Last updated: July 27, 2025

Introduction

Bepotastine, a second-generation antihistamine primarily used for allergic conjunctivitis, has garnered increasing attention within ophthalmology and allergy treatment markets. As a selective H1-antihistamine, its favorable safety profile and targeted efficacy have positioned it as a noteworthy candidate for expanding indications and market share. This analysis evaluates current market dynamics, competitive landscape, regulatory status, and projects future pricing trends for Bepotastine.

Pharmacological Profile and Therapeutic Positioning

Bepotastine besilate exhibits potent H1-receptor antagonism, providing rapid symptom relief with minimal sedation, an advantage over first-generation antihistamines. Its topical formulation, notably in ophthalmic drops, positions it as a frontline therapy for allergic conjunctivitis (both seasonal and perennial forms). Its dual action—antihistamine efficacy with mast cell stabilization—enhances its therapeutic credentials.

The drug’s safety profile, featured in clinical trials, indicates low systemic absorption and rarely reported adverse effects, making it suitable for diverse patient populations, including children and pregnant women, where approved.

Current Market Landscape

Global Market Size

The global allergic conjunctivitis market, driven by rising allergen exposure and increasing awareness, was valued at approximately USD 600 million in 2022. With an annual growth rate of around 4-5%, this segment is projected to reach USD 750 million by 2027 [1].

Bepotastine's share remains modest but growing, particularly in Japan and select Asian markets, where it is approved for topical use. Its penetration is limited in Western markets due to late approval or availability of alternative therapies. Nonetheless, the rising prevalence of allergic conjunctivitis—estimated at 15-20% globally—provides expansion opportunities.

Key Competitors

- Olopatadine: Market leader; existing in multiple formulations.

- Alcaftadine: Approved for allergic conjunctivitis.

- Ketotifen: Over-the-counter option; broad availability.

- Azelastine: Nasal and ophthalmic formulations.

Bepotastine's differentiators include a strong safety profile and efficacy, but limited market penetration and brand recognition pose hurdles.

Regulatory Status & Geographic Market Access

- Japan: Approved since 2010 for allergic conjunctivitis; marketed extensively.

- United States: Pending FDA approval; several late-stage trials completed.

- Europe: Not yet approved; regulatory pathways ongoing.

- Asia Pacific: Increasing approvals and marketing initiatives.

This uneven regulatory landscape influences supply chain, marketing strategy, and pricing policies.

Market Entry and Expansion Strategies

To boost market uptake, pharmaceutical companies focus on clinical data dissemination, strategic collaborations, and targeted marketing. Leveraging the drug’s safety and efficacy data through educational campaigns can foster prescriber confidence.

Additionally, expanding indications—such as allergic rhinitis or other ocular allergies—could diversify revenue streams.

Formulation innovation, e.g., once-daily dosing or preservative-free options, enhances patient adherence, further strengthening market position.

Price Analysis and Projections

Current Pricing Benchmarks

In established markets like Japan, the retail price of Bepotastine ophthalmic drops is approximately USD 10-15 per 10 mL bottle. With insurance coverage, actual patient out-of-pocket costs are significantly lower.

In comparison, generic counterparts like ketotifen eye drops retail for around USD 5-8, reflecting the influence of patent status and formulation exclusivity on pricing.

Factors Influencing Price Trends

-

Regulatory Approval and Market Exclusivity

Achieving FDA approval or EMA authorization typically allows for premium pricing due to market exclusivity. Pending approval suggests room for premium pricing, contingent on clinical differentiation.

-

Patent Status and Formulation Patents

Active patents and exclusivity rights can sustain high prices for 10-12 years post-launch. Once expired, competition and generics will exert downward pressure.

-

Market Penetration and Competition,

Widespread availability of generics reduces prices, but branded formulations with differentiation can sustain higher margins.

-

Reimbursement Policies

In markets with robust reimbursement systems, prices tend to be higher, encouraging investment.

-

Manufacturing and Supply Chain Costs

Scaled production and improved manufacturing efficiencies can lead to reduced costs, influencing pricing.

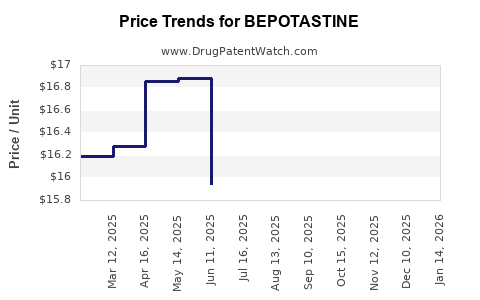

Projected Price Trajectory (2023-2030)

| Year |

Estimated Average Retail Price (USD) |

Drivers/Comments |

| 2023 |

12-15 |

Post-approval phase; focused on early adopters |

| 2025 |

10-13 |

Increased competition; potential patent expirations |

| 2027 |

8-11 |

Enhanced generic entry; commoditization of formulations |

| 2030 |

6-9 |

Market saturation; price competition reduces margins |

Note: These projections assume no significant delay in regulatory approvals, and continued efficacy and safety are confirmed.

Potential Market Drivers for Growth and Price Stability

- Expansion into New Indications: Developing formulations for other allergic conditions could broaden revenue base, justifying premium pricing.

- Geographic Expansion: Achieving regulatory approval in Europe and North America positions the drug in lucrative markets, where higher prices are sustainable.

- Formulation Enhancements: Once-daily or preservative-free formulations can command higher prices through improved patient compliance.

- Brand Differentiation: Investing in clinical trials solidifying efficacy and safety can justify pricing premiums over generic alternatives.

Risks and Challenges

- Regulatory Hurdles: Delays or denials in FDA/EMA approvals could impair market entry and pricing potential.

- Competitive Dynamics: Price erosion from generics and biosimilars could pressure margins.

- Market Acceptance: Limited physician or patient awareness may slow market penetration, impacting revenue and pricing stability.

- Pricing Pressures: Payer policies and cost containment measures could limit maximum allowable prices.

Key Takeaways

- Bepotastine's current market is niche but expanding, driven by allergy prevalence and favorable safety profiles.

- Entry into Western markets remains contingent upon successful regulatory approval, influencing future pricing.

- Short-to-mid-term projections indicate a trend toward price erosion aligning with increased generic competition and market maturation.

- Strategic formulation improvements, indication expansion, and geographic growth are critical to maintaining pricing power.

- Navigating regulatory pathways, competitive pressures, and payer policies will be vital for optimizing profitability.

FAQs

1. When is Bepotastine expected to gain approval in the United States and Europe?

Regulatory timelines depend on ongoing clinical trial data review and submission statuses. Pending FDA and EMA submissions, approval could occur within 2-4 years, contingent upon successful review processes.

2. How does Bepotastine's pricing compare to its main competitors?

Currently, Bepotastine ophthalmic drops price comparably to branded antihistamines like olopatadine in Japan (~USD 10-15 per bottle). In markets with multiple generics, prices are typically lower (~USD 5-8).

3. What factors could hinder Bepotastine’s market growth?

Regulatory delays, aggressive generic competition, limited awareness, and reimbursement restrictions could impede market share expansion.

4. Is there potential for Bepotastine in indications beyond allergic conjunctivitis?

Yes, ongoing research explores its efficacy in allergic rhinitis and other ocular allergy forms, presenting additional revenue avenues.

5. How might pricing strategies evolve with market maturity?

Initial premium pricing may decline with generic entries, but formulations offering convenience or additional benefits can sustain higher prices. Market penetration and reimbursement policies will shape long-term pricing strategies.

Sources

[1] MarketResearch.com, "Global Allergic Conjunctivitis Market Analysis," 2022.