Last updated: July 30, 2025

Introduction

The global anti-diarrheal drug market addresses a significant health concern affecting populations worldwide, particularly in low- to middle-income countries where infectious diarrhea remains a leading cause of morbidity and mortality. The market encompasses a diverse portfolio, including over-the-counter (OTC) remedies, prescription medications, and novel therapeutics targeting irritable bowel syndrome (IBS) and other gastrointestinal conditions. Analyzing current market dynamics and projecting future prices involve assessing factors such as epidemiological trends, technological advancements, regulatory landscapes, and competitive innovations.

Market Overview

The anti-diarrheal drugs market is poised for sustained growth driven primarily by increasing incidences of diarrhea due to diverse etiologies: infectious agents (bacteria, viruses, parasites), chronic conditions (IBS, inflammatory bowel diseases), and lifestyle factors. According to a report by Grand View Research, the global gastrointestinal drugs market, which includes anti-diarrheal agents, was valued at approximately USD 23.8 billion in 2021, with a compound annual growth rate (CAGR) of 4.4% forecasted through 2028 ([1]).

Key Market Segments

- OTC Anti-Diarrheal Agents: Loperamide and bismuth subsalicylate dominate this segment, owing to accessibility and established efficacy.

- Prescription Treatments: Pharmacological classes include opioids (diphenoxylate), antisecretory agents, probiotics, and emerging biologics.

- Innovative Therapeutics: Focused on targeted therapies, microbiome modulation, and vaccines to prevent infectious diarrhea.

Geographical Distribution

Developed regions such as North America and Europe exhibit high consumption due to healthcare infrastructure and consumer awareness, whereas emerging economies like India and Brazil see rapid growth driven by higher disease prevalence and increasing healthcare access.

Epidemiological Trends

Diarrheal diseases account for approximately 1.9 million deaths annually, predominantly impacting children under five, per WHO data ([2]). Urbanization, climate change, and sanitation challenges are exacerbating disease prevalence, particularly in densely populated areas. This health burden sustains ongoing demand for effective anti-diarrheal solutions.

Market Drivers

- Rising Incidence of Gastrointestinal Disorders: Increased prevalence of IBS, travel-related diarrhea, and infectious cases.

- Advancements in Drug Delivery: Enhanced formulations (e.g., fast-acting tablets, sustained-release) improve patient compliance.

- Growing Awareness and OTC Accessibility: Facilitates self-medication, especially in regions with limited physician access.

- Regulatory Support for Novel Agents: Faster approval pathways for new therapeutics, particularly biologics and microbiome-based interventions.

Competitive Landscape

Key companies include Johnson & Johnson (Loperamide), Bayer (Bismuth subsalicylate), and emerging biotech firms focusing on microbiome therapeutics. Patent expirations (e.g., Loperamide's patent renewal in 2022) and the influx of generics influence market pricing and dynamics.

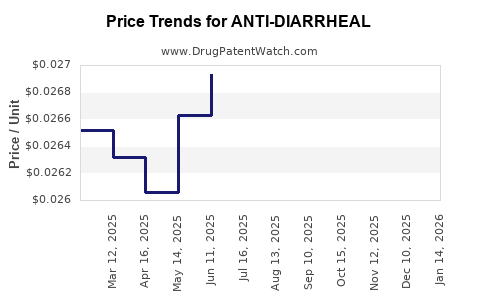

Pricing Analysis

-

Current Pricing Trends: OTC anti-diarrheals typically retail at USD 4-10 per package, with generics undercutting branded options by approximately 40%. Prescription medications range from USD 20-50 per treatment course, influenced by formulation complexity and patent status.

-

Cost of Development and Regulatory Impact: Biologics and novel therapies face higher R&D costs, often resulting in premium prices, especially during initial market entry. Progressive patent expiries and biosimilar developments could reduce prices over time.

Price Projections

Short-term (1-3 years):

- OTC Market: Expect minor price fluctuations (~2-3%) driven by raw material costs, distribution logistics, and competitive pressure.

- Prescription Segment: Slight downward adjustments (~5%) anticipated due to generic proliferation and increased biosimilar competition.

- Innovative Therapeutics: Initial prices are expected to be high (USD 100-200 per course), targeting niche markets with high unmet needs.

Mid-term (4-7 years):

- Growing Competition: Introduction of biosimilars and improved formulations will drive prices downward by 15-25%.

- Market Penetration of Novel Agents: Cost reductions towards USD 50-100 per course through scaling, improved manufacturing, and patent expirations.

- Emerging Markets: Prices are projected to be significantly lower (USD 10-30), considering socioeconomic factors and regulatory policies.

Long-term (8-10 years):

- Price Stabilization: Expect stabilized prices aligned with manufacturing efficiencies and long product lifecycles.

- Potential for New Paradigms: Digital therapeutics and microbiome-based interventions could alter traditional pricing models, introducing subscription or value-based pricing strategies.

Regulatory and Market Influencers

- Regulatory Pathways: Accelerated approval for biosimilars and combination therapies may lower prices.

- Healthcare Policies: Government initiatives focused on sanitation and vaccination programs could reduce diarrheal disease incidence, affecting drug demand and pricing.

- Technological Innovations: Advances in pharmacogenomics and microbiome research could lead to personalized therapies, impacting pricing structures.

Challenges and Opportunities

Challenges:

- Stringent regulatory environments may delay market entry for innovative therapies.

- Price sensitivity in emerging markets necessitates affordable pricing models.

- Competition from natural remedies and alternative therapies could impact traditional drug sales.

Opportunities:

- Development of vaccines and microbiome modulators presents high-growth potential.

- Strategic partnerships for regional manufacturing can enhance affordability.

- Digital health integration offers novel monetization and engagement avenues.

Key Takeaways

- The anti-diarrheal drug market is on a growth trajectory due to rising disease prevalence, especially in developing regions.

- OTC products dominate the segment, but prescription and innovative therapies are gaining prominence, influencing overall pricing dynamics.

- Short-term prices are relatively stable, but innovation, patent landscapes, and regulatory changes will drive significant price adjustments over the next decade.

- Cost reductions associated with biosimilars and generics are expected to lower prices, making treatments more accessible.

- Market opportunities exist in microbiome-based therapies, vaccines, and digital health solutions, which could reshape the pricing and competitive landscape.

FAQs

1. What factors most significantly influence anti-diarrheal drug prices?

Drug prices are impacted by manufacturing costs, patent status, regulatory approval processes, competition, and regional healthcare policies.

2. How will emerging markets affect the global anti-diarrheal drug price outlook?

Emerging markets often demand lower-priced products due to economic constraints, driving regional pricing strategies and stimulating affordable formulations.

3. Are biologic-based anti-diarrheal therapies expected to be more expensive than traditional options?

Yes, biologics require complex development and manufacturing processes, which initially lead to higher prices, though they may offer targeted efficacy.

4. What role will digital health and microbiome therapies play in future market pricing?

These innovations could reduce long-term treatment costs, enable personalized therapy, and shift pricing from drug-centric to value-based models.

5. How might global health initiatives impact the demand and pricing of anti-diarrheal drugs?

Programs aimed at improving sanitation and vaccination can decrease disease incidence, potentially reducing overall drug demand and influencing pricing strategies.

References

[1] Grand View Research. "Gastrointestinal Drugs Market Size, Share & Trends Analysis Report." 2022.

[2] World Health Organization. "Diarrhoeal Disease." 2021.