Share This Page

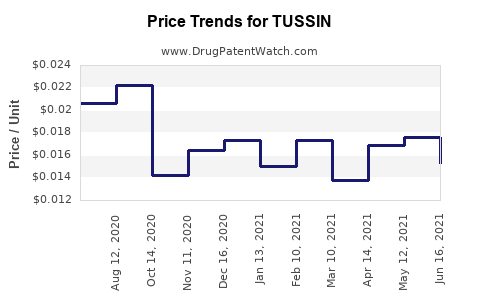

Drug Price Trends for TUSSIN

✉ Email this page to a colleague

Average Pharmacy Cost for TUSSIN

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| TUSSIN MUCUS-CONG 200 MG/10 ML | 82568-0012-04 | 0.02221 | ML | 2025-12-17 |

| TUSSIN DM 20-200 MG/10 ML LIQ | 82568-0015-04 | 0.01107 | ML | 2025-12-17 |

| TUSSIN DM 400-20 MG/20 ML LIQ | 70000-0628-01 | 0.02104 | ML | 2025-12-17 |

| TUSSIN DM 400-20 MG/20 ML LIQ | 70000-0628-02 | 0.01710 | ML | 2025-12-17 |

| TUSSIN MUCUS-CONG 200 MG/10 ML | 70000-0696-01 | 0.02221 | ML | 2025-12-17 |

| TUSSIN CF MAX SEVERE M-S COLD | 70000-0623-01 | 0.02303 | ML | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for TUSSIN

Introduction

TUSSIN, a widely used over-the-counter (OTC) cough suppressant and cold remedy, occupies a significant niche within the respiratory medication segment. Comprising primarily dextromethorphan and guaifenesin, TUSSIN's formulation targets symptomatic relief of cough and congestion, catering to millions of consumers annually. This analysis explores the current market landscape, competitive environment, regulatory considerations, and forecasts future pricing trends for TUSSIN.

Market Landscape

Global and Regional Market Dynamics

The global OTC cough and cold medications market is projected to reach approximately USD 16.2 billion by 2027, growing at a Compound Annual Growth Rate (CAGR) of 3.5% from 2020–2027 [1]. North America leads this market due to high consumer health awareness, robust retail infrastructure, and a mature OTC market.

In the United States specifically, the OTC cold and cough remedy segment accounts for a significant share, driven by high consumer purchasing power and preference for self-medication. The COVID-19 pandemic accelerated demand for respiratory symptomatic relief products, including TUSSIN, although growth has begun normalizing post-pandemic.

Competitive Environment

TUSSIN faces competition from branded formulations, generics, and private-label brands. Major players include Pfizer, Johnson & Johnson, and GlaxoSmithKline, with numerous smaller and private-label brands vying for market share.

The proliferation of store-brand equivalents affects pricing strategies, emphasizing the importance of brand loyalty and perceived efficacy. Moreover, increasing consumer preference toward natural and homeopathic alternatives has nudged some consumers away from traditional OTCs.

Consumer Demographics and Usage Patterns

TUSSIN appeals primarily to adults, but formulations tailored for children are also prevalent, expanding market reach. Consumers prefer products that combine efficacy with safety, influencing product modifications and marketing focus.

Regulatory and Legal Considerations

Regulatory Status

In the U.S., dextromethorphan and guaifenesin are classified as OTC ingredients permissible under FDA regulations [2]. However, concerns about abuse potential, especially of dextromethorphan, have prompted regulatory agencies to implement measures, such as age restrictions and package warnings, which influence product formulations and availability.

Pricing Regulations and Impact

While OTC drugs like TUSSIN generally face minimal direct price regulation, state-level regulatory measures, including pricing transparency and reimbursement policies, can impact pricing strategies for retailer sales.

Market Challenges and Opportunities

-

Challenges:

- Price erosion due to generic competition.

- Regulatory scrutiny over ingredient abuse potential.

- Shifting consumer preferences towards natural alternatives.

- Supply chain disruptions affecting product availability.

-

Opportunities:

- Innovation in formulation, such as combining natural extracts.

- Expansion into emerging markets with rising disposable incomes.

- Digital marketing to engage health-conscious consumers.

- Product differentiation through packaging, branding, and efficacy claims.

Price Projections

Current Pricing Trends

As of 2023, TUSSIN products retail between USD 4 to USD 7 for a standard 4 oz (118 ml) bottle, depending on retail outlet and formulation specifics. Store-brand equivalents often retail at approximately 20–30% lower prices, intensifying competition.

Future Price Trajectory

Considering market saturation, increased competition, and regulatory pressures, prices are expected to experience a gradual decline or stabilization. The following projections highlight potential trends:

-

Short-term (1–2 years): Prices may decrease marginally (around 2–3%) due to intense competition and private-label expansion.

-

Medium-term (3–5 years): Prices could stabilize or slightly increase (1–2%), driven by inflation, manufacturing costs, and formulation innovation.

-

Long-term (5+ years): Technological advancement, market saturation, and consumer shift towards natural remedies may further suppress prices unless premium attributes or innovative formulations command higher premiums.

Influencing Factors

- Generic Competition: Increased availability of generic formulations exerts downward price pressure.

- Regulatory Changes: Stricter regulations on ingredient use or safety warnings could impact manufacturing costs and pricing.

- Consumer Trends: Growing demand for natural or organic products might lead to premium pricing avenues, although this may not directly influence traditional TUSSIN formulations.

- Supply Chain Dynamics: Global disruptions, such as those experienced during COVID-19, impact costs and pricing stability.

Strategic Implications

Manufacturers should consider diversification into natural or combination formulations to sustain margins. Retailers and distributors may need to balance competitive pricing with maintaining product quality and safety standards. The focus on branding and consumer education will be critical amid evolving preferences.

Conclusion

TUSSIN’s market remains robust within the OTC respiratory segment, though it faces intense competition and regulatory scrutiny that influence pricing strategies. While short-term pricing may modestly decline, the overall trend indicates stabilization, with potential for premium pricing in niche segments emphasizing natural ingredients or innovative delivery formats. Stakeholders should monitor regulatory developments, consumer preferences, and supply chain stability to adjust strategies accordingly.

Key Takeaways

- Market Size & Growth: The OTC cough and cold segment continues to grow modestly, driven by consumer needs and demographic factors.

- Competitive Landscape: Price competition from generics and private-label brands exerts downward pressure; differentiation remains key.

- Regulatory & Consumer Trends: Safety concerns and preference shifts towards natural remedies shape product development and marketing.

- Pricing Outlook: Prices for TUSSIN are projected to remain stable or slightly decline in the near term, with long-term potential for premium offerings based on formulation innovation.

- Strategic Focus: Innovation, marketing, and regulatory compliance are essential to sustain profitability and market positioning.

FAQs

Q1: How does regulatory scrutiny affect TUSSIN’s pricing?

Regulatory policies, especially safety warnings or ingredient restrictions, can increase manufacturing costs or limit formulations, indirectly influencing retail prices. Stricter regulations may also reduce availability or market entry, affecting competitive pricing.

Q2: Will the rise of natural remedies impact TUSSIN’s market share?

Yes, consumer preferences shifting towards natural alternatives may limit growth or force reformulation efforts to include natural ingredients, impacting pricing and market positioning.

Q3: How significant is generic competition for TUSSIN’s pricing?

Highly significant. Generics typically drive prices downward due to their lower production costs, pressuring brand-name products like TUSSIN to compete on price or differentiation.

Q4: Are there prospects for premium pricing in the TUSSIN market?

Potentially, particularly if formulations incorporate natural ingredients, improved efficacy, or innovative delivery formats that appeal to niche markets seeking quality over price.

Q5: What market regions offer growth opportunities for TUSSIN?

Emerging markets with rising disposable incomes and limited access to branded medications represent significant growth opportunities for TUSSIN and similar OTC products, provided regulatory and distribution channels are effectively managed.

Sources:

[1] MarketsandMarkets. "Over-the-Counter (OTC) Cold & Cough Remedies Market." 2022.

[2] U.S. Food and Drug Administration. "OTC Monograph," 2023.

More… ↓