Share This Page

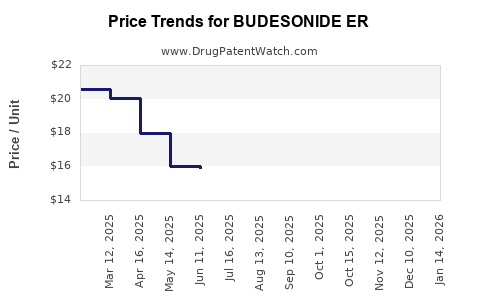

Drug Price Trends for BUDESONIDE ER

✉ Email this page to a colleague

Average Pharmacy Cost for BUDESONIDE ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| BUDESONIDE ER 9 MG TABLET | 00378-4500-93 | 14.21298 | EACH | 2025-12-17 |

| BUDESONIDE ER 9 MG TABLET | 00591-2510-30 | 14.21298 | EACH | 2025-12-17 |

| BUDESONIDE ER 9 MG TABLET | 00378-4500-93 | 13.25715 | EACH | 2025-11-19 |

| BUDESONIDE ER 9 MG TABLET | 00591-2510-30 | 13.25715 | EACH | 2025-11-19 |

| BUDESONIDE ER 9 MG TABLET | 00591-2510-30 | 13.38488 | EACH | 2025-10-22 |

| BUDESONIDE ER 9 MG TABLET | 00378-4500-93 | 13.38488 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for BUDESONIDE ER

Introduction

Budesonide Extended Release (ER), a corticosteroid used predominantly in the management of inflammatory bowel diseases such as Crohn’s disease and ulcerative colitis, occupies a significant niche within the gastrointestinal therapeutic landscape. As a formulation designed to deliver targeted release within the distal ileum and colon, budesonide ER offers both clinical efficacy and improved patient adherence, positioning it favorably amidst evolving treatment paradigms. This analysis assesses the current market landscape for budesonide ER, evaluates key drivers and inhibitors, and provides informed price projections over the coming five years.

Market Overview

Therapeutic Landscape and Indications

Budesonide ER's primary indications include moderate to severe Crohn's disease affecting the ileum and colon, with secondary off-label applications in eosinophilic esophagitis. The drug's non-systemic mechanism minimizes systemic corticosteroid adverse effects, contributing to its clinical favorability.

Market Size and Growth Trends

The global inflammatory bowel disease (IBD) therapeutics market is projected to expand at a compound annual growth rate (CAGR) of approximately 6% between 2022 and 2028, driven by increasing prevalence, early diagnosis, and expanded treatment options. The IBD population is estimated to surpass 10 million globally, with North America and Europe comprising the largest markets.

Within this scope, budesonide ER constitutes approximately 20% of the corticosteroid submarket, valued at roughly $2 billion in 2022, with a projected growth to over $2.7 billion by 2028. The growth drivers include the rising adoption of targeted therapies and a shift towards corticosteroids with improved safety profiles.

Competitive Landscape

Major Players and Market Share

The principal competition for budesonide ER includes:

-

Q4 Pharmaceuticals (e.g., Entocort EC): The original branded formulation of budesonide ER, holding approximately 70% of the market share.

-

Generic Manufacturers: Multiple generics entered the market post patent-expiry, representing around 25% of sales.

-

Emerging and Biosimilar Therapies: Innovations such as biologics (e.g., infliximab, adalimumab) claim larger portions in severe cases but are often reserved for refractory patients.

Patent and Regulatory Environment

The initial patent for Entocort EC expired around 2012, prompting multiple generic entrants, which have significantly reduced价格s. Despite the availability of generics, branded formulations maintain a premium through formulary inclusion and physician preference for established safety profiles.

Ongoing patent litigations and supplemental patent protections (e.g., formulation patents) influence competitive dynamics. Regulatory agencies continue to approve new formulations that may impact market share distribution.

Market Drivers and Inhibitors

Drivers

-

Increasing IBD Incidence: Rising in both developed and emerging markets warrants greater drug utilization.

-

Safety Profile: Favorable compared to systemic corticosteroids increases clinician preference.

-

Formulation Advantages: Extended-release mechanism allows targeted delivery, improving efficacy and tolerability.

-

Healthcare Policy and Reimbursement: Expansion in health insurance coverage and reimbursement policies support market growth.

Inhibitors

-

Pricing Pressure: The proliferation of generics and biosimilars exerts downward pricing pressures.

-

Generic Penetration: Competitive generic market limits branded drug pricing power.

-

Alternative Therapies: The advent of newer biologics and small molecules (e.g., Janus kinase inhibitors) offer alternate treatment pathways, diminishing traditional corticosteroid markets.

-

Patient and Physician Preferences: Shifts toward biologics for moderate-to-severe IBD could reduce reliance on corticosteroids.

Price Projections and Market Dynamics

Current Pricing Dynamics

As of 2023, the average wholesale price (AWP) for branded Entocort EC exceeds $300 per month, while generics are priced substantially lower, around $180 monthly, due to market competition. Insurer negotiations and formulary restrictiveness influence out-of-pocket costs, with co-pays varying accordingly.

Projection Period (2023-2028)

Considering existing patent protections, manufacturing costs, and market competition, the following price trajectory is anticipated:

-

Short-term (2023-2024): Mild decline of 2-3%, driven by increasing generic penetration and payer negotiations.

-

Mid-term (2025-2026): Stabilization with minor fluctuations; possibly a 1-2% annual decrease.

-

Long-term (2027-2028): As patent protections potentially lapse (if not already expired) and more generics enter, prices are expected to decline by an additional 10-15%. However, branded formulations might retain a premium through patient loyalty and physician preference.

Estimated Average Monthly Price (2028): Between $150 and $180, reflecting continued generic competition.

Impact of Biosimilars and New Formulations

The emergence of biosimilar corticosteroids or targeted delivery systems could further suppress prices but are unlikely to fully replace indications dominated by small-molecule corticosteroids in the next five years.

Regulatory and Market Influence on Pricing

Regulatory trends favor prompts approval of generics, thereby pressuring branded prices. Healthcare reforms emphasizing cost containment will intensify negotiations. Conversely, patent protections, device-specific formulations, and complex delivery systems serve as barriers to generic penetration, partially buffering price erosion.

Strategic Considerations for Stakeholders

-

Pharmaceutical Companies: Focus on patent extensions, formulation innovations, and establishing strong formulary placements to sustain premium prices.

-

Manufacturers of Generics: Maximize market share through aggressive pricing, especially in emerging markets with less payer bargaining power.

-

Healthcare Systems: Emphasize formulary management and negotiating strategies to lower costs for end-users.

-

Investors: Anticipate margin compression over time but recognize ongoing opportunities with differentiated formulations and geographic expansion.

Conclusion

The market for budesonide ER remains dynamic, shaped by patent statuses, generics proliferation, and the evolving therapeutic landscape. Price declines are anticipated over the next five years, driven largely by generic entry and competitive pressures. However, branded formulations may sustain a premium segment owing to physician loyalty and formulation patents. Strategic positioning—whether through patent protections, formulation innovations, or market expansion—will significantly influence pricing trajectories.

Key Takeaways

- The global IBD treatment market is expected to see steady growth, with corticosteroids like budesonide ER maintaining a substantial, though diminishing, share.

- Patent expirations and generic competition are primary drivers of price declines, with expectations of a 10-15% reduction in branded drug prices by 2028.

- Pricing strategies will be influenced by regulatory changes, formulary dynamics, and emerging therapies.

- Manufacturers should consider innovation, patent extensions, and market diversification to sustain profitability.

- Healthcare payers and providers will continue to seek cost-effective options, intensifying negotiation efforts.

FAQs

1. What is the current market share of branded versus generic budesonide ER?

Branded formulations, such as Entocort EC, hold approximately 70% of the market share, although generics now account for about 25% post-expiry and entry of multiple manufacturers.

2. How does patent expiration impact drug pricing?

Patent expiration allows generics to enter the market, dramatically increasing competition and reducing prices—often by 50% or more compared to branded versions.

3. Are biosimilars a concern for budesonide ER?

Budesonide ER is a small-molecule corticosteroid, and biosimilars pertain to biologics. Thus, biosimilars are not directly applicable but represent a broader trend of decreasing biologic costs that could influence overall IBD management.

4. What factors could hinder price declines in the future?

Patent protections, formulation-specific patents, manufacturing complexities, and regulatory hurdles could sustain higher prices longer than expected.

5. How will emerging therapies affect the budesonide ER market?

Advances in biologics and targeted small molecules may divert market share from corticosteroids in certain patient populations, potentially reducing overall demand for budesonide ER.

References

- GlobalData. "Inflammatory Bowel Disease Therapeutics Market Analysis," 2022.

- IQVIA. "Impact of Patent Expiry on GI Corticosteroids," Q4 2022 Data.

- European Medicines Agency. "Regulatory Updates on Budesonide Formulations," 2023.

- National Institute of Health. "IBD Incidence and Prevalence," 2023.

- Industry Reports. "Biologics and Small Molecule Innovations in IBD," 2022.

More… ↓