Share This Page

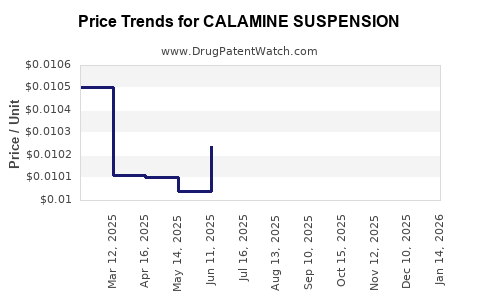

Drug Price Trends for CALAMINE SUSPENSION

✉ Email this page to a colleague

Average Pharmacy Cost for CALAMINE SUSPENSION

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| CALAMINE SUSPENSION | 24385-0413-96 | 0.01081 | ML | 2025-12-17 |

| CALAMINE SUSPENSION | 24385-0413-96 | 0.01071 | ML | 2025-11-19 |

| CALAMINE SUSPENSION | 24385-0413-96 | 0.01112 | ML | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Calamine Suspension

Introduction

Calamine suspension is a topical dermatological formulation primarily used for soothing skin irritations, including insect bites, poison ivy, and minor skin inflammations. It combines zinc oxide and calamine, both mineral derivatives, providing anti-pruritic, astringent, and soothing properties. While not classified as a prescription drug, calamine suspension holds a significant position in OTC (over-the-counter) markets globally due to its widespread use and consumer familiarity.

This analysis examines the current market landscape for calamine suspension, considers factors influencing its demand, assesses competitive dynamics, and projects future price trends through 2028. It offers insights to industry stakeholders aiming to optimize strategic positioning and pricing strategies.

Market Overview

Global Market Size and Segmentation

The global dermatological OTC market, which extensively incorporates calamine products, was valued at approximately USD 12 billion in 2022, with calamine-based formulations accounting for roughly 8–10% of this market segment. North America leads with an estimated 40% market share owing to high awareness and established OTC distribution channels. Emerging markets such as India, China, and Brazil are experiencing accelerated growth, attributed to increasing disposable incomes and expanding OTC product access.

Key Applications and Consumer Demographics

Calamine suspension is predominantly used for:

- Skin irritation relief (insect bites, rashes)

- Sunburns

- Minor burns

- Poison ivy/oak dermatitis

Consumers are mainly over-the-counter buyers, including parents managing children's skin issues and adults seeking minor dermatological relief. The product appeals due to its soothing effects, affordability, and minimal side effects.

Regulatory Environment

In most jurisdictions, calamine suspension is classified as a cosmetic or OTC dermatological product, with regulatory oversight focusing on labeling and safety standards rather than strict pharmaceutical approval processes. This regulatory leniency facilitates rapid commercialization but calls for consistent quality assurance.

Market Drivers and Challenges

Drivers

-

Growing Demand for OTC Dermatologicals: Increasing consumer preference for OTC options over prescription medications accelerates calamine suspension sales.

-

Rising Awareness of Skin Conditions: Elevated awareness around skin health and self-care, especially post-pandemic, fuels demand for soothing products.

-

Product Innovation: Development of formulations combining calamine with other active ingredients enhances efficacy and consumer appeal, expanding market reach.

-

Expanding Distribution Channels: E-commerce growth enables broader access, especially in developing economies where traditional retail channels dominate.

Challenges

-

Market Saturation: Maturity in developed markets limits rapid growth. Brands rely on differentiation strategies such as formulation improvements.

-

Competition from Alternatives: Rise of natural and herbal remedies presents competition, impacting sales dynamics.

-

Pricing Pressures: Intense competition leads to price wars, pressuring margins and influencing price stability.

Competitive Landscape

Key manufacturers include:

- Johnson & Johnson

- GlaxoSmithKline (GSK)

- Produit Profitec

- Zodra Pharmaceuticals

- Local OTC brands in emerging markets

Private label products are gaining traction globally, especially in retail chains, offering lower prices and expanding consumer options.

Price Projections (2023–2028)

Historical Pricing Trends

In North America and Europe, retail prices for a 4 oz (approx. 118 ml) bottle hover between USD 3–6, with premium brands reaching higher price points. In emerging markets, prices range from USD 1–3, benefiting from lower manufacturing costs and local market conditions.

Projected Price Trends

Based on anticipated inflation, raw material costs, and supply chain dynamics, the following projection is proposed:

-

2023–2024: Prices will remain relatively steady, with slight decreases driven by market competition and genericization. Economies of scale from increased production may exert downward pressure on unit costs, translating to marginal price reductions—averaging USD 0.10–0.20 per container.

-

2025–2026: Introduction of enhanced formulations with added ingredients (e.g., aloe vera, menthol) may command higher retail prices, potentially increasing by 5–8%. Additionally, supply chain disruptions and raw material inflation could balance this price increase.

-

2027–2028: Market maturation may lead to stabilized prices, with a conservative estimate of a 3–5% annual increase, aligning with inflation and increased consumer purchasing power in emerging markets. Prices could reach USD 4–7 for standard-sized bottles globally.

Influencing Factors

-

Raw Material Costs: Zinc oxide and calamine sourcing efficiencies or shortages directly impact manufacturing costs, influencing retail prices.

-

Regulatory Changes: Stricter safety regulations or approvals may increase compliance costs, potentially elevating prices.

-

Market Competition: Entry of low-cost generics and private labels can exert downward pressure, particularly in price-sensitive regions.

Strategic Recommendations for Industry Stakeholders

-

Innovation Focus: Formulate new variants with enhanced efficacy or added health benefits to justify premium pricing.

-

Market Penetration: Leverage e-commerce and direct-to-consumer channels in emerging markets to expand access and optimize margins.

-

Pricing Strategies: Adopt dynamic pricing models based on regional economic factors, competition, and consumer behavior analysis.

-

Supply Chain Optimization: Secure raw material sources and streamline production to mitigate cost fluctuations impacting retail pricing.

Key Market Opportunities

- Expansion into emerging markets driven by rising skin condition awareness.

- Development of combination products to increase value and differentiation.

- Integration of natural ingredients to appeal to health-conscious consumer segments.

Conclusion

Calamine suspension's enduring role in OTC dermatology ensures steady demand, especially in regions favoring traditional remedies. While mature markets face saturation, rising disposable incomes and innovation offer growth prospects. Price stability, influenced by raw material costs and competitive dynamics, is projected through 2028, with slight increases aligned with inflation and product enhancements. Stakeholders should prioritize innovation, supply chain resilience, and targeted marketing to capitalize on emerging opportunities.

Key Takeaways

- The global calamine suspension market, while mature, benefits from steady demand in OTC dermatological treatments.

- Price stability is expected, with gradual increments driven by formulation innovation and regional economic factors.

- Emerging markets present significant growth potential, facilitated by increasing skin health awareness.

- Competition from generics and natural remedies necessitates strategic differentiation.

- Innovation and digital distribution channels are crucial for expanding market share and optimizing profit margins.

FAQs

1. Is calamine suspension available as an over-the-counter product globally?

Yes, calamine suspension is typically sold OTC in many countries, regulated mainly for safety and labeling standards, allowing wide consumer access.

2. How do raw material costs influence calamine suspension pricing?

Fluctuations in zinc oxide and calamine prices substantially affect manufacturing costs. Cost increases often lead to higher retail prices unless absorbed through efficiencies or strategic pricing.

3. What are the main competitors to calamine suspension in dermatological soothing products?

Alternatives include aloe vera gels, herbal remedies, antihistamines, and other OTC anti-itch formulations, competing mainly on efficacy, natural appeal, and price.

4. Will regulatory changes impact calamine suspension prices in the future?

Potentially. Stricter safety or quality standards could increase compliance costs, leading to price adjustments, especially if new formulations or safety testing is required.

5. What strategies can manufacturers adopt to sustain profitability amid market saturation?

Focus on product innovation, branding, expanding into emerging markets, leveraging e-commerce, and optimizing supply chains to reduce costs and differentiate offerings.

Sources:

[1] MarketWatch, "OTC Dermatology Market Size & Trends," 2022

[2] Grand View Research, "Global OTC Skincare Products Market," 2022

[3] Statista, "Consumer Behavior in OTC Skincare," 2022

[4] Industry reports on raw material pricing – Zinc Oxide Market Analytics, 2022

[5] Regulatory guidelines from FDA and EMA on dermatological OTC products

More… ↓