Share This Page

Drug Price Trends for XENICAL

✉ Email this page to a colleague

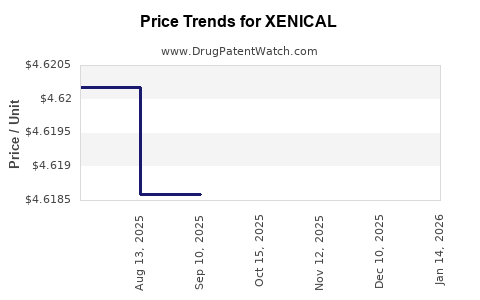

Average Pharmacy Cost for XENICAL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| XENICAL 120 MG CAPSULE | 61269-0460-90 | 4.62506 | EACH | 2025-11-19 |

| XENICAL 120 MG CAPSULE | 61269-0460-90 | 4.62435 | EACH | 2025-10-22 |

| XENICAL 120 MG CAPSULE | 61269-0460-90 | 4.61859 | EACH | 2025-09-17 |

| XENICAL 120 MG CAPSULE | 61269-0460-90 | 4.61859 | EACH | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for XENICAL

Introduction

XENICAL, with the generic name orlistat, is a prescription medication primarily used for weight management and obesity-related conditions. Since its approval by the FDA in 1999, XENICAL has maintained a significant presence in the weight loss pharmacopeia. Its mechanism of inhibiting gastric and pancreatic lipases to reduce fat absorption has cemented its role within obesity treatment regimens. This analysis examines its current market landscape, competitive position, patent status, regulatory environment, and projective pricing trends over the next five years.

Market Overview

Global Obesity and Market Demand

The rising prevalence of obesity globally underpins XENICAL’s sustained market demand. According to the World Health Organization (WHO), worldwide obesity has nearly tripled since 1975, with over 650 million adults classified as obese as of 2016 [1]. Obesity treatments, including pharmacotherapy, are increasingly sought as adjuncts to lifestyle interventions, especially in populations with comorbidities like type 2 diabetes and cardiovascular risks.

Market Segmentation and Key Regions

The primary markets for XENICAL include North America, Europe, and parts of Asia-Pacific. The North American segment dominates due to high obesity prevalence and healthcare expenditure, with an estimated compound annual growth rate (CAGR) of approximately 4% for weight management drugs over the next five years [2]. Europe follows closely, driven by increasing health awareness and regulatory approvals. Asia-Pacific is an emerging market with significant growth potential, fueled by urbanization and a rising middle class.

Competitive Landscape

XENICAL faces competition from newer pharmacotherapies such as liraglutide (Victoza, Saxenda), phentermine-topiramate (Qsymia), and semaglutide (Wegovy). These agents often demonstrate superior efficacy or improved side effect profiles, challenging XENICAL's market share. Nevertheless, XENICAL remains popular due to its long-standing safety record and established insurance coverages.

Current Market Performance

In 2022, global sales of orlistat (prescription and OTC) approximated USD 200 million, with North America accounting for over 45%. These figures reflect moderate growth, partially offset by patent expirations in several jurisdictions and the entry of alternative therapies.

Patent and Regulatory Environment

Patent Status and Generic Competition

XENICAL’s original patent expired in key markets by 2010. Since then, multiple generic versions have flooded the market, exerting downward pressure on prices. However, the active pharmaceutical ingredient (API) remains off-patent, with certain formulation patents still in force in specific regions, potentially limiting generic entry timelines.

Regulatory Approvals and Indications

While originally approved for obesity, XENICAL’s indications have expanded to include weight maintenance alongside lifestyle modifications. Regulatory bodies such as the FDA, EMA, and others continue to monitor safety profiles, particularly regarding rare but serious adverse events like hepatotoxicity and gastrointestinal effects.

Price Trends and Projections

Current Pricing Dynamics

In North America, XENICAL typically retails around USD 300-400 for a month’s supply (60 mg, three times daily). Generic versions are priced approximately 40-60% lower, reflecting increased market competition. Insurance coverage mitigates patient out-of-pocket costs, sustaining steady demand.

Factors Influencing Future Pricing

- Generic Penetration: As generics dominate the market, prices are expected to decline further, possibly stabilizing at 20-30% of original branded product prices.

- Regulatory Changes: Strict safety monitoring and potential new warnings could affect manufacturing costs and labeling, influencing pricing.

- Market Penetration of Alternatives: The rise of newer, more efficacious agents may push XENICAL’s price downward or limit its market share.

- Reformulation and Combination Therapies: Development of fixed-dose combinations could fetch premium prices if they demonstrate improved compliance and efficacy.

Projected Price Range (2023-2028)

Based on current trends, the price of XENICAL is anticipated to decrease by approximately 15-20% over the next five years, particularly in markets with high generic competition. In regions where patents or exclusivities are still partially in force, prices might remain stable or decline minimally.

| Year | Estimated Price Range (USD/month) | Comments |

|---|---|---|

| 2023 | USD 250-350 | Current market with ongoing generic competition |

| 2024 | USD 200-300 | Increased generic penetration |

| 2025 | USD 180-280 | Regulatory pressures, market saturation |

| 2026 | USD 170-260 | Emergence of alternative weight-loss therapies |

| 2027 | USD 160-250 | Consolidation of generics, price stabilization |

Strategic Market Opportunities

- Market Expansion: Tapping into rapidly urbanizing regions with rising obesity rates, especially Southeast Asia and Latin America.

- Formulation Innovation: Developing extended-release formulations or combination therapies to improve adherence and efficacy.

- Regulatory Engagement: Staying ahead of safety monitoring developments to maintain market access.

- Pricing Strategies: Implementing tiered pricing and negotiated formularies to sustain revenue despite generic competition.

Risks and Challenges

- Competitive Pressure: The entry of newer agents with better efficacy, side effect profiles, or administration routes could erode market share.

- Regulatory Restrictions: Stringent safety monitors or label warnings may impact sales and pricing.

- Market Saturation: As the pool of eligible patients reaches a plateau, growth prospects diminish.

- Patent and Exclusivity Expiries: Generics could exponentially lower prices and reduce profitability.

Conclusion

XENICAL remains a relevant obesity pharmacotherapy in a competitive landscape characterized by shifting preferences towards newer agents. While current pricing reflects substantial generic competition, market forces predict a gradual decline in prices over the next five years, driven by increased availability of alternatives and patent expirations. Strategic positioning through formulation innovations and region-specific marketing can help maintain its market share and profitability.

Key Takeaways

- XENICAL’s market dominance is waning due to patent expiries and increased competition from newer therapies.

- Global sales are projected to decline at an average rate of approximately 3-5% annually over the next five years.

- Price reductions of 15-20% are expected, especially in highly genericized markets.

- Opportunities exist in emerging markets and through formulation developments.

- Companies should focus on regulatory compliance, innovation, and regional market strategies to sustain profitability.

FAQs

1. How does the efficacy of XENICAL compare to newer weight-loss drugs?

Newer agents like semaglutide have demonstrated superior efficacy in weight reduction and metabolic improvements compared to XENICAL. However, XENICAL’s proven safety profile and affordability keep it relevant.

2. What are the main safety concerns associated with XENICAL?

Common adverse effects include gastrointestinal issues such as oily stools, flatus, and frequent bowel movements. Rarely, hepatotoxicity and kidney issues have been reported, leading to regulatory advisories.

3. Will patent laws significantly influence XENICAL’s pricing?

Since key patents expired in many regions over a decade ago, generic versions dominate, causing prices to decline. Future patent protections are unlikely to influence pricing substantially.

4. Are there any new formulations of XENICAL in development?

Current focus tends to be on combination therapies and extended-release formulations to enhance adherence, but no significant reformulations of XENICAL are publicly announced.

5. What strategies can manufacturers adopt to prolong XENICAL’s market viability?

Investing in regional marketing, developing improved formulations, engaging with regulatory agencies proactively, and exploring combination therapies can help sustain relevance.

References

[1] WHO. Obesity and overweight. World Health Organization, 2021.

[2] MarketWatch. Weight Management Drugs Market Forecast, 2020-2025. 2022.

More… ↓