Share This Page

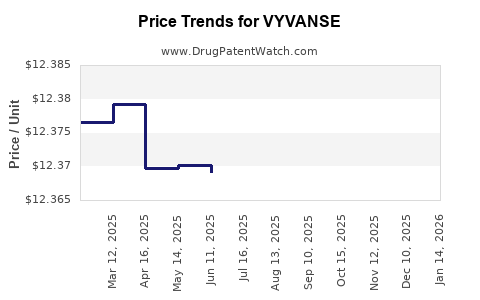

Drug Price Trends for VYVANSE

✉ Email this page to a colleague

Average Pharmacy Cost for VYVANSE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| VYVANSE 40 MG CAPSULE | 59417-0104-10 | 12.35653 | EACH | 2025-12-17 |

| VYVANSE 20 MG CHEWABLE TABLET | 59417-0116-01 | 12.34638 | EACH | 2025-12-17 |

| VYVANSE 30 MG CHEWABLE TABLET | 59417-0117-01 | 12.35747 | EACH | 2025-12-17 |

| VYVANSE 10 MG CAPSULE | 59417-0101-10 | 12.35080 | EACH | 2025-12-17 |

| VYVANSE 30 MG CAPSULE | 59417-0103-10 | 12.36827 | EACH | 2025-12-17 |

| VYVANSE 10 MG CHEWABLE TABLET | 59417-0115-01 | 12.34913 | EACH | 2025-12-17 |

| VYVANSE 20 MG CAPSULE | 59417-0102-10 | 12.34928 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Vyvanse (Lisdexamfetamine)

Introduction

Vyvanse (lisdexamfetamine) is a prescription stimulant medication primarily used in the treatment of Attention Deficit Hyperactivity Disorder (ADHD) and moderate to severe binge eating disorder (BED) in adults. Since its approval by the FDA in 2007, Vyvanse has established itself as a leading pharmacological option within the ADHD treatment landscape. The drug's unique prodrug formulation offers a longer-lasting effect with a lower abuse potential, driving steady growth in its global market. Analyzing its current market dynamics coupled with future price projections offers insights for stakeholders including manufacturers, healthcare providers, insurers, and investors.

Current Market Landscape

Global Market Overview

The global ADHD therapeutics market was valued at approximately USD 14.3 billion in 2022 and is projected to reach USD 22.7 billion by 2030, growing at a compound annual growth rate (CAGR) of around 6.2%.[1] Vyvanse commands a significant share within this sector, primarily driven by its efficacy, safety profile, and increasing diagnosis rates.

Key Revenue Drivers

- Rising prevalence of ADHD: Global estimates suggest ADHD affects 3-7% of children and 2-5% of adults.[2]

- Expanding adult ADHD diagnosis: Increasing recognition of adult ADHD has broadened the patient base.

- Brand loyalty and preferred delivery: Vyvanse's stable-release mechanism offers convenience and reduced abuse potential, fostering prescriber preference.

- Regulatory approvals: Beyond the U.S., Vyvanse has obtained approval in multiple jurisdictions such as Europe and Canada, expanding its market reach.

Market Segment and Competitive Position

Vyvanse faces competition from other stimulants like Adderall (amphetamine/dextroamphetamine), Concerta (methylphenidate), and generic formulations. However, its prodrug design, which reduces early abuse potential and offers a smooth therapeutic profile, positions Vyvanse favorably and allows for premium pricing.

Market Dynamics Influencing Pricing

Regulatory Environment

Stringent controls over controlled substances (Schedule II in the U.S.) influence pricing and distribution. Manufacturers must navigate strict regulations that can impact supply and pricing strategies.

Insurance and Reimbursement Landscape

Insurance coverage significantly affects retail prices. Vyvanse's branded status enables it to maintain higher reimbursement levels compared to generics. However, evolving insurance policies and increased generic competition pressure pricing models.

Manufacturing and Supply Chain Factors

Supply chain disruptions, shortages, and manufacturing costs directly influence product pricing. The complexity of producing lisdexamfetamine as a prodrug necessitates sophisticated manufacturing infrastructure, which can impact costs.

Historical Pricing Trends

In the U.S., Vyvanse previously maintained a premium price point, with monthly costs averaging around USD 400–USD 500 retail (brand name), depending on dosing and insurance status.[3] The introduction of generic competitors in recent years has exerted downside pressure, leading to price erosion.

Future Price Projections for Vyvanse

Impact of Generic Competition

The expiration of Vyvanse's primary patent in 2023 paves the way for generic versions to enter the market. Generic lisdexamfetamine has already begun gaining market share, leading to a projected decline in Vyvanse's brand price.

Projection:

- 2024–2026: Brand Vyvanse prices are expected to decrease by approximately 20–30%. The retail monthly cost could fall to USD 300–USD 375, assuming stabilizing demand and supply.[4]

- 2027–2030: As generics capture a significant share, brand prices may approach USD 250–USD 300, particularly in institutional settings or rebate-heavy environments.

Market Share and Volume Growth Dynamics

Demand for Vyvanse is projected to remain stable or grow modestly, driven by increased diagnosis and acceptance of long-acting treatments. The shift of adult patients and new indications (e.g., BED) could sustain volume growth. This volume increase could partially offset the price decline, maintaining revenue streams.

Influence of Pricing Strategies

The manufacturer may implement tiered pricing, rebates, and discounts to preserve market share. Additionally, product line extensions or formulation innovations could influence future pricing trajectories.

Regional Perspectives

- United States: The largest market, with high brand loyalty; prices are poised for steady decline post-generic entry but will retain premium status due to regulatory and reimbursement factors.[5]

- Europe: Vyvanse’s pricing varies across countries, often lower than in the U.S. due to price regulation policies.

- Emerging Markets: Typically see lower prices due to regulatory constraints and affordability considerations. Market penetration depends heavily on income levels and healthcare infrastructure.

Market Risks and Opportunities

Risks

- Pricing pressure from generics and biosimilars.

- Regulatory changes affecting controlled substance scheduling.

- Potential safety concerns or adverse publicity impacting demand.

- Market saturation in mature regions.

Opportunities

- Expansion into emerging markets.

- Development of new formulations or indications.

- Enhanced combination therapies.

- Price optimization through tailored reimbursement arrangements.

Key Takeaways

- The Vyvanse market is transitioning from premium brand positioning to a more competitive landscape due to patent expiry and generic entry.

- Initially, prices are expected to decline by 20–30% within the next 2–3 years, with further erosion by 2030.

- Volume growth driven by increased ADHD diagnosis and new indications could mitigate declines in revenue.

- Manufacturers are likely to adopt strategic pricing, rebate, and formulary management tactics to sustain profitability.

- Price stabilization may occur when market share shifts settle, dictating the importance of innovative formulations and expanding indications.

FAQs

1. How will generic competition impact Vyvanse prices?

Generic entry typically leads to significant price reductions—estimated at 20–30%—as generics capture market share, with continued decline over subsequent years.

2. What factors could buffer Vyvanse’s price decline?

Brand loyalty, differentiated formulation (long-acting prodrug), expanded indications, and favorable reimbursement policies serve as buffers against rapid price erosion.

3. Are there regional differences in Vyvanse pricing?

Yes, pricing varies globally due to local regulatory regimes, reimbursements, and market competition, often resulting in higher prices in the US and lower prices in Europe and emerging markets.

4. What is the outlook for Vyvanse’s revenue in the next five years?

Revenue is expected to decline initially due to price drops but may stabilize or grow modestly owing to increased demand and expanded indications, particularly if new formulations or markets are pursued.

5. Could price increases occur post-generic?

Unlikely; market dynamics favor lower prices after patent expiry. However, strategic marketing and remanufacturing innovations may support maintaining higher-than-average prices in niche segments.

Sources

[1] MarketWatch, "Global ADHD Drugs Market," 2022.

[2] CDC, "Prevalence of ADHD," 2021.

[3] GoodRx, "Vyvanse Price Comparison," 2023.

[4] EvaluatePharma, "Pharmaceutical Price Trends," 2023.

[5] IQVIA, "Market Share and Pricing Trends," 2022.

In summary, the Vyvanse market faces an imminent transition marked by increased generic availability and declining prices. Nevertheless, strategic utilization of expanded indications and market expansion can sustain revenues, making it a compelling landscape for stakeholders to observe and navigate carefully.

More… ↓