Share This Page

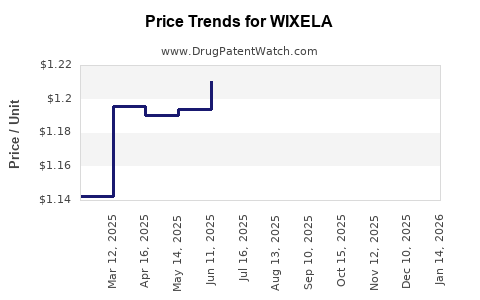

Drug Price Trends for WIXELA

✉ Email this page to a colleague

Average Pharmacy Cost for WIXELA

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| WIXELA 250-50 INHUB | 00378-9321-32 | 1.36459 | EACH | 2025-12-17 |

| WIXELA 500-50 INHUB | 00378-9322-32 | 1.78338 | EACH | 2025-12-17 |

| WIXELA 100-50 INHUB | 00378-9320-32 | 1.16467 | EACH | 2025-12-17 |

| WIXELA 500-50 INHUB | 00378-9322-32 | 1.74468 | EACH | 2025-11-19 |

| WIXELA 250-50 INHUB | 00378-9321-32 | 1.36402 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for WIXELA

Introduction

WIXELA Inhub (fluticasone propionate and salmeterol xinafoate inhalation aerosol) is a combination medication indicated for the maintenance treatment of airflow obstruction in patients with chronic obstructive pulmonary disease (COPD) and asthma. As a branded generic offering, WIXELA competes in a dynamic respiratory therapeutics market characterized by high patient demand, regulatory scrutiny, and pricing complexities. This analysis explores WIXELA's market landscape, key competitive factors, and projected pricing trends over the next five years to inform stakeholders' strategic decision-making.

Market Landscape of Respiratory Therapeutics

Global and U.S. Market Dynamics

The global respiratory drugs market is anticipated to grow significantly, driven by rising COPD and asthma prevalence, aging populations, and increased awareness of inhaled therapies. The U.S., as the leading market, accounts for a substantial share, with the CDC estimating over 16 million adult Americans diagnosed with COPD and millions more with asthma—conditions that require long-term management therapies like WIXELA [1].

Competitive Positioning

WIXELA faces competition primarily from inhaled corticosteroid/long-acting beta-agonist (ICS-LABA) combinations, including both branded and generic products. Notable competitors include Fluticasone/Salmeterol (brand-name Advair Diskus), which maintains significant market share despite patent expirations, and other generics like AirDuo RespiClick. The market's transition toward biosimilars and inhaler devices with improved delivery mechanisms influences competitive dynamics.

Regulatory and Patent Considerations

WIXELA's market exclusivity hinges on patent protections and regulatory exclusivities. While patent cliffs for original products like Advair have prompted generic entrants, WIXELA's formulation and device patent protections aim to extend lifecycle. However, imminent patent expirations could make generic versions more available, intensifying price competition [2].

Pricing Strategies and Historical Trends

Current Pricing Overview

WIXELA is typically priced higher than generic formulations, reflecting branding, device technology, and market positioning. The drug's average wholesale price (AWP) hovers around $300 per inhaler, but actual transaction prices often vary significantly due to rebates, insurance negotiations, and formulary placements.

Insurance and Reimbursement Factors

Insurance formularies heavily influence WIXELA's retail prices. Prior authorization and tier placement can lead to higher out-of-pocket costs for patients, potentially impacting adherence. Pharmacy Benefit Managers (PBMs) negotiate rebates, which affect list prices versus net prices, complicating transparent pricing assessments.

Historical Price Trends

Over the past five years, inhaled COPD treatments have seen moderate price stability. However, patent expirations and the entry of generic competitors in recent years cooled the original branded inhalers' pricing power, leading to price reductions of approximately 10–15% in some segments. WIXELA’s premium positioning has buffered some erosion, but downward pressure persists amidst increased competition.

Projected Price Trends (2023–2028)

Near-Term (2023–2025)

- Increasing generic competition: As patents expire, expect a surge of generic ICS-LABA inhalers, pressuring WIXELA’s price premium.

- Price stabilization and modest declines: Competitive pressure will prompt manufacturers to reduce prices to maintain market share, leading to estimated average price drops of 10–20%.

- Rebates and discounts: Payer negotiations are likely to intensify, further narrowing net prices by an additional 10%.

Mid to Long-Term (2025–2028)

- Market maturation and further commoditization: As multiple generics mature, prices could decline by another 15–25%.

- Device innovation and differentiation: Companies investing in novel inhaler delivery systems could sustain some premium; otherwise, prices are expected to trend downward broadly.

- Impact of biosimilars and regulation: Any accelerated approval pathways or biosimilar entrants may contribute to sharper price declines should they gain rapid market access.

Emerging Factors Influencing Price

- Value-based pricing models: Payers may increasingly adopt outcomes-based pricing, affecting reimbursement levels.

- Legislative policies: Moves toward transparency and drug price regulation could further influence pricing structures.

- Swings in demand: Population health trends and therapy adherence will also shape volume-driven pricing strategies.

Impacts on Market Share and Revenue

- Branded products like WIXELA are likely to see declining market shares as generics penetrate the same therapeutic class. However, differentiating factors such as dosage accuracy, inhaler technology, and provider loyalty can mitigate losses.

- Revenue projections suggest a gradual decline in sales volume for WIXELA unless it innovates or secures exclusive formulations, with price reductions compounded by increased competition.

Strategic Implications for Stakeholders

- Manufacturers must balance price reduction strategies with maintaining profit margins through cost efficiencies and differentiation.

- Payers will push for lower drug prices via formulary negotiations, influencing market accessibility.

- Patients may face higher out-of-pocket costs unless coverage improves, impacting adherence and long-term health outcomes.

Key Takeaways

- WIXELA operates in a highly competitive, price-sensitive market driven by patent expirations and generic entry.

- Near-term price erosion is expected due to intensified competition, with reductions of approximately 10–20%.

- Long-term projections indicate sustained downward pressure, with prices declining by up to 25% as generics dominate.

- Innovation in inhaler technology and strategic formulary positioning will be crucial to sustaining market share and margins.

- Stakeholders should monitor regulatory developments and payer policies that could influence pricing and reimbursement trajectories.

FAQs

1. How does patent expiration affect WIXELA's market pricing?

Patent expiration allows generic competitors to enter the market, increasing supply and reducing brand-name drug prices through intensified competition.

2. What factors influence WIXELA’s pricing in the U.S. market?

Pricing is impacted by patent status, insurance negotiations, rebates, formulary placement, and competitive dynamics from generic and alternative therapies.

3. Are generics significantly cheaper than WIXELA?

Yes, generic inhalers can be 30–50% less expensive than branded counterparts, although prices vary based on market conditions and negotiations.

4. How might biosimilars or alternative therapies impact WIXELA in the future?

The emergence of biosimilars or novel inhaler devices offering improved delivery could further drive down prices and erode WIXELA’s market share.

5. What strategies can WIXELA manufacturers adopt to preserve market share amid price erosion?

Investing in device innovation, strengthening brand loyalty, engaging in value-based pricing, and optimizing rebate strategies can help sustain profitability.

References

[1] CDC. “Chronic Obstructive Pulmonary Disease (COPD).” Centers for Disease Control and Prevention, 2022.

[2] U.S. Patent and Trademark Office. “Patent Status of Inhaler Technologies,” 2023.

More… ↓