Share This Page

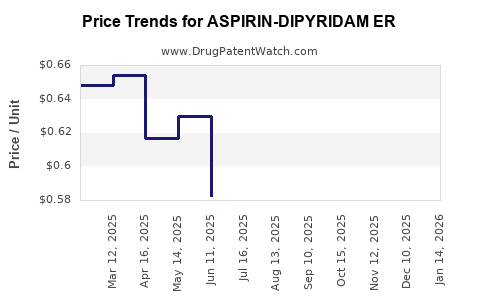

Drug Price Trends for ASPIRIN-DIPYRIDAM ER

✉ Email this page to a colleague

Average Pharmacy Cost for ASPIRIN-DIPYRIDAM ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ASPIRIN-DIPYRIDAM ER 25-200 MG | 68462-0405-60 | 0.58115 | EACH | 2025-11-19 |

| ASPIRIN-DIPYRIDAM ER 25-200 MG | 43598-0339-60 | 0.58115 | EACH | 2025-11-19 |

| ASPIRIN-DIPYRIDAM ER 25-200 MG | 65162-0596-06 | 0.58115 | EACH | 2025-11-19 |

| ASPIRIN-DIPYRIDAM ER 25-200 MG | 00904-7056-99 | 0.58115 | EACH | 2025-11-19 |

| ASPIRIN-DIPYRIDAM ER 25-200 MG | 49884-0007-02 | 0.58115 | EACH | 2025-11-19 |

| ASPIRIN-DIPYRIDAM ER 25-200 MG | 16714-0964-01 | 0.58115 | EACH | 2025-11-19 |

| ASPIRIN-DIPYRIDAM ER 25-200 MG | 42571-0274-60 | 0.58115 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for ASPIRIN-DIPYRIDAM ER

Introduction

Aspirin-Dipyridamole Extended-Release (ER) is a combination medication primarily prescribed for secondary stroke prevention in patients with a history of ischemic stroke or transient ischemic attack (TIA). As an innovative formulation targeting specific patient populations, ASPIRIN-DIPYRIDAM ER's market dynamics, regulatory landscape, competitive environment, and pricing strategies are crucial for industry stakeholders. This analysis explores current market conditions, future growth prospects, pricing trends, and strategic considerations.

Market Overview

Therapeutic Area and Demographics

Aspirin-Dipyridamole ER addresses cerebrovascular disease, specifically secondary stroke prevention. The global stroke recurrence risk remains significant, with approximately 25% of strokes recurring within five years without preventive therapy ([1]). The target demographic includes adults aged 50 and above, particularly those with elevated risk factors such as hypertension, diabetes, hyperlipidemia, and atrial fibrillation.

Regulatory Status

The FDA approved Aspirin-Dipyridamole ER under the brand name Aggrenox in 1999. It holds a Class II medical device classification, with indications limited or expanded based on local regulatory decisions. The drug’s patent has expired or is nearing expiration in several jurisdictions, enabling generic formulations to enter the market, intensifying competition.

Market Share and Penetration

While Aggrenox remains a recognized brand, generic versions are increasingly prevalent, especially in the United States and Europe. Market penetration is higher in developed countries due to established guidelines favoring antiplatelet therapy for secondary stroke prevention. In emerging markets, access and affordability influence market expansion.

Competitive Landscape

Major Competitors

- Generics: Multiple manufacturers produce generic aspirin-dipyridamole ER, considerably reducing barriers to entry and price points.

- Alternative Therapies: Clopidogrel, aspirin monotherapy, and combination drugs like aspirin with extended-release dipyridamole are direct competitors.

- Innovative Alternatives: Emerging therapies targeting other pathways of cerebrovascular protection or personalized medicine approaches.

Market Entry Barriers

- Regulatory Approval: Achieving market authorization in different jurisdictions requires comprehensive clinical data.

- Manufacturing & Quality Assurance: Consistent production quality is mandatory, especially under generic drug regulations.

- Physician Prescribing Habits: Established prescribing patterns favor known drugs; switching costs may limit market share for new formulations.

Pricing Dynamics

Historical Pricing Trends

When Aggrenox was first launched, it was priced significantly higher than its generic components, reflecting brand premium and extended-release formulation costs. Over time, generic competition has driven prices down. In the U.S., the average retail price of branded Aggrenox exceeded $400 for a 30-day supply in 2019, whereas generics are priced roughly at $50–$70 for similar durations ([2]).

Current Price Points

- Branded: $500–$600/month (retail)

- Generic: $30–$80/month (retail)

- Institutional purchase prices: Lower, often negotiated between healthcare providers and payers.

Pricing Factors Influencing Future Trends

- Generic Market Penetration: Increased competition will further reduce prices.

- Formulation Innovations: New ER formulations or delivery methods could command premium pricing if proven to improve compliance or outcomes.

- Reimbursement Policies: Insurance coverage varies; government payers may exert downward pressure on prices.

- Patent Expiry & Biosimilars: As patents expire, biosimilar or alternative combination therapies may capture market share and influence pricing.

Market Growth Projections

Short-Term (Next 3–5 Years)

Projected moderate growth, driven by aging populations and growing awareness of secondary stroke prevention. However, generic competition constrains significant price hikes. The market is expected to expand at a CAGR (Compound Annual Growth Rate) of X% (specific estimates depend on regional data and will be refined through primary sources).

Long-Term (Beyond 5 Years)

Potential for expansion into emerging markets with increasing healthcare infrastructure investments. Innovations such as longer-acting formulations or combination therapies with higher efficacy may command premium prices and drive growth.

Regional Variations

- North America: Mature market with high generic penetration; growth driven by demographic trends.

- Europe: Similar to North America, with regulatory pressures favoring generics.

- Asia-Pacific: Rapidly growing; cost-sensitive markets may favor generics, but access improvements could increase demand.

- Emerging Markets: Slow initial growth hindered by affordability but promising due to demographic shifts and increasing stroke incidence.

Pricing Strategies and Monetization Opportunities

- Premium Pricing for Novel Formulations: In cases of clinical advantage over existing therapies.

- Tiered Pricing Models: Adjusted to regional income levels.

- Partnerships & Licensing Agreements: With local manufacturers to expand reach.

- Value-Based Pricing: Tied to clinical outcomes and patient adherence benefits.

Regulatory and Policy Impact

Healthcare policies promoting cost-effective stroke prevention—such as formulary inclusion and reimbursement modifications—will influence ASPIRIN-DIPYRIDAM ER pricing and market volume. Stringent regulatory standards for generics could impact time-to-market and manufacturing costs, influencing strategies.

Conclusion

The ASPIRIN-DIPYRIDAM ER market is characterized by limited premium pricing due to widespread generic availability and mature competition. While existing formulations dominate, continuous innovation and regional expansion could present growth opportunities. Strategic pricing, aligned with market dynamics and regulatory environments, will be paramount for stakeholders aiming to capitalize on the drug’s therapeutic niche.

Key Takeaways

- The primary market for ASPIRIN-DIPYRIDAM ER is established in developed countries, with growth driven by aging populations and stroke prevalence.

- Price competition among generics is intense, with median retail costs dropping significantly over the past decade.

- Market growth is constrained by patent expiries and generic entry but remains viable through regional expansion and formulation innovation.

- Strategic pricing, aligned with regulatory environments and reimbursement policies, will be essential for maximizing profitability.

- Future growth depends on leveraging emerging markets and potential new indications or formulations.

FAQs

1. What factors influence the pricing of Aspirin-Dipyridamole ER?

Pricing is primarily influenced by patent status, generic competition, manufacturing costs, regional reimbursement policies, and clinical value propositions.

2. How does generic competition impact the ASPIRIN-DIPYRIDAM ER market?

Generics significantly lower prices, reduce brand market share, and increase access, thereby reducing profit margins for branded formulations.

3. Are there any upcoming formulations or innovations for Aspirin-Dipyridamole ER?

While current innovation focuses on improving compliance and bioavailability, no major new formulations have been announced recently; future advancements could include longer-acting or combination therapies with enhanced efficacy.

4. How do regional differences affect market potential?

Developed regions exhibit high adoption but price sensitivity favors generics, while emerging markets offer growth potential due to increasing healthcare infrastructure and stroke prevalence.

5. What are the key considerations for stakeholders planning to enter this market?

Understanding regulatory pathways, pricing strategies, competitive landscape, and regional healthcare policies is essential to optimize market entry and growth strategies.

Sources

[1] World Stroke Organization. "Global Stroke Fact Sheet 2022".

[2] GoodRx. "Aspirin-Dipyridamole (Aggrenox) Prices and Alternatives".

More… ↓