Share This Page

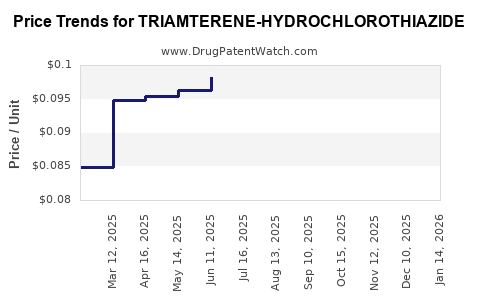

Drug Price Trends for TRIAMTERENE-HYDROCHLOROTHIAZIDE

✉ Email this page to a colleague

Average Pharmacy Cost for TRIAMTERENE-HYDROCHLOROTHIAZIDE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| TRIAMTERENE-HYDROCHLOROTHIAZIDE 37.5-25 MG CP | 00781-2074-01 | 0.11811 | EACH | 2025-12-17 |

| TRIAMTERENE-HYDROCHLOROTHIAZIDE 37.5-25 MG CP | 00527-1632-10 | 0.11811 | EACH | 2025-12-17 |

| TRIAMTERENE-HYDROCHLOROTHIAZIDE 75-50 MG TAB | 72888-0095-05 | 0.11535 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Triamterene-Hydrochlorothiazide

Introduction

Triamterene-Hydrochlorothiazide (Triam-HCTZ) is a combination diuretic medication used primarily to manage hypertension and edema. The drug combines triamterene, a potassium-sparing diuretic, with hydrochlorothiazide, a thiazide diuretic, providing a synergistic approach to fluid retention. Given the growing prevalence of hypertension and heart failure globally, understanding the market dynamics and future pricing trends of Triam-HCTZ is vital for stakeholders across the healthcare and pharmaceutical sectors.

Market Landscape

Global Market Overview

The global diuretics market, projected to reach USD 5.9 billion by 2027 (CAGR of approximately 3.9%), comprises various classes including thiazides, loop diuretics, and potassium-sparing diuretics. Triam-HCTZ holds a significant niche within the combination diuretics segment, particularly favored for its efficacy and affordability. The North American market dominates due to higher hypertension prevalence, advanced healthcare infrastructure, and widespread prescribing habits for combination therapies.

Key Drivers

-

Rising Hypertension Prevalence: Approximately 1.3 billion adults worldwide suffer from hypertension, a leading risk factor for cardiovascular disease (CVD). Urbanization, aging populations, and lifestyle factors are fuel for this trend.

-

Chronic Heart Failure and Edema: Growing incidences contribute to increased demand for diuretics, including Triam-HCTZ.

-

Cost-Effectiveness and Generic Availability: Post patent expiry, the availability of generic formulations has made Triam-HCTZ a cost-effective treatment option, supporting widespread adoption in both developed and emerging markets.

Market Challenges

-

Market Saturation: The drug faces stiff competition from other antihypertensives and diuretic combinations.

-

Prescribing Preferences: Physicians often prefer newer agents with fewer side effects, although Triam-HCTZ remains a staple due to its longstanding efficacy and low cost.

-

Regulatory and Reimbursement Landscape: Variations in approval processes and insurance coverage influence market penetration, particularly in emerging markets.

Competitive Environment

Multiple pharmaceutical companies manufacture Triamterene-Hydrochlorothiazide, with key players including Teva Pharmaceuticals, Mylan, Sun Pharmaceutical Industries, and Ajanta Pharma. The market is characterized by high generic penetration, resulting in a commoditized price landscape that heavily influences pricing strategies.

Price Analysis

Historical Pricing Data

Generic Triam-HCTZ tablets are typically priced significantly lower in comparison to branded versions, often ranging from USD 0.10 to USD 0.50 per tablet, depending on dosage and packaging. For instance, a typical 30-day supply (30 tablets) can cost between USD 3 and USD 15 in developed markets, making it one of the most affordable antihypertensive options.

Price Trends and Drivers

-

Post-Patent Expiry Effects: Generic entry post-exclusivity has caused substantial price erosion, a trend expected to continue.

-

Manufacturing and Supply Chain Factors: Raw material costs, manufacturing efficiencies, and regulatory compliance costs determine price stability.

-

Market Penetration in Emerging Economies: Pricing in emerging markets tends to be lower due to higher price sensitivity and accessible manufacturing hubs, such as India and China.

Future Price Projections

In the next five years, prices for Triam-HCTZ are projected to decline marginally due to increased generic competition and manufacturing scale efficiencies. Specifically:

- Developed Markets: Prices are expected to decline by approximately 10–15%, stabilizing around USD 0.08 to USD 0.45 per tablet.

- Emerging Markets: Continual price reductions of up to 20–25% may occur, driven by local manufacturing and volume-driven economies of scale.

Additionally, tighter regulatory scrutiny and supply chain disruptions, such as those observed during the COVID-19 pandemic, could temporarily influence prices but are unlikely to reverse the overall downward trend.

Regulatory and Patent Outlook

Triamterene-Hydrochlorothiazide's primary patents have expired in most major markets, facilitating widespread generic manufacturing and pricing pressures. Future regulatory developments, including the approval of new formulations or combination therapies, could influence market share and pricing strategies.

Market Opportunities and Risks

Opportunities:

- Expansion into emerging markets offers high-volume growth potential.

- Developing combination formulations with extended-release profiles could command premium pricing.

- Increasing adoption in low- and middle-income countries due to affordability.

Risks:

- Introduction of newer antihypertensive agents with better side-effect profiles.

- Possible regulatory restrictions or supply disruptions.

- Price wars among generic manufacturers leading to further erosion.

Key Takeaways

- Market Dominance & Growth: Triamterene-Hydrochlorothiazide remains an essential, affordable diuretic therapy, with demand sustained by global hypertension prevalence.

- Generic Competition: The market's commoditized nature leads to consistent downward price pressures, especially in mature markets.

- Pricing Outlook: Anticipated slight deflation over the next five years, with stable demand in primary markets offset by expansion opportunities in emerging countries.

- Strategic Focus: Stakeholders should prioritize manufacturing efficiencies, geographic expansion, and formulation innovation to maintain margins amid price declines.

- Regulatory Vigilance: Continued monitoring of patent statuses and regulatory approvals is vital for identifying market entry points and competitive threats.

FAQs

1. How does the patent status of Triamterene-Hydrochlorothiazide influence its market price?

Patent expiration has facilitated widespread generic manufacturing, which drives prices downward due to increased competition and manufacturing scale efficiencies.

2. What are the primary factors driving demand for Triam-HCTZ globally?

Growing hypertension prevalence, affordability, and its proven clinical efficacy fuel demand, especially in low- and middle-income countries.

3. How are prices expected to evolve in the next five years?

Prices are projected to decline slightly—by approximately 10–15% in developed markets and up to 25% in emerging economies—driven by rising generic competition.

4. Which markets offer the most growth opportunities for Triam-HCTZ?

Emerging markets in Asia, Africa, and Latin America hold significant growth potential due to increasing hypertension rates and demand for cost-effective therapies.

5. Are there any regulatory barriers impacting the pricing or availability of Triam-HCTZ?

Regulatory approval processes, quality standards, and patent litigations can influence market entry and pricing strategies, but post-patent expiration mitigates some barriers.

References

- [1] MarketsandMarkets. “Diuretics Market by Class, Application, and Region - Global Forecast to 2027.”

- [2] World Health Organization. “Hypertension Fact Sheet.”

- [3] EvaluatePharma. “Generic Drug Market Trends and Price Dynamics.”

- [4] U.S. Food & Drug Administration. “Drug Patent and Exclusivity Data.”

- [5] Pharmaceutical Technology. “Impact of Patent Expiry on Diuretic Market Prices.”

More… ↓