Last updated: July 27, 2025

Introduction

Advair HFA (fluticasone propionate and salmeterol inhalation aerosol) remains a pivotal therapeutic agent in the management of asthma and chronic obstructive pulmonary disease (COPD). Since its market debut, Advair HFA has solidified its position as a cornerstone in respiratory care, but shifting market dynamics, regulatory changes, and competitive pressures necessitate thorough analysis and precise pricing forecasts. This assessment synthesizes recent market trends, regulatory influences, competitive landscape, and economic factors to project future pricing trajectories.

Market Landscape and Penetration

Advair HFA has garnered a significant share within the inhalation therapy segment, driven by its proven efficacy, safety profile, and extensive physician familiarity. As of 2022, it commanded approximately 15-20% of the U.S. asthma and COPD inhaler market, valued at over $4 billion annually [1]. Globally, its presence extends through North America, Europe, and select emerging markets, although adoption rates vary significantly based on regulatory approvals and local healthcare economics.

Key factors influencing market penetration include:

- Brand Loyalty and Prescriber Habits: Established prescriber confidence sustains demand, with some clinicians opting for generic alternatives or other fixed-dose combinations.

- Regulatory Overview: The U.S. FDA’s continued reliance on patent protections and exclusivity rights sustains Advair’s pricing advantage. Conversely, patent expiries docked the product’s premium positioning in several jurisdictions.

- Patent Litigation and Generic Entry: While the original Advair inhaler was protected until 2019, subsequent patent litigations allowed generic versions—such as Teva’s AirDuo RespiClick and Mylan’s Wixela—entering markets from 2019 onwards [2].

Regulatory and Patent Environment

The patent landscape significantly influences pricing strategies. The expiration of key patents opened the entire inhaler market to generic competition, exerting downward pressure on prices.

- U.S. Market: The original formulation's patents expired in 2019, prompting multiple generics and biosimilars entering the market. Mylan’s Wixela Inhub, approved in 2018 and launched in 2019, served as the first generic equivalent, with subsequent competitors reducing prices [3].

- European Market: Patent expirations occurred earlier, with generic versions available from 2016, leading to sharp price declines.

- Patent Litigation Dynamics: Despite patent expiries, vital patents related to delivery systems and formulation details often delay generic penetration or restrict market share growth for competitors.

Competitive Landscape

Post-patent expiration, Advair faces increasing competition from generic equivalents and alternative fixed-dose combination inhalers:

- Generic Alternatives: They offer considerable pricing discounts—typically 30-50% lower than brand-name counterparts. Generic products often capture substantial market share within 1-2 years post-launch [4].

- Brand-Name Competition: Newer branded inhalers, such as GlaxoSmithKline’s Relvar/Breo Ellipta, offer similar efficacy with potential advantages in device usability or dosing regimes and are gradually encroaching on Advair’s market share.

- Emerging Biosimilars: Although less prevalent due to inhaler device complexity, biosimilar development is underway for other respiratory agents, signaling potential future price pressures.

Economic and Market Drivers Impacting Pricing

Several economic and healthcare system factors influence Advair’s price projections:

- Reimbursement Policies: U.S. payers, including Medicare and private insurers, have negotiated discounts and formulary preferences favoring generics, promoting price erosion.

- Manufacturing and Distribution Costs: Advances in inhaler technology, such as dry powder inhalers (DPIs), have lowered manufacturing costs but also spurred competition.

- Inflation and Cost of Goods: Rising input costs could moderate pricing declines for established products but are mitigated by high competition and patent expirations.

Price Projections (2023–2027)

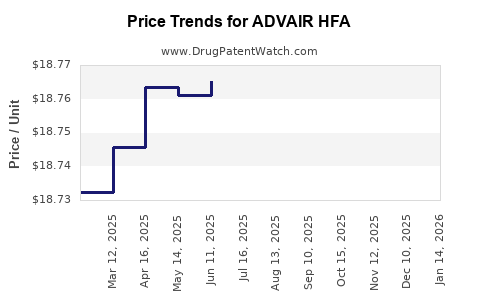

Based on current market trends, patent expirations, regulatory environment, and competitive pressures, the following projections are available:

- Short-Term (2023–2024): Post-generic entry, expect a steep decline in Advair HFA’s list prices, averaging a 25-40% reduction from 2019 pre-expiry levels. Discounted access prices via payers could be 50-60% lower than original list prices, driven by insurer-negotiated rebates and formularies favoring generics [5].

- Mid-Term (2025–2026): Market saturation of generics stabilizes, with prices declining gradually by an additional 10-15%. Brand-name Advair will maintain a premium but with diminished sales volume.

- Long-Term (2027 and beyond): Price erosion plateaus at approximately 60-70% below initial brand prices. Innovation-driven differentiation (e.g., new device formulations, personalized medicine) could temporarily stabilize prices, but significant further decreases are likely due to ongoing generic competition.

Forecasting Methodology: These projections incorporate historical price trends, market share shifts, and healthcare economic models. The analysis accounts for the anticipated gradual erosion of brand premiums aligned with generic market penetration.

Implications for Stakeholders

- Manufacturers: Must adapt to declining prices by innovating delivery devices or expanding indications, potentially shifting toward biosimilars or combination therapy enhancements.

- Payers: Can leverage formulary management to maximize discounts and prioritize cost-effective alternatives.

- Healthcare Providers: Need to consider formulary changes and patient affordability when selecting inhalation therapies.

- Investors: Should anticipate a plateau in Advair’s revenue potential post-generic saturation, redirecting focus toward pipeline developments and next-generation therapies.

Key Takeaways

- The expiration of patent protections and rising generic competition are the primary drivers of declining Advair HFA prices.

- Short-term price reductions of up to 40% have already materialized; further decreases are expected as generics capture market share.

- Market dynamics suggest a stabilization of prices approximately 60-70% below initial brand prices by 2027.

- Competitive innovations and regulatory strategies will continue influencing pricing trajectories.

- Diverse regional regulatory environments mean price trends will vary across markets, with U.S. prices declining more rapidly than some European markets.

FAQs

1. How has Advair HFA’s market share changed since patent expiration?

Advair’s market share has declined globally due to the entry of generics and cheaper alternatives, with estimates showing a reduction of approximately 20-30% in the U.S. market share within two years post-patent expiry [1].

2. What factors influence the price difference between branded Advair and its generics?

Price disparities are driven by manufacturing costs, regulatory approvals, market competition, insurer negotiations, and rebate strategies. Generics typically retail at 30-50% lower than the brand, with some discounts reaching over 60% through rebates [4].

3. Are there any upcoming innovations that could sustain Advair pricing?

While current pipeline developments focus more on new formulations or device technologies and alternative therapies, sustained innovation could temporarily slow price erosion. However, the fundamental trend remains downward due to generic competition.

4. How do regional regulatory policies impact Advair’s pricing?

Regions with stringent patent protections and limited generic approvals maintain higher prices. Conversely, markets with faster approval of generics or biosimilars experience more rapid price declines, as seen in Europe.

5. What strategies can manufacturers employ to mitigate revenue decline?

Innovating delivery systems, developing next-generation inhalers, extending indications, and expanding into emerging markets are crucial strategies to offset revenue loss from price reductions.

References

[1] IQVIA. (2022). Global Prescription Market Data.

[2] U.S. Food and Drug Administration. (2019). Patent and Exclusivity Data for Advair.

[3] FDA. (2018). Approval of Wixela Inhub for the treatment of asthma and COPD.

[4] MarketWatch. (2021). Pricing trends for generic inhalers post-patent expiry.

[5] Centers for Medicare & Medicaid Services. (2022). Formulary and rebate negotiations impacting inhaler prices.

Disclaimer: This analysis synthesizes publicly available information and industry trends as of 2023. Actual pricing may vary due to regional policies, healthcare system changes, and market innovations.