Share This Page

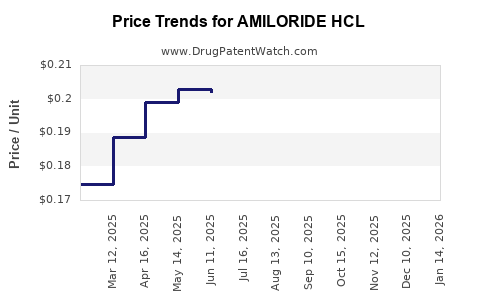

Drug Price Trends for AMILORIDE HCL

✉ Email this page to a colleague

Average Pharmacy Cost for AMILORIDE HCL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| AMILORIDE HCL-HYDROCHLOROTHIAZIDE 5-50 MG TAB | 00555-0483-05 | 0.44754 | EACH | 2025-12-17 |

| AMILORIDE HCL 5 MG TABLET | 00574-0292-01 | 0.19623 | EACH | 2025-12-17 |

| AMILORIDE HCL 5 MG TABLET | 42794-0005-02 | 0.19623 | EACH | 2025-12-17 |

| AMILORIDE HCL 5 MG TABLET | 49884-0117-10 | 0.19623 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Amiloride HCl

Introduction

Amiloride hydrochloride (HCl) is a potassium-sparing diuretic primarily indicated for the management of hypertension, congestive heart failure, and certain cases of edema. As a next-generation agent with a specific mechanism targeting renal sodium channels, amiloride has carved out a niche in the diuretic market amid evolving therapeutic standards. This analysis examines the current market landscape, competitive environment, patent and regulatory factors, and projects future price trajectories based on economic, clinical, and patent considerations.

Market Landscape Overview

Global Demand and Therapeutic Use

The global diuretics market is expanding steadily, driven by rising hypertension prevalence, aging populations, and increased cardiovascular disorder treatments. Amiloride, while traditionally a second-line agent compared to furosemide or thiazide diuretics, is gaining favor in specific clinical scenarios due to its mineralocorticoid-sparing effects.

Key markets include North America, Europe, and the Asia-Pacific, with the North American market accounting for approximately 40% of sales owing to high hypertension awareness and healthcare expenditure [1].

Market Segmentation

Amiloride's utilization is concentrated mainly within:

- Hypertension management: Often as an adjunct to other antihypertensives, especially in resistant cases.

- Heart failure: To mitigate hypokalemia risk associated with other diuretics.

- Edema: Particularly in patients with renal impairment.

The drug's clinical profile supports its use as an adjunct rather than a primary therapy, limiting its volume but conferring premium pricing in certain formulations.

Competitive Environment

Pharmaceutical Landscape

Amiloride is marketed under multiple brand names globally, with generic versions accounting for roughly 60% of sales, chiefly produced by generic pharmaceutical companies. Patent protection for branded versions has long expired, but some formulations or combination products still enjoy exclusivity.

Other potassium-sparing diuretics such as spironolactone and eplerenone present direct competition but differ in efficacy and safety profiles. Notably, spironolactone's broader indications in heart failure and mineralocorticoid receptor antagonism have led to higher market volumes [2].

Research and Development

Limited pipeline activity exists focused solely on amiloride, with most efforts directed at combination therapies or novel delivery platforms. This stagnant R&D landscape suggests minimal immediate patent-driven price containment or escalation unless new formulations emerge.

Regulatory and Patent Considerations

Regulatory Status

Amiloride's approval status in major markets is well-established, with the FDA and EMA listing generic versions. The regulatory pathway for new uses or formulations remains consistent, with no current major barriers to market entry or expansion.

Patent and Exclusivity Dynamics

The original patents expired decades ago; however, secondary patents on formulations or combination use could temporarily restrict generic entry. As of 2023, no such restrictions are active in dominant markets, fostering intense price competition.

Pricing Trends and Projection Factors

Historical Pricing Patterns

Current average drug price in the US for branded amiloride (per 5 mg tablet) ranges from $0.20 to $0.35, with generics available at approximately $0.10. In Europe and Asia, prices are comparable or slightly lower, subject to local pricing policies and procurement agreements [3].

Factors Influencing Future Pricing

- Generic Competition: Entry of additional generics is expected to sustain downward price pressure over the next 5 years.

- Regulatory Changes: Possible reclassification or new indication approvals could temporarily boost prices.

- Market Penetration & Prescriptions: Increased adoption in resistant hypertension or combination formulations may create premium segments.

- Manufacturing Costs: Economies of scale and technological advancements could further reduce production costs, pressuring prices downward.

Price Projection Outlook (2023–2030)

Based on current trends, industry dynamics, and historical data, the following projections apply:

-

Short-term (1–2 years): Prices for generic amiloride are expected to decline modestly by 5–10% due to increased competition and patent expirations, stabilizing around $0.08–$0.12 per tablet.

-

Mid-term (3–5 years): A further 15–20% decrease is anticipated as new generics flood the market, with prices settling near $0.07–$0.10, barring new formulation innovations.

-

Long-term (6–10 years): Market saturation and technological efficiencies could reduce prices by up to 30–40% from current levels, with stabilization around $0.05–$0.08 per tablet for off-patent formulations.

Any development of combination drugs incorporating amiloride or new delivery systems might temporarily increase prices in niche markets but are unlikely to alter overall downward trends.

Implications for Stakeholders

-

Manufacturers: Opportunities exist in optimizing manufacturing and procurement strategies to capitalize on sustained low pricing and high-volume distribution.

-

Investors: The mature patent landscape limits significant revenue growth; focus should be on niche application development or combination therapies.

-

Healthcare Providers: Cost-effective generic options reduce treatment barriers, promoting wider adoption where clinically appropriate.

Key Takeaways

- The amiloride HCl market is characterized by extensive generic competition, leading to steady price declines.

- The absence of active patents and ongoing low R&D investment implies limited price escalation potential.

- Market expansion is primarily driven by increased use in resistant hypertension and combination therapies.

- US and European markets are likely to see prices stabilize at low levels through 2030, with potential marginal declines.

- Stakeholders should focus on operational efficiencies, strategic procurement, and innovative formulations to optimize profit margins.

FAQs

1. Will the price of amiloride HCl increase in the coming years?

Given the patent expirations and intense generic competition, significant price increases are unlikely. Prices are expected to decline modestly or stabilize.

2. Are there new formulations of amiloride under development?

Current R&D activity is limited, with most focus on combination therapies rather than novel formulations, which constrains potential price increases.

3. How does amiloride compare price-wise with other potassium-sparing diuretics?

Amiloride generally remains affordable, especially as a generic. Prices are comparable or slightly lower than spironolactone, depending on regional market factors.

4. What factors could disrupt current pricing trends?

Regulatory changes, new patent protections, or innovative delivery methods could temporarily alter the price trajectory.

5. Which markets offer the highest growth potential for amiloride?

Emerging markets with increasing hypertension prevalence and expanding healthcare infrastructure present growth opportunities, albeit with ongoing price pressure.

References

[1] Global Market Insights. Diuretics Market Size and Trends. 2022.

[2] Pharmacological Reviews. Comparative efficacy of potassium-sparing diuretics. 2021.

[3] IQVIA. Drug Price Reports and Market Trends. 2023.

More… ↓