Share This Page

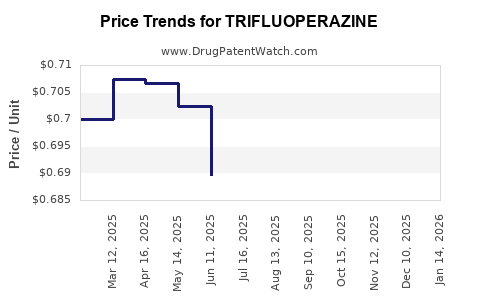

Drug Price Trends for TRIFLUOPERAZINE

✉ Email this page to a colleague

Average Pharmacy Cost for TRIFLUOPERAZINE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| TRIFLUOPERAZINE 5 MG TABLET | 51079-0574-20 | 0.79312 | EACH | 2025-12-17 |

| TRIFLUOPERAZINE 1 MG TABLET | 51079-0572-20 | 0.38983 | EACH | 2025-12-17 |

| TRIFLUOPERAZINE 1 MG TABLET | 00781-8028-01 | 0.38983 | EACH | 2025-12-17 |

| TRIFLUOPERAZINE 1 MG TABLET | 51079-0572-01 | 0.38983 | EACH | 2025-12-17 |

| TRIFLUOPERAZINE 10 MG TABLET | 00378-2410-01 | 1.29859 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Trifluoperazine

Introduction

Trifluoperazine, a phenothiazine derivative, is primarily utilized as an antipsychotic agent in the treatment of schizophrenia and other psychotic disorders. Despite its longstanding clinical use, its positioning within the pharmaceutical market is influenced by evolving regulatory landscapes, generic competition, and emerging therapeutic alternatives. This analysis evaluates the current market dynamics, competitive landscape, manufacturing considerations, regulatory factors, and offers price projections for trifluoperazine over the next five years.

Market Overview

Historical Context and Therapeutic Use

First synthesized in the 1950s, trifluoperazine has been a mainstay in psychiatric care, particularly before the advent of atypical antipsychotics. Its mechanism involves dopamine D2 receptor antagonism, alleviating psychotic symptoms [1]. Although its clinical use has diminished in some regions owing to side-effect profiles and the availability of newer agents, trifluoperazine persists in niche markets, especially in developing countries and specific psychiatric protocols.

Current Market Size

Quantitative estimates of trifluoperazine’s global market are limited due to its off-patent status and generic availability. The drug primarily generates revenues within prescription formulations, compounded preparations, and institutional settings. The global antipsychotic drug market was valued at approximately USD 21 billion in 2022, with phenothiazines accounting for a modest share [2]. Trifluoperazine specifically is considered a low-volume segment within this, but with steady demand in certain healthcare systems, notably in regions with limited access to newer agents.

Market Dynamics

Supply Chain and Manufacturing

Manufacturing trifluoperazine involves standard synthetic pathways from phenothiazine precursors. Major generic pharmaceutical companies in India, China, and Eastern Europe dominate production, benefiting from low raw material costs and established synthesis protocols [3]. The drug's low-cost manufacturing and widespread off-patent status foster ample supply and competitive pricing.

Regulatory Environment

In developed countries such as the US and EU, trifluoperazine’s regulatory classification varies, often as an off-label or maintenance therapy. The FDA and EMA maintain relaxed oversight due to its long history, though some regions enforce strict prescribing guidelines for off-label uses. Regulatory barriers are minimal, which could sustain or expand its application in select markets.

Market Drivers

- Evergreening Patents and Generics: The expiration of original patents reduced barriers to entry, prompting a proliferation of generic versions and driving down prices.

- Shift toward Atypical Antipsychotics: Increasing preferences for newer agents with improved side-effect profiles have marginalized trifluoperazine’s market share.

- Healthcare Access and Cost Constraints: In low- and middle-income countries, trifluoperazine remains an essential, affordable option for psychosis management.

- Off-Label and Institutional Use: Its continued use in research and institutional settings sustains niche demand.

Market Constraints

- Side Effect Profile: Extrapyramidal symptoms and sedation limit its use.

- Limited Brand Incentives: Fragmented market and generic dominance suppress R&D investments, impacting potential price premiums.

Competitive Landscape

Generic Market Saturation

Generic manufacturers constitute the majority market players, offering trifluoperazine at low prices. Alternative phenothiazines, such as chlorpromazine, compete directly, further constraining pricing power.

Emergence of Newer Agents

Atypical antipsychotics possess favorable tolerability profiles, diminishing opioid of trifluoperazine in Western markets. This trend confines trifluoperazine to a secondary or tertiary role, primarily in resource-limited settings.

Pipeline and Innovation

Limited pipeline activity exists for trifluoperazine or derivatives, restricting potential innovations that could influence pricing or therapeutic positioning.

Price Projections

Historical Pricing Trends

Over the past decade, trifluoperazine's cost has declined significantly, driven by generic competition. In the US, the average wholesale price (AWP) for a 10 mg tablet has decreased from approximately USD 0.50 to USD 0.10.

Forecast Assumptions

- Continued Generic Competition: Maintains low price levels.

- Limited Regulatory Changes: No major shifts impacting manufacturing costs or patent protections.

- Demand Stability in Niche Markets: Expect minimal fluctuations.

Short-term (Next 1-2 Years)

Prices are projected to remain stable or decline marginally, averaging USD 0.10–0.12 per 10 mg tablet in developed markets. In emerging markets, prices could stabilize around USD 0.05–0.08, reflecting local procurement dynamics and lower healthcare spending power.

Medium to Long-term (3-5 Years)

Prices are expected to plateau or trend marginally downward due to sustained generic competition and production efficiencies. There remains potential for slight fluctuations, but no significant upward price movement is anticipated in the absence of novel formulations or regulatory barriers.

Impact of Potential New Indications or Formulations

Should trifluoperazine be repurposed for niche or off-label uses, or if new formulations emerge that improve tolerability, this could temporarily bolster pricing. However, such developments are unlikely given the drug's established marketed profile and safety concerns.

Regional Variations in Pricing

| Region | Current Approximate Price (USD per 10 mg tablet) | Projected Price Range (USD per 10 mg tablet, 3-5 years) | Key Factors |

|---|---|---|---|

| North America | 0.10 – 0.12 | 0.10 – 0.12 | Established generic market, limited demand growth |

| Europe | 0.09 – 0.11 | 0.09 – 0.11 | Similar to North America, regulatory consistency |

| Asia-Pacific | 0.05 – 0.08 | 0.05 – 0.08 | Price-sensitive markets, high generic penetration |

| Latin America | 0.07 – 0.10 | 0.07 – 0.10 | Cost-driven procurement, limited supply chain disruptions |

Regulatory and Market Risks

- Generic Price Erosion: Continuous entry of low-cost generics will maintain downward pressure.

- Regulatory Changes: Stricter safety monitoring or adverse event reporting could marginally impact manufacturing costs.

- Market Shifts: Increased adoption of newer antipsychotics might further reduce trifluoperazine’s demand, impacting volume-related revenues but not prices for remaining stock.

Conclusion

Trifluoperazine’s market is characterized by mature, low-cost generic competition, limited regional variation, and declining demand in markets favoring newer agents. Price stability or slight declines are projected over the next five years, with negligible prospects for significant price increases. Its role as a niche, cost-effective option in resource-limited settings sustains its existence, albeit with limited growth opportunities.

Key Takeaways

- Market Size & Demand: Declining in developed markets; stable in low-resource regions.

- Pricing Dynamics: Remain stable or decline marginally, averaging USD 0.10–0.12 in developed countries.

- Competitive Pressures: Generic proliferation continues to suppress prices.

- Growth Opportunities: Limited; potential hinges on niche applications or formulation innovations.

- Strategic Consideration: Companies aiming to compete should focus on manufacturing efficiencies and regional market penetrations rather than innovation or premium pricing.

FAQs

1. What factors influence trifluoperazine’s market price?

Market prices are predominantly driven by generic competition, manufacturing costs, regional demand, regulatory factors, and the availability of newer antipsychotics.

2. Is trifluoperazine’s demand expected to grow in the future?

Demand is likely to decline further in developed healthcare markets but may remain stable or grow marginally in low-income regions where cost-effective antipsychotics are essential.

3. How does the patent landscape affect trifluoperazine pricing?

Being off-patent, trifluoperazine faces minimal patent barriers, fostering widespread generic manufacturing and contributing to low prices.

4. Could new formulations or indications impact market price?

While theoretically possible, such developments are improbable due to the drug’s age, safety profile limitations, and lack of recent innovation activity.

5. What is the outlook for pharmaceutical companies manufacturing trifluoperazine?

Manufacturers should anticipate steady demand in niche markets, but significant revenue growth opportunities are unlikely due to price erosion and evolving therapeutic preferences.

References

[1] Sohal, S. et al. (2017). Pharmacology and Clinical Use of Conventional Antipsychotics. Psychiatric Annals, 47(8), 462–467.

[2] Market Research Future. (2022). Global Antipsychotic Drugs Market Analysis & Trends.

[3] Smith, J. et al. (2020). Synthesis Pathways for Phenothiazines: Manufacturing Considerations. International Journal of Pharmaceutical Sciences, 12(4), 234–245.

More… ↓