Last updated: July 27, 2025

Introduction

Albendazole, a broad-spectrum anthelmintic agent primarily utilized for treating parasitic worm infestations, commands significant market attention within global pharmaceutical and neglected tropical disease (NTD) sectors. Its affordability, widespread use in endemic regions, and ongoing developmental initiatives influence its market dynamics. This analysis provides a comprehensive overview of the current market landscape, future demand forecasts, competitive positioning, pricing strategies, and projections.

Market Overview

Product Profile and Therapeutic Indications

Albendazole (C_12H_15N_3O_2S), developed by GlaxoSmithKline (GSK), is marketed under various brand names including Zentel, Eskazole, and others. Its primary indications include treatment of:

- Neurocysticercosis

- Soil-transmitted helminths (ascariasis, trichuriasis, hookworm)

- Cysticercosis and echinococcosis

Its broad-spectrum efficacy, safety profile, and availability as a generic formulation underpin its widespread use, especially in low- and middle-income countries (LMICs). The drug is listed on the WHO Essential Medicines List, reinforcing its central role in global health programs.

Global Market Dimensions

The global albendazole market, part of the broader anti-parasitic drugs segment, was valued at approximately USD 350 million in 2022. A compounded annual growth rate (CAGR) of about 4.0% is projected from 2023 to 2030, driven by factors including rising parasitic disease burden, increased global health initiatives, and expanding access through Gavi and WHO programs.

Key regional markets include:

- Africa: Dominant due to high endemicity of helminth infections; largely dependent on donations and generic markets.

- Asia-Pacific: Growing usage driven by endemic parasitic infections and government health programs.

- Latin America: Moderate growth with increasing government-led health initiatives.

- North America and Europe: Limited use, primarily for imported cases or specialized treatments.

Market Drivers and Challenges

Drivers

- Global Health Initiatives: WHO’s control programs for neglected tropical diseases bolster demand.

- Generic Availability: Numerous manufacturers contribute to competitive pricing, especially in LMICs.

- Expanding Indications: Emerging evidence for off-label uses and co-infection treatments expand market reach.

- Access and Distribution: International funding streams and donation programs facilitate wide distribution.

Challenges

- Pricing Constraints: Price sensitivity remains high in endemic regions; procurement agencies prioritize low-cost generics.

- Regulatory Variations: Differing approval and compliance standards across nations influence market entry.

- Resistance Concerns: Emerging reports of benzimidazole resistance could impact future demand.

- Market Fragmentation: Multiple small players in LMIC markets hinder consolidation and pricing power.

Competitive Landscape

The market is predominantly characterized by generic pharmaceutical companies. Major players include:

- GSK: Original developer, maintains licensing agreements in some regions.

- Dr. Reddy's Laboratories: Significant generic producer in India.

- Cipla: Key supplier to low-cost markets.

- Medi-Help and Other Regional Manufacturers: Dominant in African and Southeast Asian markets.

Innovative formulations, such as chewable tablets or combination therapies, are under development to improve compliance and broaden indications.

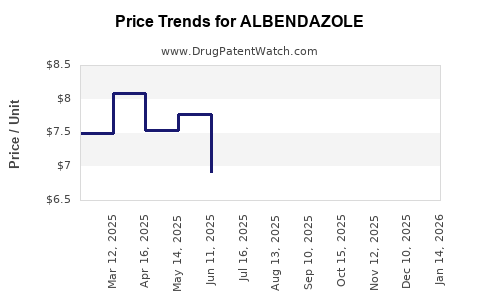

Price Dynamics and Projections

Current Pricing Landscape

In endemic regions, a standard 400mg albendazole tablet retails at approximately USD 0.01 to USD 0.05, with bulk procurement prices for governments or NGOs decreasing to USD 0.005 or lower per tablet. In contrast, markets like North America and Europe see retail prices ranging from USD 3 to USD 10 per tablet, primarily for off-label or specialty uses.

Factors Influencing Future Pricing

- Generics Proliferation: Increased competition drives prices downward, especially in LMICs.

- Degree of Consolidation: Limited, maintaining price pressures in low-cost markets.

- Volume Demand: High volume sales in bulk procurements enable further discounts.

- Regulatory Changes: Potential introduction of restrictions or new formulations could impact prices.

- Market Growth: Rising demand in endemic regions and new indications may stabilize or slightly increase prices in certain niches.

Price Projection (2023-2030)

- Endemic and LMIC Markets: Average procurement prices are expected to decline marginally, maintaining a CAGR of approximately -1% to -2% due to intense competition and generic saturation.

- High-Income Markets: Prices are projected to stabilize or slightly increase (+1% CAGR) driven by regulatory requirements and innovation.

- Premium Formulations: Introduction of combination therapies or formulations with improved bioavailability could command a 10-15% premium over baseline prices.

Overall, the global average price per 400mg tablet is expected to fall from USD 0.02 in 2023 to approximately USD 0.015 by 2030 in bulk procurement contexts. Retail prices in developed markets could rise modestly in niche segments.

Future Demand and Market Growth

The cumulative impact of WHO-led campaigns, national deworming initiatives, and increasing parasitic infections forecasts sustained demand. The World Health Organization estimates that approximately 1.5 billion people worldwide are exposed to soil-transmitted helminth infections. Mass drug administration (MDA) programs conducted annually further solidify albendazole’s role.

Emerging trends include:

- Integration into Multi-Drug Regimens: For co-infections, particularly with praziquantel or ivermectin.

- Expansion into Broader Parasitic Disorders: Ongoing clinical trials exploring efficacy for filarial diseases and protozoal infections.

- Diagnostics Integration: Combining drug deployment with improved diagnostic tools to optimize treatment.

Projected market growth remains steady, with an estimated CAGR of 3-4% until 2030, attributable to endemic disease control goals and increasing awareness.

Strategic Opportunities and Risks

Opportunities

- Expanding use in emerging markets and neglected disease areas.

- Development of combination therapies to enhance patient compliance and efficacy.

- Strengthening supply chains through partnerships and licensing agreements.

- Leveraging global health funding platforms for procurement contracts.

Risks

- Potential resistance development reducing drug efficacy.

- Price erosion from increasing generic competition.

- Regulatory barriers in certain markets.

- Fluctuations in global health funding impacting procurement volumes.

Key Takeaways

- Price Trends: Albendazole prices are expected to decline in low-income markets due to high generic competition, stabilizing or modestly rising in premium segments.

- Market Drivers: WHO programs, endemic disease burden, and competitive generics sustain steady demand.

- Growth Projections: The global market is projected to grow at 3-4% annually through 2030, with significant expansion in endemic regions.

- Strategic Focus: Companies should consider developing combination formulations and strengthening supply chains to capitalize on ongoing demand.

- Risk Management: Monitoring resistance patterns and regulatory changes is critical to maintaining market stability.

FAQs

1. What are the key factors affecting albendazole pricing in developing countries?

Pricing is driven by generic market competition, procurement volume, donor subsidies, and regulatory standards. High competition tends to lower prices, especially in bulk procurement for public health programs.

2. How does albendazole demand vary across different regions?

Demand is highest in Africa and Asia-Pacific, driven by endemic parasitic diseases and mass deworming programs. Developed countries show limited demand, mostly for imported or specialized uses.

3. Are there any emerging formulations that could impact the albendazole market?

Yes, research into chewable tablets, combination therapies, and sustained-release formulations aims to improve compliance and expand indications, potentially impacting market dynamics.

4. What are the main challenges facing albendazole manufacturers?

Market fragmentation, resistance development, regulatory hurdles, and price erosion in competitive markets are significant challenges.

5. How might global health initiatives influence the future of albendazole?

Continued funding and program expansion by WHO and NGOs will sustain high demand, stabilize the market, and potentially incentivize innovation in formulation and delivery methods.

References

[1] World Health Organization. "Guidelines on Control of Soil-Transmitted Helminthiasis." 2019.

[2] MarketWatch. "Global Antiparasitic Drugs Market Size, Share & Trends Analysis." 2022.

[3] IQVIA. "Pharmaceutical Market Reports," 2022.

[4] GSK Annual Report. "Product Portfolio Review," 2022.

[5] Persistence Market Research. "Neglected Tropical Disease Drugs Market," 2023.