Share This Page

Drug Price Trends for clarithromycin

✉ Email this page to a colleague

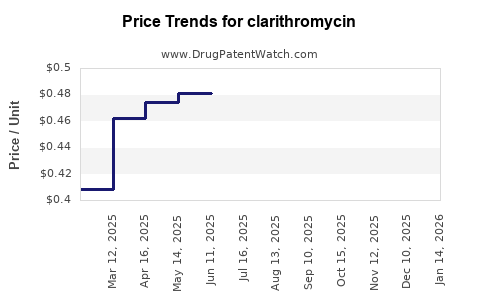

Average Pharmacy Cost for clarithromycin

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| CLARITHROMYCIN 250 MG TABLET | 62135-0616-60 | 0.41831 | EACH | 2025-11-19 |

| CLARITHROMYCIN 250 MG TABLET | 50268-0178-11 | 0.41831 | EACH | 2025-11-19 |

| CLARITHROMYCIN 250 MG TABLET | 57237-0044-60 | 0.41831 | EACH | 2025-11-19 |

| CLARITHROMYCIN 125 MG/5 ML SUS | 00781-6022-46 | 0.97474 | ML | 2025-11-19 |

| CLARITHROMYCIN 250 MG TABLET | 50268-0178-15 | 0.41831 | EACH | 2025-11-19 |

| CLARITHROMYCIN 250 MG TABLET | 00527-1931-06 | 0.41831 | EACH | 2025-11-19 |

| CLARITHROMYCIN 250 MG TABLET | 00781-1961-60 | 0.41831 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Clarithromycin

Introduction

Clarithromycin, a macrolide antibiotic, has maintained a significant position in infectious disease treatment since its approval in the late 1980s. Its broad-spectrum activity against respiratory tract infections, skin infections, and Helicobacter pylori-associated ulcers underscores its sustained clinical relevance. However, evolving antimicrobial resistance, shifting regulatory landscapes, and pharmaceutical market dynamics influence its market position and pricing. This report provides an in-depth analysis of the current market environment for clarithromycin, explores upcoming trends, and projects future prices with strategic insights for stakeholders.

Market Overview

Current Market Landscape

The global clarithromycin market has exhibited stable demand, driven by its established efficacy and formulary presence. Estimated to be valued at approximately USD 500 million in 2022, the market encompasses both branded formulations—such as Biaxin (AbbVie) and Klaricid (Abbott)—and generic equivalents (e.g., Teva, Mylan). The prevalence of respiratory infections and H. pylori treatments sustains year-round demand.

Regulatory and Patent Status

Clarithromycin’s original patents expired decades ago, inaugurating a broad pipeline of generic manufacturers. Nonetheless, certain formulations or combination therapies might still be under proprietary protection or subject to regulatory restrictions in specific regions. Regulatory agencies have maintained stringent standards for antimicrobial approvals, and recent concerns over antimicrobial resistance (AMR) influence prescribing patterns.

Drivers and Barriers

-

Drivers:

- Increasing incidence of respiratory infections globally.

- Growing prevalence of H. pylori infections in developing nations.

- Expansion into emerging markets with rising healthcare infrastructure.

-

Barriers:

- Rising antimicrobial resistance reducing efficacy.

- Stringent antimicrobial stewardship programs discouraging use.

- Competition from newer antibiotics with broader activity or fewer side effects.

Market Dynamics by Region

North America

The North American market remains mature, with brand loyalty still prevalent despite generic competition. The FDA's recent Black Box warnings for certain antibiotic classes have heightened prescribing caution. The trend towards antibiotic stewardship and resistance monitoring influences demand, potentially contracting the market slightly in the next five years.

Europe

European markets are similar to North America with established penetration. Enhanced regulatory oversight and national AMR action plans, especially in the UK, Germany, and France, may lead to decreased utilization, favoring targeted therapies over broad-spectrum antibiotics.

Emerging Markets

In Asia-Pacific, Latin America, and parts of Africa, markets are characterized by increasing volumes driven by rising infection rates and expanding healthcare access. Price-sensitive markets prefer generic clarithromycin, fostering intense price competition but also incentivizing local manufacturing.

Competitive Landscape

- Brand Manufacturers: Maintain a foothold through marketing, clinical data, and patient trust.

- Generics: Dominant in volume, pressuring prices downward.

- Combination Therapies: Growing popularity in H. pylori eradication regimens (e.g., clarithromycin with amoxicillin and proton pump inhibitors) influence demand dynamics.

Price Trends and Projections

Historical Pricing

Between 2018 and 2022, the average wholesale price (AWP) of generic clarithromycin declined by approximately 25%, from USD 2.50 to USD 1.88 per 250 mg tablet. Brand-name products maintained higher price points, averaging USD 5.00 per tablet.

Forecasted Price Movements (2023–2028)

-

Short-term (1–2 years): Expectations of marginal price stabilization due to existing generic competition, with potential for transient price drops amid increased market saturation.

-

Mid-term (3–5 years): Projected gradual price decline—estimated at 10-15%—driven by increased generic manufacturing, procurement efficiencies, and price erosion. Regulatory measures targeting antimicrobial stewardship might further suppress volumes, indirectly impacting unit prices.

-

Long-term (beyond 5 years): Possible price stabilization or slight increases contingent on regulatory changes, resistance patterns, and shifts to newer, more effective therapies altering demand.

Factors Influencing Pricing

- Supply Chain: Entry of low-cost generic manufacturers in emerging markets may further reduce prices.

- Resistance Patterns: Rising resistance may demand combination therapies or alternative antibiotics, decreasing clarithromycin's relative use.

- Regulatory Policies: Restrictions on antibiotic prescribing, labeling requirements, and antimicrobial stewardship initiatives will influence demand and pricing.

- Patent and Formulation Innovations: Should new formulations (e.g., extended-release) or novel delivery mechanisms emerge, they could command premium prices temporarily.

Future Market Trends

- Antimicrobial Resistance (AMR) Impact: Increased resistance, notably in H. pylori and respiratory pathogens, diminishes clinical utility, constraining growth and exerting downward pressure on prices.

- Shift Toward Precision Medicine: Diagnostic tools enabling targeted therapy reduce unnecessary antibiotic use, impacting volume but not necessarily unit prices.

- Policy and Stewardship Programs: Governments and health systems emphasizing stewardship may restrict prescribing, marginally reducing market volume.

- Emergence of Novel Agents: Newer antibiotics with superior efficacy or fewer resistance issues could erode clarithromycin's market share over time.

Strategic Implications for Stakeholders

- Pharmaceutical Companies: For branded products, focus on clinical differentiation and patient compliance. For generics, optimize manufacturing and supply chain efficiencies.

- Investors: Recognize mature markets' saturation and resistance patterns shaping long-term outlooks. Diversify portfolios to include innovative antibiotics addressing resistance.

- Healthcare Providers: Embrace stewardship guidelines to balance treatment efficacy with resistance mitigation while monitoring evolving resistance patterns.

Key Takeaways

- The clarithromycin market remains sizable but is under pressure from antimicrobial resistance, stewardship initiatives, and aggressive generic competition.

- Price projections indicate modest declines over the next five years, primarily driven by increased generics and market saturation.

- Emerging markets offer growth opportunities driven by rising infection burdens but face price sensitivity challenges.

- The evolving regulatory landscape and resistance concerns necessitate agile strategies and ongoing market surveillance.

- Stakeholders should prioritize differentiation, cost optimization, and adherence to stewardship practices to navigate future market conditions effectively.

FAQs

1. How is antimicrobial resistance impacting clarithromycin’s market?

Rising resistance, especially in H. pylori and respiratory pathogens, reduces clarithromycin’s clinical efficacy, leading to decreased prescribing and, consequently, a potential decline in market volume and prices.

2. Are there any new formulations or combination therapies affecting the clarithromycin market?

Yes, combination therapies for H. pylori eradication, including clarithromycin with proton pump inhibitors and amoxicillin, sustain demand. However, newer triple or quadruple therapies with alternative antibiotics are emerging as resistance spreads.

3. What are the key regional differences influencing clarithromycin pricing?

Advanced markets enforce strict antimicrobial stewardship, contributing to pricing pressures, whereas emerging markets favor generics, leading to lower prices but higher volumes.

4. Do patent protections still influence clarithromycin’s pricing?

Most patents have expired, leading to widespread generic manufacturing; however, certain formulations or combination medicines could be under proprietary protection, temporarily impacting pricing strategies.

5. What are the long-term prospects for clarithromycin’s market share?

Long-term, the market may decline due to resistance and the advent of newer antibiotics. Nonetheless, clarithromycin will retain niche roles, especially where cost constraints favor older, proven therapies.

Sources

[1] Market research reports and industry publications (e.g., IQVIA, EvaluatePharma)

[2] FDA and EMA regulatory documents on antimicrobial approvals and resistance measures

[3] WHO reports on antimicrobial resistance and global health trends

[4] Recent peer-reviewed studies on clarithromycin use, efficacy, and resistance patterns

More… ↓