Last updated: July 27, 2025

Introduction

Sumatriptan, a selective 5-HT1 receptor agonist, is a cornerstone pharmacological treatment for acute migraine attacks. Since its approval in the early 1990s, sumatriptan has secured a significant role in migraine management, characterized by high efficacy, rapid onset, and an established safety profile. Market dynamics for sumatriptan are influenced by factors such as patent and patent expirations, rising migraine prevalence, advancements in formulation delivery systems, and competitive landscape evolution. This analysis dissects current market conditions, forecasts price trends, and provides strategic insights pertinent to stakeholders.

Market Overview

Global Market Size and Growth Trajectory

The global migraine therapeutics market, inclusive of triptans like sumatriptan, was valued at approximately USD 2.2 billion in 2022 and is projected to reach USD 3.4 billion by 2030, reflecting a compound annual growth rate (CAGR) of around 6%. Sumatriptan commands a substantial share owing to its status as the first-approved triptan and its widespread clinical familiarity.

Dominant Market Players

Key manufacturers include GlaxoSmithKline (GSK), Teva Pharmaceutical Industries, Sun Pharmaceutical Industries, and Novartis, among others. GSK historically maintained a robust market position via its branded sumatriptan products (e.g., Imitrex in the U.S.), although generics have increasingly gained prominence post-patent expiry.

Regulatory and Market Entry Barriers

Patents on certain formulations expired around 2018–2020, prompting a diversification of generic products. However, regulatory hurdles, quality assurance concerns, and patent protections on specific delivery systems continue to shape market entry barriers.

Therapeutic Alternatives and Competition

The market faces competition from other triptans (e.g., rizatriptan, zolmitriptan), CGRP antagonists (e.g., erenumab), and NSAIDs. These alternatives influence market share dynamics and pricing strategies.

Market Drivers

-

Increasing Migraine Prevalence: Approximately 1 billion people globally suffer from migraines, with prevalence rising proportionally to urbanization and lifestyle stress factors [1].

-

Enhanced Formulation Options: Innovations such as nasal sprays, autoinjectors, and combination therapies boost patient adherence and widen application scope.

-

Growing Awareness and Diagnosis: Increasing awareness campaigns and improved diagnostic criteria facilitate earlier and broader treatment adoption.

-

Healthcare Infrastructure Expansion: Developing economies with expanding healthcare infrastructure open additional markets.

Market Challenges

-

Pricing and Cost-Containment Pressures: Payers and governments exert downward pressure on drug prices, especially in price-sensitive markets.

-

Generic Competition: Post-patent expiry, generic options exert substantial price erosion on branded sumatriptan.

-

Side Effect Profile and Limitations: While generally effective, contraindications in cardiovascular patients limit universality.

Price Analysis and Projections

Current Pricing Landscape

Branded Products

In the U.S., the average wholesale price (AWP) for a single-dose (6 mg) injectable sumatriptan is around USD 40–50, translating to approximately USD 350–450 per month for a typical acute-use regimen (about 15 doses). The nasal spray variants typically retail at USD 30–40 per unit.

Generic Products

Generic sumatriptan offers prices as low as USD 10–15 per dose, with some market reports indicating monthly costs around USD 100–200.

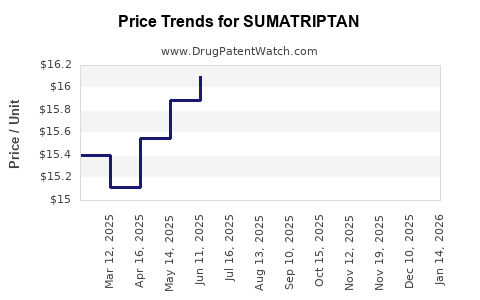

Pricing Trends and Influencing Factors

The expiration of period-specific patents has resulted in significant price erosion post-2018. The competitive landscape now features numerous generics, with prices expected to decline further due to market saturation and capacity expansion. Widespread adoption of combination devices (e.g., auto-injectors with built-in dose counters) may sustain premium pricing for advanced formulations, but price sensitivity remains a key driver.

Forecasts for the Next 5–10 Years

-

Branded Sumatriptan: Anticipated price stabilization or slight decline (1-2% annually), owing to market saturation and competitive pressures, with exceptions for differentiated delivery systems and formulations.

-

Generics: Prices are predicted to decrease by 10-15% annually for the foreseeable future, driven by increased generic competition and manufacturing efficiencies.

-

Impact of Biosimilars and Novel Delivery: Although biosimilars are unlikely for sumatriptan due to its small-molecule nature, innovations in nasal or autoinjector devices could command a price premium of 10-20% over standard generics.

Regional Variations

-

United States: Higher pricing due to complex insurance structures and high brand premiums; generics are widely accessible at lower prices.

-

Europe: Pricing varies by country, with government negotiations often leading to lower prices than the U.S.

-

Emerging Markets: Prices are significantly lower, with imports and local generics dominating.

Regulatory Outlook and Market Access

Regulatory agencies like the FDA and EMA continue to facilitate access to newer formulations and combination therapies, which may influence price dynamics. Cost-effective drug reimbursement schemes in developed countries are likely to pressure prices further, whereas emerging markets may adopt lower-cost generics faster.

Strategic Implications

-

Brand Versus Generic Strategies: Firms should invest in value-added features (e.g., novel delivery devices) to retain premium pricing, while generic manufacturers capitalize on price competition.

-

Innovation Focus: Development of combination formulations or improved delivery systems could sustain both market share and profitability.

-

Market Penetration: Emerging markets represent significant growth opportunities for cost-effective generic sumatriptan.

-

Pricing and Reimbursement Negotiations: Deep understanding of regional payer policies can optimize market access.

Key Takeaways

-

The sumatriptan market remains significant, buoyed by high migraine prevalence and expanding formulations.

-

Post-patent, prices for generics are declining sharply; branded prices are likely to stabilize but remain sensitive to competitive pressures.

-

Innovations in delivery systems could offer pricing premiums, but overall price erosion is inevitable due to commoditization of simpler formulations.

-

Regional disparities influence pricing, with developed markets maintaining higher prices through reimbursement and insurance schemes.

-

Strategic focus on both cost-effective generics and value-added branded products is essential for sustained profitability.

FAQs

1. How will patent expiries impact sumatriptan pricing?

Patent expiries have introduced extensive generic competition, leading to significant price reductions. Branded sumatriptan products may maintain premium pricing through formulation innovations, but the generic market will continue to exert downward pressure.

2. Are there emerging alternatives that could replace sumatriptan?

Yes. CGRP antagonists like erenumab and fremanezumab offer preventive options with novel mechanisms. While effective, they are generally more expensive and prescribed for prophylaxis rather than acute treatment, thus complementing rather than replacing sumatriptan.

3. What regional factors influence sumatriptan market prices?

Pricing varies based on regional healthcare policies, reimbursement structures, patent laws, and market maturity. Developed markets tend to have higher list prices with insurance coverage, whereas emerging markets favor low-cost generics.

4. What role do delivery system innovations play in the future pricing of sumatriptan?

Delivery innovations, such as nasal sprays with improved absorption or auto-injectors, can command premium prices due to increased convenience and efficacy, sustaining higher margins for branded products.

5. How is the COVID-19 pandemic affecting sumatriptan market dynamics?

The pandemic increased demand for telemedicine and home-based treatments, potentially boosting sales for user-friendly formulations. However, healthcare resource allocation and economic constraints may temporarily dampen pricing flexibility.

References

[1] Goadsby, P.J., et al. (2019). "Migraine: An update on clinical characteristics and management." The Lancet, 394(10209), 1740–1750.

[2] MarketWatch. (2022). "Global Migraine Therapeutics Market Size, Share & Trends Analysis."

[3] IQVIA. (2021). "Pharmaceutical Pricing & Market Trends."

[4] American Migraine Foundation. (2020). "Migraine Prevalence and Treatment Data."