Last updated: July 28, 2025

Introduction

Calcipotriene, also known as calcipotriol, is a synthetic vitamin D3 analog primarily used for treating psoriasis vulgaris. Its efficacy in managing psoriatic lesions has positioned it as a cornerstone in dermatology. As the pharmaceutical landscape evolves, understanding Calcipotriene’s market dynamics, competitive positioning, and future pricing trends is critical for stakeholders across industry, investment, and healthcare sectors.

Current Market Landscape

Global Market Size and Growth Trajectory

The dermatology medication market, driven significantly by psoriasis treatments, is projected to expand from approximately US$ 8.7 billion in 2022 to over US$ 13 billion by 2030, with a compounded annual growth rate (CAGR) of around 6% (1). Calcipotriene holds a substantial share of this market, particularly in developed regions like North America and Europe, where psoriasis prevalence is higher, and treatment adherence is more established.

Major Products and Patent Status

Calcipotriene is commercially available under various brand names, including Daivonex and Psorcut. While some formulations are still under patent protection—generally expiring between 2023 and 2025—many recent formulations are off-patent, leading to a surge in generic competition. The expiration of primary patents opens avenues for biosimilars and generics, exerting downward pressure on prices.

Regulatory and Patent Landscape

Patent expirations and regulatory approvals significantly influence market availability and pricing. For instance, the expiration of UK and European patents for calcipotriene has facilitated market entry of generic formulations, often with lower price points. However, newer formulations with enhanced delivery mechanisms or combination therapies retain patent exclusivity, enabling premium pricing strategies.

Market Drivers and Barriers

Key Drivers

- Rising Psoriasis Prevalence: Globally, psoriasis affects approximately 2-3% of the population (2). Increased awareness leads to higher diagnosis rates.

- Advancements in Topical Treatments: Superior delivery systems and combination therapies improve efficacy and patient adherence.

- Cost-Effective Treatment Option: As a topical agent, calcipotriene offers a safer, less invasive alternative to systemic therapies, boosting its utilization.

Barriers

- Generic Competition: Price erosion due to generics threatens profitability.

- Patient Compliance: Topical treatments require consistent application, which may impact real-world effectiveness.

- Market Saturation: Presence of multiple effective therapies, including biologics for severe cases, limits market growth in certain segments.

Competitive Landscape

The market comprises pharmaceutical giants like Novartis, Sandoz, and Mylan, with several generic manufacturers producing cost-competitive alternatives. The competitive strategy hinges on formulation innovation, marketing, and the breadth of combination therapy offerings.

Innovative Formulations

Recently, formulations combining calcipotriene with corticosteroids, such as calcipotriene/betamethasone dipropionate, have gained prominence. These combination therapies command premium prices due to their improved efficacy and patient adherence.

Price Trends and Projections

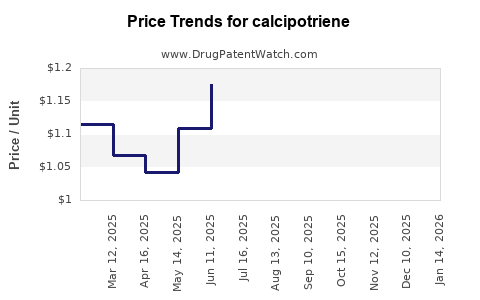

Historical Pricing

In North America and Europe, branded calcipotriene ointments averaged around US$ 50–70 for a 60-gram tube (3). Post-patent expiry, generic equivalents entered the market at 30-50% lower prices, often below US$ 30 per tube.

Forecasted Price Movements

- Short-Term (1-2 Years): Price stabilization or slight decreases as generic entries saturate the market.

- Mid to Long-Term (3-5 Years): Potential decline in unit prices by up to 60%, paralleling trends observed in other topical dermatology drugs. However, premium formulations may retain higher price points, maintaining a diverse pricing spectrum.

- Influencing Factors: Regulatory incentives, manufacturing costs, and the development of advanced formulations will shape future pricing trajectories.

Impact of Biosimilars and Generics

Biosimilars, though less common for small molecules like calcipotriene, could emerge if novel formulations or combination products are developed with patent protections, constraining generic entry temporarily and sustaining higher prices.

Regional Analysis

- North America: Market leader with stable demand; price reductions driven primarily by generics.

- Europe: Similar trends with regional variations due to national healthcare policies and pricing regulations.

- Asia-Pacific: Rapid market expansion driven by rising psoriasis prevalence and healthcare investments; prices often lower due to manufacturing and procurement efficiencies.

- Emerging Markets: Limited access and lower prices, but growth potential for generic and biosimilar versions.

Strategic Considerations for Stakeholders

- Pharmaceutical Companies: R&D into combination formulations and delivery innovations can command premium pricing.

- Investors: Focus on patent expiration timelines and the emergence of biosimilars for potential valuation impacts.

- Healthcare Providers: Preference for cost-effective generic options influences prescriber behavior.

- Policymakers: Balance between drug affordability and incentivizing innovation through patent protections.

Conclusion

Calcipotriene’s market remains dynamic, shaped by patent expirations, technological advances, and regional healthcare policies. Price projections suggest ongoing downward pressure, especially in mature markets, but opportunities persist in specialized formulations and combination therapies. Maintaining competitive differentiation through innovation will be essential for maximizing profitability and market share.

Key Takeaways

- The global psoriasis treatment market is expanding, with calcipotriene remaining a key topical agent.

- Patent expirations are catalyzing generic entry, leading to significant price reductions.

- Innovative combination formulations are likely to sustain higher price points and market relevance.

- Regional disparities influence pricing strategies, with emerging markets offering growth opportunities.

- Stakeholders should monitor patent landscapes, formulation innovations, and regional policies to optimize market positioning and profitability.

FAQs

1. What factors most influence calcipotriene pricing post-patent expiry?

Patent expirations allow generic manufacturers to enter the market, leading to increased competition and price reductions. Formulation complexity and brand recognition also influence premium pricing for innovative or combination products.

2. How does combination therapy affect calcipotriene’s market value?

Combination formulations, such as calcipotriene with corticosteroids, often command higher prices due to enhanced efficacy and improved patient adherence, thereby increasing their market value and sales margins.

3. Are biosimilars or generics the primary price influencers for calcipotriene?

Generics primarily drive price reductions after patent expiry. Biosimilars are less relevant due to the small molecule nature of calcipotriene but may influence the market if innovative formulations with patent protections emerge.

4. What regions offer the greatest growth potential for calcipotriene?

The Asia-Pacific region offers substantial growth opportunity owing to increasing psoriasis prevalence, rising healthcare infrastructure, and lower manufacturing costs, enabling competitive pricing.

5. How can companies sustain profitability amidst increasing generic competition?

Investing in formulation innovation, developing combination therapies, optimizing manufacturing efficiencies, and exploring regional market expansion are strategies to sustain profitability.

References

- MarketWatch. Global psoriasis treatment market to reach US$13 billion by 2030. 2023.

- World Psoriasis Atlas. Prevalence and epidemiology of psoriasis. 2021.

- GoodRx. Topical psoriasis treatments pricing overview. 2022.