Share This Page

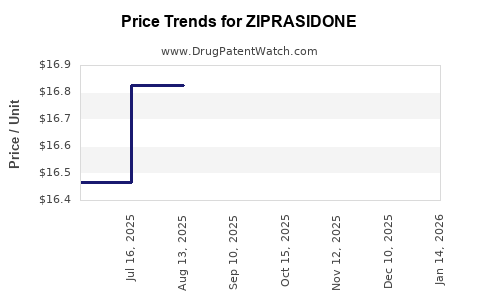

Drug Price Trends for ZIPRASIDONE

✉ Email this page to a colleague

Average Pharmacy Cost for ZIPRASIDONE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ZIPRASIDONE 20 MG/ML VIAL | 72205-0205-07 | 18.70083 | EACH | 2025-12-17 |

| ZIPRASIDONE 20 MG/ML VIAL | 72266-0160-42 | 18.70083 | EACH | 2025-12-17 |

| ZIPRASIDONE 20 MG/ML VIAL | 43598-0848-58 | 18.70083 | EACH | 2025-12-17 |

| ZIPRASIDONE HCL 20 MG CAPSULE | 00781-2164-60 | 0.30538 | EACH | 2025-12-17 |

| ZIPRASIDONE 20 MG/ML VIAL | 72266-0160-10 | 18.70083 | EACH | 2025-12-17 |

| ZIPRASIDONE 20 MG/ML VIAL | 43598-0061-58 | 18.70083 | EACH | 2025-12-17 |

| ZIPRASIDONE HCL 20 MG CAPSULE | 00904-6269-08 | 0.30538 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for ZIPRASIDONE

Introduction

ZIPRASIDONE, marketed under the brand name Geodon among others, is an atypical antipsychotic primarily prescribed to treat schizophrenia and acute manic or mixed episodes associated with bipolar disorder. Approved by the FDA in 2001, it has gained recognition for its effectiveness and favorable side-effect profile, especially regarding metabolic parameters compared to other antipsychotics. As global mental health awareness increases, the demand for targeted treatments like ZIPRASIDONE is expected to influence its market trajectory significantly. This analysis provides a comprehensive review of the current market landscape, historical pricing trends, and future price projections, emphasizing key factors influencing these dynamics.

Market Landscape Overview

Global Market Size and Growth Drivers

The global antipsychotic drugs market was valued at approximately USD 16 billion in 2022 and is projected to reach USD 21 billion by 2028, driven by increasing prevalence of schizophrenia and bipolar disorder, growing mental health awareness, and expanding healthcare access (Research and Markets, 2022). ZIPRASIDONE’s share within this market, although modest relative to dominant medications like risperidone and aripiprazole, is expanding owing to its distinct pharmacological profile.

Prevalence and Demand Drivers

Schizophrenia affects around 20 million people worldwide, while bipolar disorder impacts approximately 45 million (WHO, 2021). The rising incidence, coupled with enhanced diagnosis and treatment adherence, elevates demand for effective atypical antipsychotics like ZIPRASIDONE. The drug's preferred status in certain regions is influenced by its metabolic neutrality, minimal weight gain, and lower risks of extrapyramidal symptoms.

Competitive Landscape

ZIPRASIDONE faces competition from other atypical antipsychotics—quetiapine, risperidone, olanzapine, and aripiprazole—each with differing efficacy, side-effect profiles, and pricing strategies. The entry of biosimilars and generic versions further intensifies market competition, potentially influencing pricing trends.

Regulatory and Patent Landscape

Patent Status and Generic Competition

Originally protected by patents, ZIPRASIDONE's exclusivity period has expired or is nearing expiration in key markets, notably the United States and Europe. The patent expiry, which occurred around 2017–2018, facilitated the entry of generic manufacturers, leading to substantial price erosion and increased accessibility.

Regulatory Approvals and Off-Label Use

While FDA approval covers schizophrenia and bipolar disorder, off-label uses such as irritability in autism spectrum disorder have been explored, affecting market dynamics slightly. Regulatory programs encouraging biosimilar approvals are expected to further influence drug prices over time.

Historical Price Trends

Brand vs. Generic Pricing Dynamics

Pre-2018, Ziprasidone's brand-name therapy commanded premiums of approximately USD 20–30 per daily dose in the U.S. (Medicare Part D data). Post-patent expiry, generic formulations—manufactured by multiple pharmaceutical companies—have driven prices down substantially. In the U.S., generic ZIPRASIDONE is now available for as low as USD 1–3 per day, with wholesale acquisition costs (WAC) reflecting significant reductions.

Regional Price Variations

- United States: High initial prices due to market exclusivity; rapid decline following patent expiration.

- Europe: Similar trends with regional pricing disparities based on healthcare policies and tendering processes.

- Emerging Markets: Prices are typically lower; however, generic penetration is increasing due to affordability and local manufacturing capabilities.

Market Penetration and Adoption Trends

Physician Prescribing Patterns

Physicians often prefer ZIPRASIDONE in patients with metabolic concerns. Its once or twice-daily dosing and lower side-effect burden favor adherence, promoting ongoing market presence. However, newer antipsychotics with broader efficacy and fewer side effects are gradually capturing market share.

Patient Access and Insurance Coverage

Insurance formulary inclusion significantly impacts patient access and prescribing trends. The shift towards generic options enhances affordability, but some payors exclude ZIPRASIDONE due to availability of cheaper alternatives, impacting its utilization.

Future Price Projections

Factors Influencing Future Pricing

- Patent Status: The expiration of patents in key markets is likely to maintain downward price pressure through increased generic competition.

- Regulatory Developments: The approval of biosimilars or competing formulations can further reduce prices.

- Market Share Dynamics: Adoption rates, therapeutic advances, and formulary preferences will influence demand and prices.

- Manufacturing and Supply Chain: Increases in production capacity may facilitate price stability or additional decreases.

Projected Price Trends (2023–2030)

- United States: Expected to stabilize around USD 1–3 per daily dose owing to competitive generic markets. Any therapeutic innovations or new combination formulations could modify pricing.

- Europe and Asia: Similar downward adjustment trends, with local manufacturing potentially lowering prices further.

- Emerging Markets: Prices may decline modestly, with regions adopting generics more rapidly for affordability.

Potential Premiums for Novel Formulations

Should R&D lead to the development of longer-acting or transdermal formulations, premium pricing could emerge due to convenience and improved adherence, though this remains speculative.

Implications for Stakeholders

- Manufacturers: Continued generic competition pressures profits; innovation in delivery systems may offer a pricing premium.

- Healthcare Providers: Cost considerations will likely favor generic prescriptions, expanding access.

- Patients: Lower prices due to generics improve medication adherence and health outcomes.

- Investors: Declining brand-name profits but opportunities exist in biosimilars and innovative delivery mechanisms.

Key Takeaways

- Patent expirations have significantly decreased ZIPRASIDONE prices, fostering broader access in developed and emerging markets.

- Generic competition is expected to sustain low price levels, with prices stabilizing around USD 1–3 per daily dose in mature markets.

- Market adoption remains influenced by the drug’s safety profile, therapeutic efficacy, and formulary placements, with demand driven by schizophrenia and bipolar disorder prevalence.

- Future price prospects hinge on regulatory developments, manufacturing capacities, and potential innovations in drug delivery.

- Stakeholders should monitor patent statuses and regulatory pathways to optimize pricing strategies and market positioning.

FAQs

1. How has patent expiration impacted ZIPRASIDONE pricing?

Patent expiration around 2017–2018 initiated a surge in generic manufacturing, causing a sharp decline in prices from USD 20–30 per dose to as low as USD 1–3, expanding patient access.

2. Are there biosimilar or alternative formulations of ZIPRASIDONE in development?

Currently, biosimilars are not applicable, as ZIPRASIDONE is a small-molecule compound. However, long-acting injectable formulations are under development, which could command premium pricing.

3. How does ZIPRASIDONE compare to other antipsychotics in terms of pricing?

Post-generic entry, ZIPRASIDONE's pricing aligns closely with similar drugs, typically in the USD 1–3 range per daily dose, making it highly competitive.

4. What factors could drive future price increases for ZIPRASIDONE?

While unlikely due to market competition, potential price increases could arise from patented innovations or new formulations offering improved adherence.

5. What is the outlook for ZIPRASIDONE in emerging markets?

Prices are generally lower due to local manufacturing, but increasing adoption of generics may lead to further cost reductions, improving treatment accessibility.

References

- Research and Markets. (2022). Global Antipsychotic Drugs Market Report.

- World Health Organization (WHO). (2021). Mental Health Data.

- Medicare.gov. (2022). Prescription Drug Data on ZIPRASIDONE Pricing.

More… ↓