Last updated: December 17, 2025

Executive Summary

Estradiol, a pivotal hormone in hormone replacement therapy (HRT), contraceptives, and menopausal management, occupies a significant segment in the global pharmaceutical landscape. The market for estradiol is characterized by robust growth driven by aging populations, increasing prevalence of hormone-related disorders, and expanding indications in transgender health. Currently, the market is dominated by bioidentical and synthetic formulations, with key players including Pfizer, Novartis, and Teva.

Projected trends suggest an Compound Annual Growth Rate (CAGR) of approximately 4.2% from 2023 to 2030, with pricing dynamics influenced by patent statuses, biosimilar entry, manufacturing costs, and regulatory environments. This report provides an in-depth market segmentation, supply chain analysis, pricing strategies, and future outlook, equipping stakeholders with strategic insights for decision-making.

Market Overview

| Aspect |

Detail |

| Global Market Size (2022) |

Estimated at USD 1.2 billion |

| CAGR (2023–2030) |

~4.2% |

| Key Regions |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Major Applications |

Menopause management, contraceptives, transgender hormone therapy, osteoporosis, hypogonadism |

Market Drivers

- Increasing life expectancy and aging demographics

- Rising awareness and diagnosis of menopause-related conditions

- Growing acceptance of hormone therapy for transgender health

- Expansion in developing economies

- Innovations in delivery systems (patches, gels, implants)

Market Constraints

- Patent expirations leading to biosimilar competition

- Stringent regulatory requirements

- Pricing pressures from healthcare payers

- Concerns over safety and side effects

Market Segmentation

By Formulation

| Segment |

Market Share (2022) |

Growth Drivers |

| Oral tablets |

45% |

Ease of administration |

| Transdermal patches |

30% |

Improved bioavailability, reduced first-pass metabolism |

| Gels & creams |

15% |

Local application benefits |

| Implants & injectables |

10% |

Long-lasting effect, specific patient needs |

By Application

| Application |

Market Share (2022) |

Key Trends |

| Menopause symptom management |

55% |

Dominant therapy segment |

| Contraception |

15% |

Growing in contraceptive markets |

| Transgender health |

10% |

Increasing acceptance and advocacy |

| Osteoporosis & hypogonadism |

20% |

Steady growth aligned with aging populations |

By Geography

| Region |

Market Share (2022) |

Expected Growth (2023–2030) |

| North America |

40% |

4.0% CAGR |

| Europe |

25% |

4.3% CAGR |

| Asia Pacific |

20% |

5.0% CAGR |

| Latin America & MEA |

15% |

4.5% CAGR |

Competitive Landscape

Major Industry Players

| Company |

Key Products |

Market Share (Estimated) |

Strategic Focus |

| Pfizer |

Estrace, Vivelle-Dot |

~25% |

Biosimilar expansion |

| Novartis |

Divigel, Gynodiol |

~15% |

Innovative delivery systems |

| Teva |

Estradiol patches |

~10% |

Cost competitiveness |

| Others |

Multiple generics & biosimilars |

~50% |

Price competition & regional expansion |

Recent Developments

- Launches of novel transdermal patches with enhanced absorption

- Entries into emerging markets through partnerships

- Patent cliffs leading to increased biosimilar activity

- Regulatory approvals for new indications

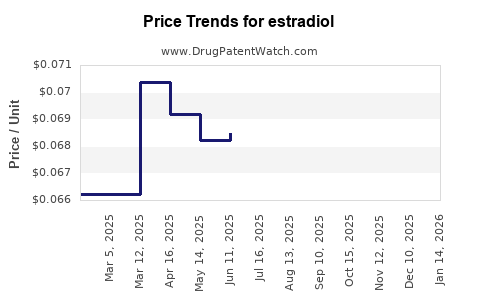

Price Dynamics and Projections

Current Pricing Landscape

| Formulation |

Price Range (USD per unit) |

Notes |

| Oral tablets |

$0.15 – $0.50 per pill |

Generic dominance |

| Transdermal patches |

$10 – $25 per patch |

Brand vs generic |

| Gels & creams |

$15 – $40 per tube |

Local administration |

| Implants |

$300 – $600 per implant |

Long-term therapy |

Factors Influencing Prices

- Patent expiration timelines

- Entry of biosimilars and generics

- Manufacturing cost reductions, especially in biosimilars

- Regulatory changes impacting pricing authority

- Reimbursement policies

Future Price Projection (2023–2030)

| Year |

Expected Price Range (USD per unit) |

Notes |

| 2023 |

Stable, slight decrease |

Biosimilar market penetration intensifies |

| 2024 |

-5% to -10% |

Increased competition reduces prices |

| 2025 |

Further 5–8% decline |

Biosimilar volume growth |

| 2026–2030 |

Stabilization at ~10–15% lower |

Mature market with price equilibrium |

Impact of Biosimilars on Pricing

| Entry Year |

Biosimilar Share of Market |

Price Reduction Impact |

Key Examples |

| 2021 |

10% |

20–30% reduction |

Estradiol patches in Europe |

| 2023 |

25% |

30–40% reduction |

Biosimilars in North America |

Regulatory and Policy Outlook

| Region |

Regulatory Authority |

Recent Policy Developments |

Impact on Market |

| US |

FDA |

Approval pathways for biosimilars |

Accelerated approvals, competitive pricing |

| EU |

EMA |

Encouraging biosimilar adoption |

Lower prices, increased access |

| Asia |

CFDA, PMDA |

Fast-tracking hormonal therapies |

Market expansion, price competition |

Patent Status Timeline

| Patent Expiry Year |

Effect on Market |

Comments |

| 2022–2025 |

Increased biosimilar entry |

Intensifies competition |

| 2025+ |

Dominance of biosimilars |

Potential price stabilization |

Strategic Recommendations

- Monitor biosimilar developments and patent cliffs to anticipate price erosion.

- Focus on formulations with patent protections to maximize margins.

- Explore expanding indications, such as transgender health and osteoporosis.

- Invest in innovative delivery systems to differentiate products.

- Engage with policymakers to navigate reimbursement pathways.

Deep-Dive Comparison: Estradiol vs. Other Hormones

| Parameter |

Estradiol |

Estrone |

Conjugated Estrogens |

Key Differentiator |

| Primary use |

Menopause, HRT |

Postmenopausal HRT |

Menopause, HRT, Contraception |

Bioequivalence, safety profiles |

| Bioavailability |

High via transdermal |

Moderate |

Variable |

Delivery method-dependent |

| Price range |

$0.15–$0.50 per pill |

Similar |

Similar |

Patent status influences pricing |

FAQs

Q1: How will biosimilar entry influence estradiol pricing over the next decade?

A1: Biosimilar entry is expected to reduce prices by approximately 30–40%, particularly post-patent expiry (~2022–2025). This will enhance affordability but may pressure brand-name formulations' margins.

Q2: Which regions exhibit the highest growth potential for estradiol?

A2: Asia Pacific and Latin America demonstrate the highest CAGR (~5–6%) due to expanding healthcare infrastructure, rising awareness, and increasing adoption of hormone therapies.

Q3: What are the main regulatory hurdles for new estradiol formulations?

A3: Demonstrating safety, efficacy, and bioequivalence, especially for biosimilars, remains the primary challenge. Regulatory agencies increasingly require rigorous clinical data and post-market surveillance.

Q4: How is the patent cliff impacting market dynamics?

A4: Patent expirations are catalyzing biosimilar proliferation, leading to price declines and market share redistribution among incumbents and challengers.

Q5: What are emerging delivery formats for estradiol?

A5: Innovations include transdermal patches with microarray technology, gels with enhanced skin penetration, subcutaneous implants, and nasal sprays, aiming to optimize absorption and compliance.

Key Takeaways

- The global estradiol market is poised for steady growth, driven by demographic shifts and expanding therapeutic indications.

- Patent expirations and biosimilar introduction will significantly influence pricing strategies, leading to substantial price reductions in mature markets.

- Regional variations in growth rates necessitate tailored market entry and expansion strategies.

- Innovation in delivery systems offers differentiation opportunities amidst intense price competition.

- Stakeholders should closely monitor regulatory trends and patent timelines to optimize portfolio and pricing strategies.

References

[1] Market Research Future, Hormone Replacement Therapy Market Analysis, 2022.

[2] Statista, Global Hormone Therapy Market Size & Forecast, 2023.

[3] FDA, Biosimilar Approval Pathways, 2022.

[4] European Medicines Agency, Guideline on Biosimilar Medicines, 2021.

[5] Global Data, Pharmaceutical Price Forecasts, 2023.

Disclaimer: This analysis is for informational purposes and does not constitute investment advice. Market conditions may change rapidly; consult a professional before making strategic decisions.