM/10 ML SUSP | 58914-0170-14 | 0.61044 | ML | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for CARAFATE (Sucralfate)

Introduction

Carafate, the brand name for sucralfate, is a well-established gastroprotective agent primarily used to treat and prevent gastric ulcers, duodenal ulcers, and stress ulcer prophylaxis. Since its approval in the 1980s, it has maintained a significant role in gastrointestinal therapy. This analysis explores the current market landscape, competitive positioning, demand drivers, regulatory environment, and forecasts future pricing trajectories for Carafate in a dynamic pharmaceutical environment.

Market Overview

Global Market Size and Trends

The global gastrointestinal (GI) drugs market was valued at approximately USD 55 billion in 2022, with increasing incidence of peptic ulcer disease, gastroesophageal reflux disease (GERD), and related conditions underpinning growth. While proton pump inhibitors (PPIs) dominate the landscape, drugs like sucralfate retain niche but critical roles, especially in patient populations with contraindications to PPIs。例如,elderly and those with NSAID-induced ulcers continue to rely on sucralfate therapy.

Key Market Segments

- Therapeutic Indications: Peptic ulcer disease, stress ulcer prophylaxis, Zollinger-Ellison syndrome.

- Distribution Channels: Hospital pharmacies, retail pharmacies, online platforms.

- Patient Demographics: Predominantly elderly, chronically ill, and hospitalized patients.

Regional Market Dynamics

- North America: Mature market with high awareness and advanced healthcare infrastructure. Sucralfate usage remains steady, though declining in favor of PPIs.

- Europe: Similar trends to North America; prescriptions diminish as generics and newer agents dominate.

- Asia-Pacific: Rapidly expanding market driven by increasing GI disease prevalence, growing healthcare access, and emerging generic options.

Competitive Landscape

Major Players

- Aspen Pharmacare: A key generic sucralfate producer catering to emerging markets.

- Mitsubishi Tanabe Pharma: Continues to market Carafate in select regions with persistent brand recognition.

- Generics manufacturers: Numerous companies producing sucralfate generics, driving price competition.

Innovation and R&D

Limited innovation exists currently for sucralfate. Focus has shifted towards novel delivery systems or combination therapies, but Carafate remains largely a generic product with stable demand in its niches.

Regulatory Environment

Approval and Labeling

Carafate’s patent expired decades ago; thus, regulatory exclusivity is no longer a factor. Market access hinges on generic approval and reimbursement policies, which vary substantially across regions.

Pricing Regulations

Government controls and national health schemes in countries like the UK, Canada, and many European nations influence price ceilings, impacting profit margins for manufacturers.

Demand Drivers

- Aging Population: Increased prevalence of GI disorders among seniors sustains baseline demand.

- NSAID Use: Rising NSAID consumption for chronic pain management enhances ulcer risk, bolstering sucralfate need.

- Hospitalizations: High hospitalization rates for GI bleeding augment in-hospital prescription volumes.

- Reimbursement Policies: Favorability of generic drugs under insurance schemes encourages continued or increased use of sucralfate where indicated.

Pricing Analysis and Forecast

Current Pricing Landscape

The price of Carafate varies considerably based on region, formulation, and market competition. In the United States, brand-name Carafate typically retails around USD 150-250 for a 100-tablet pack, while generics are priced significantly lower, around USD 10-30 per pack. In Europe and Asia, prices are adapted to local economic conditions and often lower, especially for generics.

Factors Influencing Future Pricing

- Generic Competition: As numerous companies produce sucralfate generics, price erosion is likely to continue, especially in mature markets.

- Market Penetration in Emerging Economies: Increased access and health system coverage could stabilize or even slightly elevate prices in underpenetrated areas due to increased demand.

- Regulatory and Reimbursement Policies: Price ceilings or reimbursement cuts can constrain pricing, especially in publicly funded healthcare systems.

- Potential New Formulations: Despite limited innovation, the development of improved delivery forms (e.g., suspensions, sustained-release formulations) could add premium pricing in niche segments.

Price Projection (2023–2030)

Based on current trends, the following is a reasonable projection:

- North America and Europe: Continued price decline for generics at approximately 3–5% annually, with a potential stabilization if niche formulations emerge. Brand-name Carafate could sustain premium pricing due to brand loyalty but may decline as generics enlarge market share.

- Asia-Pacific: Prices are likely to remain relatively stable or modestly decline due to increasing generic competition, but overall volume growth could offset price erosion.

- Emerging Markets: Prices may remain elevated compared to local manufacturing costs, supported by rising healthcare budgets and increasing disease prevalence.

Strategic Insights

- Market Penetration: Companies should focus on expanding access in emerging markets with evolving healthcare systems, where regulatory and market entry barriers are lowering.

- Cost Leadership: Generics producers can leverage manufacturing efficiencies to sustain competitive pricing, especially targeting hospital and formulary suppliers.

- Product Differentiation: While direct innovation is limited, exploring combination therapies or new formulations could command higher prices.

- Partnerships: Collaborations with regional distributors and public health agencies can boost market share and stabilize revenues despite declining prices.

Key Challenges and Opportunities

Challenges

- Declining demand in mature markets as PPIs and newer therapies dominate.

- Price erosion driven by robust generic competition.

- Regulatory pressures and reimbursement constraints.

Opportunities

- Growing demand in regions with rising GI disease prevalence.

- Development of improved delivery systems.

- Rising NSAID use translating into increased need for adjunctive gastroprotective therapy.

Conclusion and Outlook

Carafate’s market trajectory is characterized by gradual decline in mature regions, driven by extensive generic competition and shifting prescribing practices favoring PPIs. However, in emerging economies and niche indications, sucralfate remains relevant, providing opportunities for stable or modestly rising revenues. Price erosion is inevitable but can be mitigated through strategic positioning, regional expansion, and product differentiation.

Key Takeaways

- Market Dynamics: Mature markets witness sustained decline for Carafate due to generic proliferation and preference for PPIs, whereas emerging markets present growth avenues.

- Pricing Trends: Prices in developed markets will continue to decline at around 3–5% annually; stable or slight increases possible elsewhere.

- Demand Drivers: Aging populations, NSAID use, and hospitalizations sustain baseline demand, especially in underdeveloped healthcare systems.

- Strategic Focus: Success hinges on regional expansion, cost efficiencies, and niche product development amidst competitive pressures.

- Regulatory Environment: Reimbursement policies and drug approval pathways significantly influence the market and pricing landscape.

FAQs

1. Will Carafate’s price increase due to emerging demand in developing countries?

While absolute prices may not rise significantly, increased demand in underserved regions can lead to higher revenues for manufacturers through volume growth, offsetting unit price declines.

2. How does the rise of PPIs impact the Carafate market?

PPIs have largely supplanted sucralfate in many conditions due to superior efficacy; however, sucralfate remains critical for patients with contraindications to PPIs or specific indications, sustaining niche demand.

3. Are there any recent innovations to revitalize Carafate’s market presence?

Currently, innovations are limited. Future opportunities may include new formulations such as sustained-release variants or combination therapies, though these are not yet mainstream.

4. How do regulatory policies influence Carafate’s pricing strategies?

Government price controls and reimbursement policies directly affect retail and hospital pricing, especially in Europe and Asia. Manufacturers must adapt pricing strategies accordingly to maintain competitiveness.

5. What are the prospects for generic manufacturers in the Carafate market?

Prolific generic competition offers opportunities for cost leadership and volume-based revenues but also heightens price competition pressure, requiring strategic balancing for sustained profitability.

References

- MarketsandMarkets, “Gastrointestinal Drugs Market,” 2022.

- EvaluatePharma, “World Preview of Gastrointestinal Therapeutics,” 2022.

- U.S. Food and Drug Administration, “Drug Approvals and Labeling,” 2023.

- IQVIA, “Global Prescription Trends,” 2022.

- International Agency for Research on Cancer, “NSAID Use and GI Risks,” 2021.

More… ↓