Share This Page

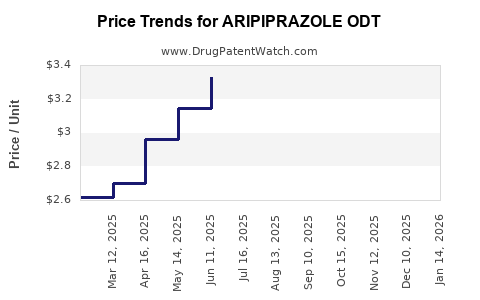

Drug Price Trends for ARIPIPRAZOLE ODT

✉ Email this page to a colleague

Average Pharmacy Cost for ARIPIPRAZOLE ODT

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ARIPIPRAZOLE ODT 10 MG TABLET | 72578-0106-06 | 3.42792 | EACH | 2025-11-19 |

| ARIPIPRAZOLE ODT 10 MG TABLET | 72578-0106-30 | 3.42792 | EACH | 2025-11-19 |

| ARIPIPRAZOLE ODT 10 MG TABLET | 69452-0338-13 | 3.42792 | EACH | 2025-11-19 |

| ARIPIPRAZOLE ODT 10 MG TABLET | 72578-0106-78 | 3.42792 | EACH | 2025-11-19 |

| ARIPIPRAZOLE ODT 10 MG TABLET | 43598-0733-30 | 3.42792 | EACH | 2025-11-19 |

| ARIPIPRAZOLE ODT 15 MG TABLET | 72578-0107-78 | 4.52768 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Aripiprazole ODT

Introduction

Aripiprazole orally disintegrating tablet (ODT) is a novel formulation of aripiprazole, marketed under trademarks such as Abilify Discmelt by Otsuka Pharmaceutical and Bristol-Myers Squibb. Approved for schizophrenia, bipolar disorder, and adjunctive treatment in depression, Aripiprazole ODT offers patients a convenient, quick-dissolving administration, improving compliance in populations with swallowing difficulties. As the demand for atypical antipsychotics expands, understanding its current market dynamics and future price trajectory offers critical insight for stakeholders.

This analysis evaluates the therapeutic landscape, market size, competitive positioning, regulatory environment, and price projections of Aripiprazole ODT, providing actionable intelligence for pharmaceutical investors, healthcare providers, and policy makers.

Market Landscape Overview

Global Market Size & Growth Trajectory

The global antipsychotic market was valued at approximately USD 8.2 billion in 2021 and is projected to grow at a compound annual growth rate (CAGR) of around 4.3% through 2028. The increasing prevalence of schizophrenia (~20 million people worldwide) and bipolar disorder (~45 million globally) and the rising adoption of second-generation (atypical) antipsychotics underpin this expansion [1].

Specifically, Aripiprazole-based therapies, including ODT formulations, constitute a significant segment, driven by advantages such as improved patient adherence, minimized sedation, and a favorable side-effect profile.

Market Penetration & Adoption

Currently, Aripiprazole ODT holds a considerable share in the U.S. and European markets. Its unique delivery differentiates it from oral tablets and injectable formulations. Despite its advantages, competition remains stiff from other atypical antipsychotics like quetiapine, risperidone, and newer agents such as brexpiprazole.

The drug's adoption is also boosted by clinical guidelines favoring medications with enhanced compliance profiles, especially for pediatric and geriatric populations with swallowing difficulties [2].

Competitive Landscape

Key competitors include:

- Risperdal (risperidone) ODT: Established in the market with similar formulations.

- Latuda (lurasidone): Offers once-daily dosing but lacks disintegrating formulation.

- Brexpiprazole (Rexulti): Approved for schizophrenia and adjunctive depression, with ongoing comparative assessments.

Emerging players also explore novel delivery systems and biosimilars, potentially impacting market share.

Regulatory Environment & Regional Dynamics

FDA & EMA Approvals

Aripiprazole ODT received FDA approval in 2009, expanding options for patients with schizophrenia and bipolar disorder. The European Medicines Agency (EMA) granted approval shortly thereafter, with regulatory pathways facilitating rebranding and formulation adaptations.

Reimbursement & Pricing Policies

Pricing strategies are affected by regional reimbursement frameworks, with high drug prices a common concern in the U.S. and less so in price-controlled markets like the UK and Germany. Payers favor drugs that improve adherence, leading to favorable formulary placements for formulations like ODT.

Current Pricing Analysis

Pricing Benchmarks

As of 2023, the average wholesale price (AWP) for Aripiprazole ODT in the U.S. is approximately $500–$600 per month for a standard dose (10–15 mg daily) [3]. Variations depend on the manufacturer, pharmacy discounts, insurance coverage, and generic availability.

Cost Drivers

- Brand Premiums: Branded formulations generally cost more than authorized generics or biosimilars.

- Formulation Advantages: Dissolvable tablets typically command higher prices due to patient demand.

- Regulatory Exclusivity: Market exclusivity influences pricing, especially for new formulations or delivery mechanisms.

Generic Competition

Generic versions of aripiprazole have significantly contributed to cost reductions since patent expiry in 2015. However, the disintegrating formulation maintains a premium segment due to its clinical and compliance benefits.

Future Price Projections

Factors Influencing Price Dynamics

-

Patent Lifecycle & Generic Entry: The key patent for the disintegrating tablet form is set to expire in the U.S. in 2025, after which generic competition is anticipated. Historically, generics reduce drug prices by approximately 70–80% within the first 2 years of entry [4].

-

Clinical Adoption & Prescribing Trends: Increasing acceptance of ODT formulations in pediatric, geriatric, and compliance-sensitive populations sustains premium pricing until generics dominate.

-

Reimbursement & Healthcare Policy: Emphasis on cost-effective therapies could pressure prices downward, especially as biosimilar and generic options expand.

-

Market Competition: Rising competition from other antipsychotics and novel delivery technologies may lead to price erosion.

Projected Range

- Pre-Patent Expiry (up to 2025): Stable or slight increase in unit price, maintained at approximately $500–$600/month.

- Post-Patent Expiry (2025+): Expected generic entry could reduce prices by 60–80%, leading to a projected price of $100–$200/month within 2–3 years of patent expiration.

Long-term Outlook

Market consolidation and biosimilar entries could further compress pricing margins. Nevertheless, premium formulations like ODT may retain a niche premium due to adherence advantages, potentially stabilizing prices around $150–$250/month in select markets.

Key Market Drivers & Challenges

Drivers

- Growing prevalence of mental health conditions.

- Clinical guidelines favoring adherence-improving formulations.

- Increasing off-label uses (e.g., irritability in autism spectrum disorder).

- Patient preference for convenience and compliance.

Challenges

- Patent expiration leading to price erosion.

- Intense generic competition.

- Price regulation in several markets.

- Emergence of innovative delivery systems or oral-biomimetic formulations.

Conclusion & Strategic Insights

Aripiprazole ODT's current market position is robust, leveraging its convenience and compliance benefits. However, imminent patent expiry signals a transition into a highly competitive environment marked by significant price reductions. Stakeholders should recognize the importance of early lifecycle management strategies, such as brand extensions or innovative formulations, to sustain market relevance and profitability.

Investors and healthcare providers should prioritize formulations with patent protection or differentiated clinical benefits. Policymakers and payers must balance fostering generic competition with ensuring patient access to preferred delivery options.

Key Takeaways

- The global market for Aripiprazole ODT is poised for growth but faces imminent price pressures due to upcoming patent expiration.

- Current prices hover around $500–$600/month, with generics likely to cut costs post-2025.

- Market expansion relies on increased prevalence, clinical guideline endorsement, and patient adherence considerations.

- Competition from other atypical antipsychotics and innovative delivery platforms poses future challenges.

- Strategic positioning before patent expiry can optimize revenue streams; post-expiration, pricing may decline sharply, impacting profitability.

FAQs

1. When will generic versions of Aripiprazole ODT become available?

Patent protections for the disintegrating tablet form are expected to expire around 2025 in the U.S., opening the market for generics.

2. How will generic entry affect the price of Aripiprazole ODT?

Generic entry typically results in a substantial price drop—by approximately 70–80% within two years—potentially reducing costs to $100–$200/month.

3. Are there clinical advantages of Aripiprazole ODT over other formulations?

Yes. The ODT formulation improves adherence, particularly in populations with swallowing difficulties, and offers rapid absorption benefits.

4. What regions show the highest potential for market growth?

The U.S. and Europe currently demonstrate strong adoption; emerging markets with expanding mental health awareness also present growth opportunities.

5. How might regulatory policies influence future prices?

Price controls and reimbursement policies in public health systems could further constrain prices, especially for branded drugs, emphasizing the value of cost-effective generics post-patent expiry.

References

[1] MarketWatch. “Global Antipsychotics Market Size & Share Analysis (2022-2028).”

[2] NICE Guidelines. Management of Schizophrenia in Adults, 2021.

[3] MMIT Drug Pricing Database, 2023.

[4] IMS Institute for Healthcare Informatics. “Impact of Patent Expirations on Prices of Branded Drugs,” 2020.

More… ↓