Last updated: July 27, 2025

rket Analysis and Price Projections for Alcohol

Introduction

Alcohol, primarily ethanol, is among the most widely consumed psychoactive substances globally, serving both recreational and industrial purposes. Its extensive market footprint encompasses beverage consumption, cosmetics, pharmaceuticals, and industrial applications. Analyzing the market landscape and projecting future pricing trends necessitate understanding regional consumption patterns, regulatory frameworks, manufacturing costs, and socio-economic influences integral to alcohol’s supply chain.

Global Market Overview

The global alcohol market is segmented into several categories—beverage alcohol (spirits, wine, beer), industrial alcohol (solvents, biofuels), and pharmaceutical-grade ethanol. The beverage segment dominates, driven by consumer preferences and cultural factors, with the beverage alcohol market alone valued at approximately USD 1.3 trillion in 2022, expanding at a CAGR of around 3% (Statista, 2023). Industrial alcohol production, valued at roughly USD 70 billion, primarily used in biofuel and cosmetic sectors, exhibits significant growth driven by sustainability initiatives.

Market Drivers and Trends

- Lifestyle and cultural shifts: Rising urbanization and disposable incomes in emerging markets fuel alcohol consumption, particularly spirits and premium beverages.

- Regulatory landscape: Stringent regulations, especially in high-income markets, impact production and pricing. Restrictions on sales, taxation, and production licensing influence market dynamics.

- Health and wellness: Increased awareness around alcohol’s health impacts leads to regulatory restrictions and a surge in non-alcoholic alcoholic beverages, subtly shifting market compositions.

- Industrial applications: The push for bio-ethanol as a renewable energy source supports industrial alcohol demand, with global biofuel policies, notably in Brazil and the US, further propelling growth.

Regional Market Dynamics

- North America: Mature market with high consumption, driven by a strong craft spirits segment and regulatory complexities. Prices tend to be stable but can be influenced by tax policies.

- Europe: Known for premium wines and spirits, Europe's alcohol market is heavily regulated, with premium pricing strategies. However, organic and craft segments command higher premiums.

- Asia-Pacific: The fastest-growing market, with booming demand in China, India, and Southeast Asia. Consumption patterns are shifting from traditional spirits to urbanized, Western-style beverages. Industrial alcohol demand also surges, especially for biofuels in India.

- Latin America: Growing middle class and cultural affinity for spirits like tequila and cachaça bolster domestic production and exports.

Pricing Factors

The price of alcohol hinges on numerous variables:

- Raw Material Costs: Ethanol is primarily derived from crops such as corn, sugarcane, and grain. Fluctuations in raw material prices—due to weather, crop yields, or commodity markets—directly impact alcohol prices.

- Production and Distribution Costs: Regulatory compliance, safety standards, and transportation infrastructure inflate manufacturing expenses. Industrial alcohol may benefit from economies of scale, reducing unit costs.

- Taxation and Regulatory Policies: Alcohol taxes vary substantially across jurisdictions—a key determinant of final consumer prices. For example, in the US, excise taxes on distilled spirits average USD 13.50 per proof gallon, influencing retail prices.

- Demand and Supply Dynamics: Seasonal fluctuations, festivals, or policy changes (e.g., sales bans) create price volatility. Industrial alcohol prices often move in tandem with crude oil and energy costs.

- Market Speculation and Investment: Increased institutional investment in ethanol futures and commodity markets can induce short-term price swings.

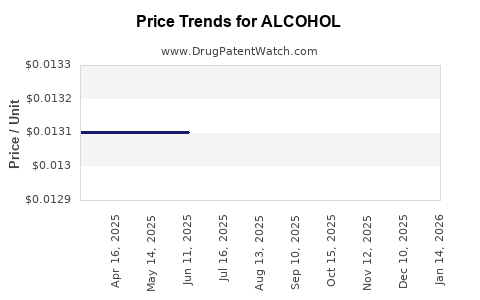

Historical Price Trends and Projections

- Beverage Alcohol: Consumer beverage prices have exhibited moderate annual increases aligned with inflation, tax hikes, and premiumization trends. For instance, US retail prices for distilled spirits have risen approximately 2-4% annually over the past decade. Future price projections suggest a continued trend of gradual increase, especially for premium brands, driven by inflation and inflation-adjusted taxes.

- Industrial Alcohol (Ethanol): Prices have been highly volatile, heavily influenced by biofuel policies and crude oil prices. The ethanol price in the US averaged around USD 2.20 per gallon in 2022, with projections indicating a range of USD 2.00 to USD 2.50 per gallon over the next five years, subject to energy market fluctuations. Rising demand for bio-ethanol as a renewable fuel is likely to sustain upward pressure.

Regulatory and Policy Impact on Pricing

Taxation policies remain the most potent influencer of alcohol pricing, with specifics varying from country to country. Increasing excise taxes, as seen in European countries like France and Germany, directly elevate retail prices, discouraging excessive consumption but generating government revenue. Conversely, subsidies or tax incentives for bioethanol production in regions like the US and Brazil could stabilize or lower industrial ethanol prices, fostering broader adoption.

Market Challenges and Risks

- Regulatory Uncertainty: Changing legal frameworks, especially concerning alcohol taxation and industrial standards, can introduce volatility.

- Environmental Policies: Restrictions on crop cultivation for ethanol production, due to environmental concerns, could constrain supply and influence prices.

- Health and Social Enforcement: Stricter alcohol control policies may limit market growth, impacting prices indirectly.

- Commodity Market Fluctuations: Weather events, geopolitical tensions, and trade disputes that affect raw material and energy costs introduce price surges.

Conclusion and Future Outlook

The global alcohol market exhibits steady growth, with beverage alcohol leading in market value and industrial alcohol witnessing acceleration driven by renewable energy policies. Price projections point towards modest increases in beverage alcohol prices, primarily influenced by taxation and premiumization trends, while industrial ethanol prices are expected to remain volatile but generally upward due to biofuel demand. Market players should monitor regulatory evolutions and raw material markets closely to navigate risks and capitalize on emerging opportunities.

Key Takeaways

- Regulatory Landscape Dominates Pricing: Taxation and legal restrictions substantially influence alcohol prices across regions.

- Premiumization Drives Prices: Consumers' shift toward high-quality, craft, and organic beverages sustains price rises.

- Industrial Ethanol's Volatility: Biofuel policies and energy markets create unpredictable fluctuations, requiring strategic sourcing and risk management.

- Emerging Markets Offer Growth: Asia-Pacific's accelerating consumption presents significant upside but also price variability.

- Sustainability and Regulations Shape Future Market: Environmental policies and crop resource management will be critical in pricing dynamics, especially in bioethanol sectors.

FAQs

1. How do government taxes impact alcohol prices globally?

Government taxes are the most significant factor affecting retail alcohol prices. Higher excise taxes increase consumer prices, potentially reducing consumption and generating revenue. Tax rates vary widely; for example, the US imposes an average of USD 13.50 per proof gallon on spirits, while EU countries have their own structures.

2. What is the future outlook for industrial ethanol prices?

Industrial ethanol prices are projected to remain volatile but tend to trend upward due to increasing biofuel demand driven by environmental policies and rising energy costs. Anticipated ranges are USD 2.00–2.50 per gallon over the next five years, influenced by crude oil prices and crop yields.

3. How do raw material costs influence beverage alcohol prices?

Raw materials like sugarcane, corn, and grains directly impact production costs. Fluctuations from weather, crop yields, or commodity markets translate into price variability for alcoholic beverages. This influence is prominent in spirits and wine markets where raw material quality and availability are critical.

4. Are emerging markets expected to drive future alcohol market growth?

Yes. The Asia-Pacific region, especially China and India, exhibits rapid growth in alcohol consumption, supported by urbanization, rising incomes, and changing lifestyles. While growth offers price premiums, market entry risks include regulatory and supply chain challenges.

5. What risks threaten stable alcohol pricing?

Regulatory shifts, such as increased taxation or restrictions, market speculation, commodity price volatility, environmental policies affecting crop production, and geopolitical tensions collectively threaten price stability and market predictability.

Sources

- Statista. (2023). Global Alcohol Market Size and Forecast.

- US Alcohol and Tobacco Tax and Trade Bureau. (2022). Excise Tax Rates.

- International Trade Centre. (2022). Alcoholic Beverages Market Profiles.

- Renewable Fuels Association. (2023). U.S. Ethanol Industry Data.

- Bloomberg Intelligence. (2023). Commodity and Energy Market Analysis.