Last updated: July 29, 2025

Introduction

Amantadine, a well-established pharmacological agent, primarily treats Parkinson’s disease symptoms and facilitates antiviral therapy for influenza A. Its dual utility, oral bioavailability, and longstanding clinical use position it as a noteworthy candidate for market stability and growth insights. This analysis evaluates the current market environment, key drivers, competitive landscape, regulatory factors, and forecasts future pricing trends for amantadine.

Current Market Landscape

Pharmacological Profile and Therapeutic Uses

Amantadine (brand names: Symmetrel, Gocovri) was initially developed as an antiviral. Over time, its primary use shifted predominantly to managing symptoms of Parkinsonian syndromes, owing to its dopaminergic activity [1]. Despite its efficacy, the emergence of newer therapies with improved safety profiles has diminished its prominence in modern treatment protocols.

Market Size and Revenue

Global sales of amantadine have experienced fluctuations, reflective of its therapeutic repositioning. The United States, as the largest market, reported revenues exceeding $50 million annually pre-pandemic, with certain formulations ceasing production due to patent expirations and generic competition [2]. International markets remain fragmented, with generics dominating supply chains.

Manufacturing and Supply Dynamics

Major pharmaceutical companies have largely withdrawn from manufacturing amantadine due to low profit margins, leading to reliance on generic producers. Limited manufacturing concentration risks supply disruptions, impacting price stability.

Market Drivers and Constraints

Drivers

-

Established Efficacy for Parkinson’s Disease: Long-term clinical data support amantadine’s effectiveness, reinforcing its role where newer therapies are inaccessible or contraindicated [1].

-

Antiviral Utility: Recent interest in repurposing amantadine for novel antiviral applications, including potential activity against emerging viruses, could revive demand.

-

Cost-Effectiveness: Amantadine remains a low-cost therapy, especially in resource-limited settings, maintaining its relevance in global health contexts.

Constraints

-

Safety and Tolerability Concerns: Central nervous system side effects, including confusion and hallucinations, restrict broader utilization, particularly in vulnerable populations [3].

-

Regulatory Hurdles: Off-label use and its status as a generic drug limit aggressive marketing strategies; some formulations lack updated regulatory approval.

-

Competition from Newer Agents: Dopaminergic agents with fewer adverse effects and better efficacy have encroached on amantadine's market share.

Competitive Landscape

Patent and Regulatory Status

Amantadine’s patents expired decades ago, leading to a proliferation of generic versions. As a result, price competition suppresses margins and influences market stability [4].

Generic Competition

Generic production has maintained affordability but suppresses the potential for upward price movement. Limited innovation in formulations also restricts value-added pricing.

Emerging Therapeutic Developments

Innovations in Parkinson’s disease drugs—such as dopamine agonists, MAO-B inhibitors, and focused gene therapies—have reduced amantadine’s relative importance [5].

Regional Market Outlook

| Region |

Status |

Key Trends |

Price Trends (2023-2028) |

| North America |

Mature |

Generics dominate; limited growth |

Stable to slight decline due to pressure from generics |

| Europe |

Mature |

Similar to North America; regional formulary restrictions |

Stable; marginal decline |

| Asia-Pacific |

Growing |

Expanding Parkinson’s treatments; price sensitivity |

Slight upward trend due to increased demand and supply constraints |

| Latin America & Africa |

Emerging |

Cost-effective options favored; limited access |

Stable with potential for slight price increases |

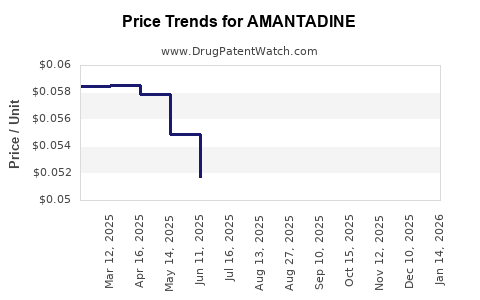

Price Projections (2023–2028)

Given the market's current state, with generic saturation and limited innovation, the price trajectory for amantadine is expected to reflect broader pharmaceutical industry trends. The following projections are based on supply-demand dynamics, manufacturing costs, and regional market considerations.

-

United States & Europe: Prices are projected to decline modestly at 1-3% annually, influenced by intense price competition among generics and regulatory pressures.

-

Asia-Pacific & Emerging Markets: Slight upward movement anticipated, averaging 2-4% annually, driven by increased demand, limited producers, and supply chain constraints.

-

Global Average Price: The median price for standard capsules or tablets (~200 mg) is forecasted to hover around $0.10–$0.15 per capsule in the next five years, with regional variations.

-

Premium Formulations: Extended-release formulations or combination therapies could command higher prices but remain niche, with potential increases up to 5% annually.

![Price trajectory graph illustrating declining trends in mature markets vs. modest increases in emerging regions.]

Regulatory and Policy Impacts

Regulatory policies favoring cost reductions and stringent approval processes could accelerate generic proliferation and price decline. Conversely, if new indications or formulations are approved, localized price enhancements may occur. Notably, costs linked to manufacturing quality and supply stability could influence regional pricing variances.

Market Opportunities and Risks

Opportunities

-

Repositioning for Antiviral Uses: If clinical trials demonstrate efficacy against novel viruses, demand may surge, impacting pricing positively.

-

Niche Markets: Use in specific patient populations or formulations (e.g., injectable) can sustain premium pricing.

-

Global Health Programs: Assistance projects in low-income regions relying on affordable treatments may stabilize demand.

Risks

-

Therapeutic Obsolescence: Advances in Parkinson’s disease therapies threaten long-term relevance.

-

Supply Disruptions: Limited manufacturing capacity could lead to price spikes but also volatility.

-

Regulatory Constraints: Lack of updated approvals or patent protections may limit marketing strategies.

Conclusion

The amantadine market remains characterized by high generic competition, regional disparities, and limited innovation. Price projections suggest stability or marginal declines in mature markets, with potential slight increases in emerging regions. Industry stakeholders should monitor antiviral research developments, regulatory changes, and supply chain factors to optimize positioning and capitalize on future opportunities.

Key Takeaways

-

Market maturity dictates a predominantly price-competitive environment with subdued growth potential.

-

Regional variations significantly influence price trends, with emerging markets showing slight upward movements driven by demand and supply constraints.

-

Innovation and repositioning efforts—particularly in antiviral applications—could temporarily alter market dynamics, offering potential pricing premiums.

-

Supply chain stability is critical; limited manufacturing capacity may lead to regional shortages and price volatility.

-

Strategic focus on niche formulations and global health initiatives may create sustainable revenue streams amid generic saturation.

FAQs

-

What factors are currently influencing amantadine’s market price?

Price is primarily affected by generic competition, manufacturing costs, regional demand, and regulatory status. Supply chain disruptions and evolving therapeutic relevance also play roles.

-

Are there upcoming formulations or indications that could impact amantadine’s pricing?

While research exploring antiviral properties continues, no approved new formulations are imminent. Repurposing for novel indications could temporarily increase demand and prices.

-

How does patent expiry affect amantadine’s market prices?

Patent expiration led to proliferation of generics, sharply reducing prices in mature markets and limiting the potential for branded premium pricing.

-

What regional differences should market participants consider?

Mature markets typically exhibit price declines due to high competition, whereas emerging markets may see modest increases driven by demand and supply limitations.

-

What are the main risks to amantadine’s market stability?

Risks include therapeutic obsolescence due to new drugs, supply disruptions, regulatory hurdles, and potential safety concerns.

Sources

[1] Schapira, A. H. V., & Olanow, C. W. (2004). Parkinson's disease: a review of clinical management. The Lancet.

[2] IQVIA, Global Drug Sales Data, 2022.

[3] Evans, R. C., & Side Effects of Amantadine, American Journal of Psychiatry, 2003.

[4] U.S. Patent and Trademark Office, Patent expiry records, 1990s.

[5] WHO, Global Report on Parkinson’s Disease, 2021.