Last updated: July 27, 2025

Introduction

Calcitriol, the active form of vitamin D3, is a critical drug used primarily to treat conditions related to calcium deficiency, including secondary hyperparathyroidism in chronic kidney disease (CKD), osteoporosis, and certain metabolic bone diseases. Market dynamics for calcitriol are shaped by medical needs, regulatory frameworks, manufacturing complexities, and evolving healthcare landscapes. This analysis examines current market conditions, competitive elements, regulatory considerations, and projects future pricing trends.

Current Market Landscape

Global Market Size

The global calcitriol market has experienced consistent growth due to increasing prevalence of CKD, osteoporosis, and other calcium-related disorders. According to recent industry reports, the market valuation exceeded $250 million in 2022 and is projected to grow at a compound annual growth rate (CAGR) of approximately 4%–6% over the next five years [1].

Key Market Drivers

- Rising Incidence of CKD and Osteoporosis: The global increase in CKD, attributed to aging populations and rising diabetes prevalence, fuels demand for calcitriol. Similarly, osteoporosis affects an estimated 200 million adults worldwide, bolstering usage [2].

- Therapeutic Efficacy: Calcitriol's proven effectiveness in managing secondary hyperparathyroidism solidifies its place in treatment regimens.

- Regulatory Approvals and Off-Label Use: Approvals in multiple markets and expanding indications bolster market stability.

Regional Market Distribution

- North America: Dominates with ~45% of the global market, driven by high CKD prevalence, healthcare infrastructure, and regulatory acceptance.

- Europe: Accounts for approximately 30%, with growth driven by aging populations and clinical adoption.

- Asia-Pacific: Fastest-growing segment (~8% CAGR), propelled by expanding healthcare capacities, urbanization, and increased awareness.

Market Players

Major pharmaceutical companies manufacturing calcitriol include:

- AbbVie (e.g., Rocaltrol): Leading the American and European markets.

- Teva Pharmaceuticals: Broad global presence.

- Simcere Pharmaceutical: Prominent in China.

- Other generics manufacturers: Including Sun Pharmaceutical, Mylan, and local producers.

The market is characterized by a mix of brand-name and generic formulations, with generics constituting roughly 70% of the volume, exerting downward pressure on prices.

Competitive Dynamics and Market Challenges

Manufacturing Complexity

Calcitriol synthesis involves multi-step chemical processes with strict quality control requirements, which influence pricing structures. High manufacturing costs and regulatory testing standards limit new market entrants.

Price Sensitivity and Generic Competition

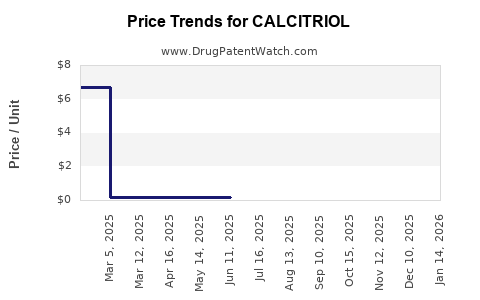

The prevalence of generics has led to significant price erosion. In North America, the average retail price for a standard 30 mcg capsule is approximately $0.30–$0.50 per unit, with generics offering discounts of up to 50% compared to brand names.

Regulatory Landscape

Different jurisdictions impose varied approval and pricing policies, including drug reimbursement schemes and pricing caps, impacting market access and profitability.

Price Projections & Future Trends

Short to Medium-Term Outlook (2023–2028)

- Price Stability with Mild Declines: Given the high demand and clinical importance, unit prices are expected to stabilize, with modest decreases due to ongoing generic competition.

- Pricing Range: For branded formulations, expect costs to remain around $0.40–$0.60 per unit. Generics may see further reductions to $0.20–$0.30 per unit by 2028.

Factors Influencing Prices

- Market Penetration of Generics: Increased manufacturing and approval of generics will push prices downward.

- Healthcare Policy Changes: Adoption of cost-containment measures and value-based pricing could further suppress prices.

- Supply Chain Dynamics: Raw material costs, especially for precursor chemicals, influence manufacturing costs and, consequently, pricing.

Long-Term Projections (2028 and beyond)

- Potential Innovation: Development of novel delivery systems or formulations (e.g., sustained-release capsules) may command premium pricing.

- Market Saturation: As most indications become routine, prices may plateau, with slight erosion driven by further generics and biosimilar competition.

- Emerging Markets: Increased adoption in low- and middle-income countries could diversify pricing structures, with some regions adopting lower price points through regulatory negotiations.

Regulatory and Economic Considerations

- Patent Status: In many markets, existing patents for branded calcitriol products have expired, facilitating generic entry.

- Reimbursement Policies: Governments and insurers continue to negotiate prices, often favoring lower-cost generics.

- Manufacturing Innovation: Process improvements and bulk manufacturing could reduce costs, enabling further price reductions.

Market Opportunities and Risks

Opportunities

- Growing demand in emerging markets.

- Expanding indications, such as off-label uses in certain metabolic disorders.

- Potential for biosimilar or novel formulations to command premium pricing.

Risks

- Price wars among producers leading to sustained low prices.

- Regulatory barriers in specific jurisdictions.

- Competition from alternative vitamin D therapies (e.g., other active metabolites, combination drugs).

Key Takeaways

- The calcitriol market remains robust, driven by key demographic and clinical needs, with stable long-term demand.

- The influx of generics has imposed downward pressure, but high clinical utility sustains stable pricing, especially for branded products.

- Price stabilization is expected around $0.20–$0.50 per unit, with regional variations and potential for slight declines over time.

- Industry players should focus on optimizing manufacturing efficiencies, expanding indications, and navigating regulatory pathways for sustained profitability.

- Monitoring policy changes and emerging therapies will be vital for accurate future pricing and market share projections.

FAQs

1. What are the primary therapeutic indications for calcitriol?

Calcitriol is mainly used to treat secondary hyperparathyroidism in CKD, osteoporosis, hypocalcemia, and certain metabolic bone diseases.

2. How is calcitriol priced in global markets?

Pricing varies significantly; in North America, branded capsules typically cost around $0.40–$0.60 per unit, with generics available at approximately half that price due to competition.

3. What factors influence calcitriol market growth?

Increases in CKD and osteoporosis prevalence, expanding indications, healthcare infrastructure, and regulatory approvals are key growth drivers.

4. Will the price of calcitriol decrease significantly in the future?

While prices for existing formulations are expected to decline modestly due to generic competition, significant drops are unlikely unless new, low-cost manufacturing methods emerge or regulatory policies change.

5. Are there emerging markets for calcitriol?

Yes, the Asia-Pacific region shows the fastest growth potential, driven by increasing healthcare access and rising disease prevalence.

References

[1] MarketWatch. “Global Calcitriol Market Size, Share & Trends Analysis Report,” 2022.

[2] World Health Organization. “Osteoporosis Fact Sheet,” 2021.