Share This Page

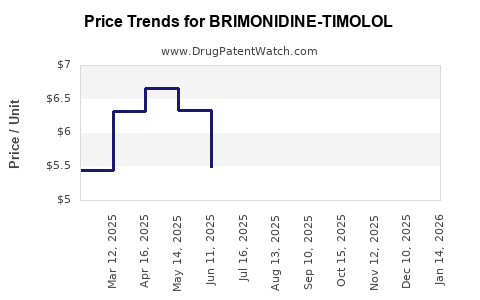

Drug Price Trends for BRIMONIDINE-TIMOLOL

✉ Email this page to a colleague

Average Pharmacy Cost for BRIMONIDINE-TIMOLOL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| BRIMONIDINE-TIMOLOL 0.2%-0.5% | 82182-0455-15 | 4.00143 | ML | 2025-12-17 |

| BRIMONIDINE-TIMOLOL 0.2%-0.5% | 00781-7186-70 | 2.67356 | ML | 2025-12-17 |

| BRIMONIDINE-TIMOLOL 0.2%-0.5% | 00781-7186-75 | 3.71832 | ML | 2025-12-17 |

| BRIMONIDINE-TIMOLOL 0.2%-0.5% | 00832-1425-05 | 3.71832 | ML | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Brimonidine-Timolol

Introduction

Brimonidine-Timolol, a fixed-combination ophthalmic solution, targets glaucoma and ocular hypertension by reducing intraocular pressure (IOP). This combination therapy integrates brimonidine, an alpha-2 adrenergic agonist, with timolol, a non-selective beta-blocker, providing dual mechanism action to optimize IOP management. As the global burden of glaucoma expands with aging populations, understanding the market landscape and pricing dynamics of Brimonidine-Timolol is critical for stakeholders aiming to maximize commercial outcomes and healthcare impact.

Market Landscape

1. Product Overview and Regulatory Status

Brimonidine-Timolol is commercially available under several brand names, including Alphagan P (Allergan/AbbVie), Combigan (AbbVie), and various generic formulations. The first fixed-dose combination entered the market nearly a decade ago, with patent protections secured initially through branded formulations.

Recent patent expirations and regulatory approvals have facilitated the entry of generics, intensifying competition. For example, the patent for Combigan has expired in several key markets like the U.S. and Europe, prompting a surge of generic manufacturers to offer cost-effective alternatives.

2. Market Size and Segmentation

The global glaucoma market was valued at approximately USD 6.8 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 4-5% over the next five years, driven primarily by aging populations and increased screening.

Brimonidine-Timolol accounts for an estimated 15-20% of the fixed-combination ophthalmic drug market, with a significant share in North America, Europe, and parts of Asia-Pacific. The drug serves a core segment—patients inadequately controlled by monotherapy, or those seeking reduction in medication burden.

3. Competitive and Therapeutic Dynamics

Key competitors include other fixed combinations like Brimonidine-Brinzolamide, Brimonidine-Brimonolol, and prostaglandin analogs such as latanoprost and used in combination therapies. The choice depends on patient response, safety profiles, and clinician preference.

In recent years, the trend towards preservative-free formulations and sustained-release delivery systems is influencing market dynamics. Additionally, the advent of drug class innovations, such as neuroprotective agents, may position Brimonidine-Timolol in a more competitive landscape long-term.

Market Drivers and Challenges

Drivers:

- Growing prevalence of glaucoma globally, with an estimated 76 million affected in 2020, expected to reach 111 million by 2040 ([1]).

- Increasing awareness and screening leading to earlier diagnosis and treatment.

- Preference for combination therapies that improve adherence and reduce treatment complexity.

- Improving patent landscapes in developing markets, expanding access.

Challenges:

- Pricing pressures due to generic competition.

- Stringent regulatory pathways increasing costs for approval of new formulations.

- Patient adherence issues related to comfort and side effects.

- Competition from emerging drug classes and alternative delivery methods.

Price Analysis and Projections

1. Current Pricing Landscape

Pricing varies significantly across geographies:

- United States: Brimonidine-Timolol branded formulations like Combigan are priced approximately USD 250-350 per bottle (2.5 mL) with insurance coverage influencing out-of-pocket costs. Generic versions are available at USD 100-150, substantially lower, exerting downward pressure on market prices.

- Europe: Prices tend to range from EUR 70-100 per bottle, with national reimbursement policies influencing consumer prices.

- Asia-Pacific: Marked price differences exist, with some markets offering the drug at USD 25-50 for generics, driven by regional pricing regulations and healthcare systems.

2. Impact of Patent Expiry and Generic Competition

Patent expiry scenarios significantly influence pricing trajectories. In markets like the U.S., Combigan’s patent expiration in 2018 led to a sharp decline in branded prices and a proliferation of generics. As of 2023, generics constitute approximately 60-70% of sales volume, but branded products retain premium positioning in specific markets due to brand reliability and physician loyalty.

3. Price Projections (2023-2028)

Given current market dynamics, the following projections are reasonable:

-

Short-term (2023-2025):

- Branded formulations may see a 10-15% price decline driven by generic entry and increased competition.

- The median price of branded Brimonidine-Timolol is expected to fall to USD 200-250 per bottle.

- Generic prices are anticipated to stabilize around USD 80-120, capturing a larger market share.

-

Mid to Long-term (2026-2028):

- Further commoditization could see branded prices decline by an additional 5-10% as generics dominate sales.

- Introduction of biosimilars or alternative delivery systems may influence pricing structures but are unlikely to significantly alter the downward trajectory unless disruptive innovations occur.

4. Factors Modulating Future Pricing

- Regulatory policies aimed at reducing healthcare costs could accelerate price reductions.

- Market penetration of biosimilars and novel delivery methods may introduce new pricing models.

- Healthcare reimbursement strategies, particularly in emerging markets, could influence consumer willingness to pay premiums for branded products.

Strategic Implications

For pharmaceutical companies, maintaining market share amid declining prices requires innovation, brand loyalty, and expanding into emerging markets. Generic manufacturers may leverage pricing advantages to increase volume, but the incumbent brands retain an edge through clinical data and physician trust.

Furthermore, partnerships with payers and inclusion in formularies are critical, especially as competition intensifies. Manufacturers should also monitor the potential for combination therapies or alternative formulations, which could influence the demand and pricing of Brimonidine-Timolol.

Key Takeaways

- The global glaucoma market is expanding, with Brimonidine-Timolol occupying a significant niche due to its efficacy and combination convenience.

- Patent expirations and generic entry have precipitated a substantial decline in branded product prices, with generics now dominating sales volume.

- Short-term projections indicate continued price erosion, with branded formulations potentially declining by up to 15% by 2025.

- Long-term growth hinges on market expansion in emerging economies and innovation in drug delivery.

- Companies should adopt strategies integrating cost-effective product offerings, partnerships, and innovation to sustain profitability.

FAQs

1. How does patent expiration affect the pricing of Brimonidine-Timolol?

Patent expiration typically leads to increased generic competition, resulting in significant price reductions for both branded and generic formulations. Branded products may see a decrease of 10-15% shortly after patent expiry, with generics offering more affordable options.

2. Are generics as effective and safe as branded Brimonidine-Timolol?

Yes. Regulatory agencies require bioequivalence studies to approve generics, ensuring comparable safety and efficacy to branded formulations.

3. What are the main factors influencing the future pricing of Brimonidine-Timolol?

Market competition, patent activity, regulatory policies, healthcare reimbursement strategies, and technological innovations in delivery systems primarily influence future pricing trajectories.

4. How can pharmaceutical companies mitigate price erosion?

Through product differentiation, adding value via improved formulations, expanding into emerging markets, and establishing strong healthcare provider relationships to foster brand loyalty.

5. Is there potential for new formulations or delivery systems in the near future?

Yes. Innovations like preservative-free drops, sustained-release implants, and combined neuroprotective agents are under development, which may redefine the market landscape and influence pricing strategies.

References

- Quigley HA, Broman AT. The number of people with glaucoma worldwide in 2020 and 2040. The Journal of Glaucoma. 2006;15(3):226-232.

- MarketWatch. Glaucoma Drugs Market Size, Share & Trends Analysis Report. 2022.

- IQVIA. The Global Use of Medicine in 2022.

- US Food and Drug Administration. Drug Approvals and Patent Status. 2023.

Prepared for healthcare professionals, stakeholders, and market analysts seeking data-driven insights into Brimonidine-Timolol's market dynamics and pricing trajectory.

More… ↓