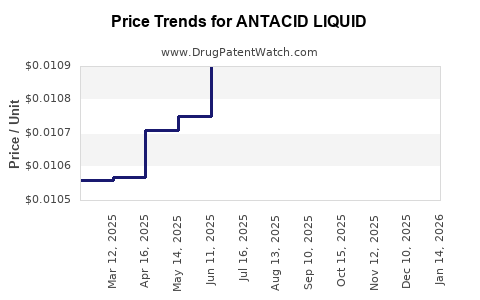

Drug Price Trends for ANTACID LIQUID

✉ Email this page to a colleague

Average Pharmacy Cost for ANTACID LIQUID

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ANTACID LIQUID | 46122-0433-40 | 0.01064 | ML | 2024-11-20 |

| ANTACID LIQUID | 46122-0433-40 | 0.01083 | ML | 2024-10-23 |

| ANTACID LIQUID | 46122-0433-40 | 0.01093 | ML | 2024-09-18 |

| ANTACID LIQUID | 46122-0433-40 | 0.01088 | ML | 2024-08-21 |

| ANTACID LIQUID | 46122-0433-40 | 0.01033 | ML | 2024-07-17 |

| ANTACID LIQUID | 46122-0433-40 | 0.01020 | ML | 2024-06-19 |

| ANTACID LIQUID | 46122-0433-40 | 0.01024 | ML | 2024-05-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |