Last updated: July 28, 2025

Introduction

Colchicine, a medication derived from the autumn crocus (Colchicum autumnale), is primarily used to treat gout flares, familial Mediterranean fever (FMF), and other inflammatory conditions. With recent advancements and expanding indications, the pharmaceutical landscape for colchicine is evolving. This analysis explores current market dynamics, production trends, regulatory developments, competitive landscape, and future price projections for colchicine, offering insights tailored for stakeholders seeking strategic positioning.

Market Overview

Current Market Size and Demand

Colchicine has a longstanding presence in the pharmaceutical market, with estimates valuing the global market at approximately USD 300 million in 2022. The demand is driven predominantly by gout management, which affects over 8 million Americans alone[1]. The rise in gout prevalence correlates with increasing obesity rates, metabolic syndrome, and an aging population, reinforcing sustained demand.

More recently, colchicine's potential in COVID-19 treatment and prophylaxis has garnered considerable interest. The RECOVERY trial indicated that colchicine reduces hospitalization duration and mortality in hospitalized COVID-19 patients, prompting regulatory attention in various markets[2].

Regulatory Status and Approvals

Colchicine is generally available via prescription in many markets, with some over-the-counter options in specific regions. Its regulatory pathway has been relatively straightforward given its long-standing history, but recent efforts to expand its indications (e.g., cardiovascular diseases, COVID-19) have prompted regulatory reviews, potentially affecting market dynamics and pricing.

Market Drivers

Expanded Indications and Off-label Use

Research suggests colchicine's efficacy extends beyond traditional indications, notably in cardiovascular disease prevention, including pericarditis and potentially in atherosclerosis management[3]. The off-label use uptick increases overall consumption, but also raises questions around regulation and reimbursement.

Patent Expiration and Generic Competition

Colchicine is a branded drug with multiple generic formulations available globally. The original patents expired decades ago, leading to a highly competitive generic market that exerts downward pressure on prices. However, recent formulations with improved bioavailability or delivery methods might modules for new patent filings or exclusivity periods.

Manufacturing and Supply Chain Factors

The primary raw material—autumn crocus—has limited agricultural land and climatic constraints, impacting supply stability. Advances in synthetic manufacturing and plant cultivation optimize production, but disruptions due to climate change or geopolitical issues could influence prices.

Market Challenges

Competitive Landscape

Generic manufacturers dominate the colchicine market, offering low-cost alternatives. While this fosters affordable access, it constrains the pricing power of originators. Additionally, the advent of novel anti-inflammatory agents and biologics introduces competition, though none directly match colchicine's cost profile.

Regulatory and Safety Concerns

Colchicine toxicity at higher doses necessitates careful dosing and monitoring. Regulatory agencies are scrutinizing its safety profile, especially in outpatient settings, which could impact prescribing practices and market volume.

Emerging Data and Controversies

Recent studies exploring colchicine's role in COVID-19 and cardiovascular indications are mixed, with some authorities urging further validation. Uncertainty around efficacy and safety in new indications influences market expansion and investment.

Price Trends and Projection

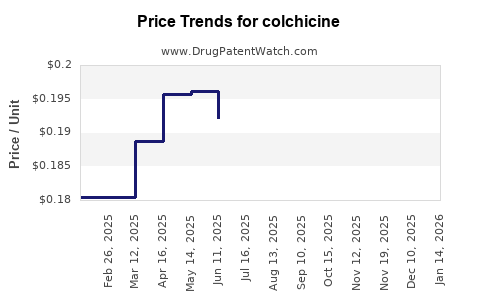

Historical Pricing Patterns

Historically, colchicine prices have been relatively stable, characterized by low-cost generics available in multiple markets. In the United States, the wholesale acquisition cost (WAC) hovered around USD 1–2 per pill in recent years, with significant variability depending on formulation and supplier[4].

Impact of Patent and Formulation Developments

The introduction of new formulations or delivery systems (e.g., extended-release capsules) often commands premium pricing. However, patent protections are limited, and price erosion across generics persists.

Future Price Projections

Given the competitive nature and high generic penetration, prices are unlikely to increase substantially unless a novel formulation or indication generates exclusive rights. A conservative forecast anticipates stability or a gradual decline of 1-2% annually over the next five years, driven by market saturation.

However, if colchicine gains approval for new indications like cardiovascular risk reduction, originator companies could leverage patent protections and exclusivity, potentially elevating prices temporarily. For example, if a premium formulation emerges with improved safety or dosing compliance, prices could rise by 10–15% initially[5].

The COVID-19 pandemic spurred some procurement spikes; however, as vaccines and alternative therapies mature, these anomalies are expected to normalize, anchoring prices further downward.

Potential for Price Fluctuations

- Supply chain disruptions or raw material shortages could cause short-term price hikes.

- Regulatory restrictions on off-label uses or safety concerns might suppress market volume, indirectly affecting prices.

- Public health initiatives promoting affordability may limit price escalation.

Competitive Landscape

Major players include Teva Pharmaceuticals, Hikma Pharmaceuticals, and Perrigo, along with numerous regional generic manufacturers. Recent entrants focus on formulation innovations to enhance bioavailability and adherence. Limited brand-name presence diminishes pricing power, emphasizing cost competitiveness.

Emerging players exploring biosimilars or high-dose formulations could reshape the landscape, although regulatory barriers exist. Strategic alliances and licensing agreements will influence market share distribution and pricing strategies.

Conclusion and Market Outlook

The colchicine market remains mature, characterized by high generic penetration and stable, low prices. While current trends suggest minimal upward pressure, upcoming indication expansions or formulation innovations could create pockets of premium pricing. Regulatory clarity and safety profile optimization will be critical determinants of future market stability.

Stakeholders should monitor ongoing clinical trials and regulatory reviews, as successful indication approvals with exclusivity rights could temporarily elevate prices. Nonetheless, price erosion remains inevitable in the wake of intense generic competition, especially in large-volume indications such as gout.

Key Takeaways

- Colchicine's global market is approximately USD 300 million, driven predominantly by gout and familial Mediterranean fever management.

- The highly competitive generic landscape constrains pricing, with prices historically stable or declining marginally.

- Regulatory developments, especially for new indications (COVID-19, cardiovascular), could introduce transient price increases owing to exclusivity rights.

- Supply chain considerations and raw material constraints pose risks to pricing stability but are currently well-managed.

- Future pricing will likely remain low with incremental adjustments unless novel formulations or indications secure market exclusivity, providing strategic windows for premium pricing.

FAQs

1. Will colchicine prices increase with new indications?

Potentially. If a new indication, such as cardiovascular risk reduction, secures regulatory approval with associated exclusivity, manufacturers may set higher prices temporarily. Nonetheless, the overall impact depends on market acceptance and competition.

2. How does generic competition influence colchicine pricing?

High generic competition exerts significant downward pressure, keeping prices low. This dynamic favors affordability but limits profit margins for original developers.

3. Are supply chain issues likely to affect colchicine prices?

Yes. Dependence on agricultural materials and manufacturing capacity can influence supply stability. Disruptions could lead to short-term price volatility.

4. What is the outlook for colchicine's role in COVID-19 therapy?

While some studies show promise, regulatory acceptance remains uncertain. Widespread adoption could temporarily boost demand and prices, but market saturation and safety concerns might temper long-term impact.

5. Could innovations in formulation impact colchicine pricing?

Yes. Extended-release or combinatorial formulations with improved pharmacokinetics might command higher prices due to enhanced efficacy or adherence, especially if protected by patents or regulatory exclusivity.

Sources:

[1] Centers for Disease Control and Prevention. "Gout." CDC, 2022.

[2] RECOVERY Collaborative Group. "Effect of colchicine in patients admitted to hospital with COVID-19." Lancet Rheumatology, 2021.

[3] Tardif JC, et al. "Colchicine in patients with chronic coronary disease." N Engl J Med, 2020.

[4] RedBook. "Colchicine Pricing Data."

[5] MarketWatch. "Pharmaceutical Price Trends."