Share This Page

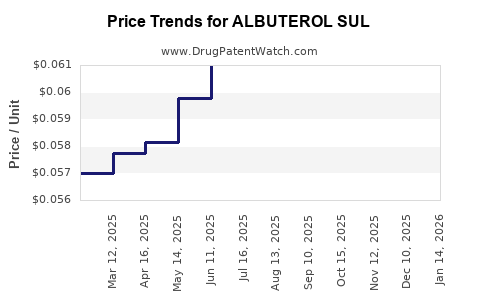

Drug Price Trends for ALBUTEROL SUL

✉ Email this page to a colleague

Average Pharmacy Cost for ALBUTEROL SUL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ALBUTEROL SUL 0.63 MG/3 ML SOL | 00487-0301-01 | 0.27505 | ML | 2025-12-17 |

| ALBUTEROL SUL 0.63 MG/3 ML SOL | 50742-0392-25 | 0.20859 | ML | 2025-12-17 |

| ALBUTEROL SUL 0.63 MG/3 ML SOL | 59651-0183-30 | 0.27505 | ML | 2025-12-17 |

| ALBUTEROL SUL 0.63 MG/3 ML SOL | 00591-3467-53 | 0.20859 | ML | 2025-12-17 |

| ALBUTEROL SUL 0.63 MG/3 ML SOL | 00378-7057-52 | 0.20859 | ML | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Albuterol Sulfate

Introduction

Albuterol sulfate, a beta-2 adrenergic agonist, serves as a frontline bronchodilator in the management of asthma, chronic obstructive pulmonary disease (COPD), and other respiratory conditions. As a generic medicine with established therapeutic efficacy, its market dynamics are shaped by regulatory, manufacturing, and demand factors. This report delves into current market conditions, competitive positioning, pricing trends, and future projections concerning Albuterol sulfate.

Market Landscape

Therapeutic Demand and Market Drivers

The global respiratory therapy market remains robust, driven by the persistent rise in asthma and COPD prevalence. According to the Global Initiative for Asthma (GINA), asthma affects over 300 million people worldwide, and COPD cases are projected to increase by over 5% annually, primarily in aging populations [1]. Consequently, demand for bronchodilators like Albuterol sulfate remains steady.

Furthermore, increased awareness about respiratory health, expanded healthcare access in developing countries, and the proliferation of combination inhalers contribute to sustained consumption. The COVID-19 pandemic underscored the importance of respiratory drugs, temporarily boosting demand, although some market segments experienced disruptions.

Regulatory and Patent Landscape

Albuterol sulfate’s patent expiration in the early 2000s facilitated the proliferation of generics worldwide—including U.S., European, and Asian markets—substantiating cost competitiveness. The absence of significant patent protections enables multiple manufacturers to produce and supply Albuterol sulfate, intensifying market competition.

Regulatory pathways, including abbreviated new drug applications (ANDAs) in the U.S. and equivalents globally, streamline the entry of generic versions, further amplifying supply.

Manufacturers and Competitive Dynamics

Major players include Teva Pharmaceutical Industries, Mylan (now part of Viatris), Sandoz, and Cipla. The commoditized nature of Albuterol sulfate means pricing is heavily influenced by manufacturing capacity, regulatory compliance, and distribution efficiencies rather than brand premiums.

Emerging manufacturers from India, China, and other emerging markets have established significant market share by offering lower-priced alternatives, especially in low- and middle-income regions.

Current Pricing Trends

Pricing in Key Markets

-

United States: The retail price for inhaled Albuterol sulfate (e.g., inhalers like Ventolin) has historically hovered around $30–$40 per inhaler for brand-name versions, but generics are frequently priced below $20, with some as low as $10 per inhaler, depending on the supplier and volume discounts [2].

-

Europe: Prices vary across countries but generally follow U.S. trends, with generics priced significantly lower than branded options.

-

Emerging Markets: Cost-effective generic versions dominate, with prices often less than $5 per inhaler or comparable units.

Price Trends and Drivers

Over the past five years, Albuterol sulfate prices have demonstrated a downward trajectory, reflecting increased generic competition, manufacturing efficiencies, and regulatory pressures. Despite occasional supply chain disruptions due to the COVID-19 pandemic, prices stabilized by Q2 2022, with slight declines observed in volume-based pricing strategies.

Additionally, the shift toward inhaler device manufacturing innovations, such as prefilled inhalers and dry powder formulations, has created niche markets but has not significantly impacted core drug prices, since Albuterol sulfate is primarily supplied as active pharmaceutical ingredient (API) and generic inhalers.

Future Price Projections (2023-2030)

Assumptions and Market Drivers

-

Competitive Landscape: Continued proliferation of generics will exert continued pressure on prices. Patent protections are unlikely to reemerge for Albuterol sulfate, solidifying a predominantly commoditized market.

-

Regulatory Environment: Stricter quality standards, including USFDA and EMA regulations, may marginally increase manufacturing costs but will unlikely influence prices significantly due to high competition.

-

Global Demand: Rising respiratory disease burdens, especially in Asia-Pacific and Africa, will sustain high global consumption, though price sensitivity in low-income regions remains high.

-

Technological Improvements: Advances in inhaler delivery systems will probably have minimal direct impact on API prices but could influence end-user costs.

Price Outlook

-

Short-Term (2023-2025): Expect continued slight declines in API and inhaler prices, averaging 2–4% annually, driven by manufacturing efficiencies and market saturation.

-

Mid to Long-Term (2026-2030): Market saturation, combined with generic pricing pressures, suggests stabilization at lower price points. Prices for API could hover around $1–$2 per gram in major manufacturing hubs, and inhaler prices are projected to remain below $15 per unit globally.

Overall, the prices of Albuterol sulfate are expected to decline gradually, with some regional variations driven by regulatory and economic factors. Price stabilization is likely as supply-demand equilibrium is maintained.

Regulatory and Market Challenges

-

Quality and Safety Regulations: Stricter manufacturing standards may marginally elevate costs, but their impact on retail prices will be limited given competition.

-

Supply Chain Disruptions: Recent global supply chain issues may temporarily inflate costs, but these effects are anticipated to be transitory.

-

New Delivery Modalities: The advent of combination therapies and novel inhaler technologies could influence downstream pricing but are less impactful on API costs.

Key Market Opportunities and Risks

Opportunities:

- Expansion into emerging markets with high respiratory disease burdens.

- Development of more cost-efficient manufacturing processes.

- Strategic partnerships for distribution in underserved regions.

Risks:

- Price erosion due to aggressive generic competition.

- Regulatory delays or compliance issues.

- Supply chain disruptions, particularly for raw materials.

Conclusion

Albuterol sulfate remains a cornerstone in respiratory therapy globally, characterized by steady demand and highly competitive pricing. Price trends point towards a gradual decrease in API and inhaler costs, guided by intense generic competition and technological standardization. Potential growth in emerging markets and ongoing demand reinforcement present upside opportunities, while market saturation and regulatory pressures reinforce downward price trajectories.

Key Takeaways

- The global Albuterol sulfate market is driven by high respiratory disease prevalence and widespread adoption of generic formulations.

- Price erosion is ongoing, with APIs in major manufacturing regions expected to stabilize around $1–$2 per gram by 2030.

- Competitive dynamics favor low-cost producers, especially from emerging markets, maintaining affordability.

- Regulatory compliance and supply chain stability are critical factors influencing market pricing.

- Opportunities exist in expanding access in developing regions, but intense competition constrains pricing flexibility.

FAQs

1. How has the patent expiration of Albuterol sulfate influenced its market price?

Patent expiration allowed multiple generic manufacturers to enter the market, significantly increasing supply and driving down prices, making Albuterol sulfate widely accessible and affordable globally.

2. What factors could lead to a price increase for Albuterol sulfate?

Regulatory compliance costs, supply chain disruptions, or the emergence of patented delivery technologies could temporarily increase prices; however, sustained increases are unlikely due to market saturation.

3. How does regional regulation impact Albuterol sulfate pricing?

Regions with stringent regulations may incur higher manufacturing costs, slightly elevating prices; however, local market competition often offsets these effects.

4. What role do technological innovations play in the future pricing of Albuterol sulfate?

While advancements in inhaler delivery systems influence end-user costs and adherence, they have minimal impact on API prices but can open opportunities for premium formulations.

5. Is there potential for brand-name Albuterol products to regain market share?

Given the dominance of generics and the commoditized nature of Albuterol sulfate, brand-name products are unlikely to regain significant market share unless differentiated through novel formulations or delivery mechanisms.

Sources:

[1] Global Initiative for Asthma (GINA). "Global strategy for asthma management and prevention." 2022.

[2] IQVIA. "National Drug Data Report," 2022.

More… ↓