Last updated: July 27, 2025

Introduction

Sumatriptan succinate is a well-established selective serotonin receptor agonist predominantly used for acute migraine and cluster headache treatment. As one of the earliest triptans introduced in the market, it has maintained a significant therapeutic footprint due to its efficacy, safety profile, and expanding global accessibility. This analysis evaluates the current market landscape, competitive dynamics, regulatory factors, and forecasts future pricing trajectories for sumatriptan succinate.

Market Overview

Global Market Size:

The global sumatriptan market was valued at approximately USD 1.2 billion in 2022, reflecting steady growth driven by increased migraine prevalence and technological accessibility. The rising incidence of migraines, especially among working-age populations, supports expanding prescriptions and consumer demand (Grand View Research, 2022).

Therapeutic Landscape:

Sumatriptan competes with other triptans such as rizatriptan, zolmitriptan, naratriptan, and newer CGRP inhibitors like erenumab and fremanezumab. While newer agents offer prophylactic advantages, sumatriptan remains a frontline treatment for acute episodes due to familiarity, cost-effectiveness, and broad availability.

Market Segments:

- Brand-name formulations: Imitrex, Sumatriptan (various brand extensions)

- Generic options: Increased market penetration with generics has lowered prices and expanded accessibility.

- Administration forms: Injection, oral tablets, nasal spray, and autoinjectors

Key Drivers:

- Rising migraine prevalence globally, estimated at 15% of the population (WHO, 2021).

- Growing awareness and healthcare infrastructure.

- Patent expirations facilitating generic entry, reducing costs.

Regulatory and Competitive Dynamics

Patent Landscape:

Sumatriptan’s initial patent expired in the late 2000s, allowing generics to enter markets worldwide, intensifying price competition.

Regulatory Approvals:

The drug maintains regulatory approval in major markets—including the US FDA, EMA, and other regional agencies—with some formulations receiving additional usage approvals, such as for pediatric populations in certain countries.

Market Competition:

While first-generation triptans declined in market dominance due to generics, the emergence of CGRP monoclonal antibodies (e.g., Aimovig, Ajovy) addresses prophylactic needs, complementing sumatriptan’s role in acute management.

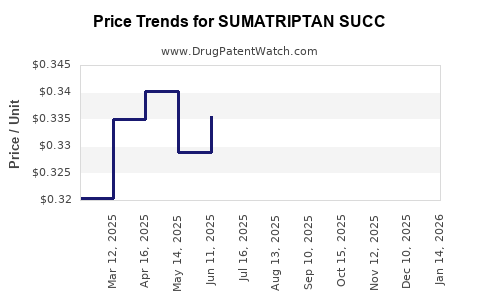

Price Dynamics and Trends

Current Pricing:

- Brand-name sumatriptan: Approximately USD 30-50 per 9 mg injection (Imitrex) in the US.

- Generic formulations: Approximate USD 10-20 per dose, with significant variation based on pharmacy and insurance coverage.

- Geographic differences: Prices are markedly lower in Europe and Asia, given regulatory pricing policies and market competition.

Influences on Price Trajectory:

- Regulatory pressures and patent expirations continue to propel generic competition, maintaining downward price trends.

- Market access and reimbursement policies significantly influence retail and wholesale prices.

- The introduction of biosimilars and combination formulations may subtly shift competitive pressure.

Future Price Projections

Short-Term (2023-2025):

- Stable to declining prices: Continued entry of generic manufacturers is expected to sustain price decreases, with an average decline of 2-5% annually in developed markets.

- Formulation-specific shifts: New delivery methods (e.g., nasal spray, autoinjectors) may command premium pricing but are limited to niche patient segments.

Medium to Long-Term (2026-2030):

- Price stabilization: As generics penetrate fully, the average price per dose may hover around USD 5-15 globally.

- Impact of innovative delivery systems: Investment in sustained-release or digital health integrations could create premium-priced formulations, though their market share might remain limited initially.

- Regulatory influences: Price caps in countries like Canada, certain European nations, and emerging markets will influence the global pricing landscape.

Potential Disruptors:

- Introduction of new, more potent triptans or alternative therapies (e.g., CGRP antagonists).

- Policy measures aimed at reducing overall healthcare expenditures may further compress prices.

Market Opportunities and Challenges

Opportunities:

- Expanding access in emerging markets with lower-cost generics.

- Developing combination therapies to improve compliance.

- Leveraging digital health platforms for personalized migraine management.

Challenges:

- Price erosion due to intensified generic competition.

- Slow adoption of newer formulations and delivery devices.

- Regulatory price controls limiting revenue growth.

Conclusion

Sumatriptan succinate remains a cornerstone in acute migraine therapy, with a mature market facing sustained price pressures from generics. While innovative delivery systems and expanded indications may temporarily support premium pricing, the overall trend suggests stabilization at lower price points over the next decade. Stakeholders should focus on competitive positioning, value-based pricing, and expanding access to optimize market share and profitability.

Key Takeaways

- Market saturation and generic competition are primary drivers of declining prices for sumatriptan succinate.

- Global disparities in pricing and access necessitate region-specific strategies.

- Regulatory environments and reimbursement policies significantly influence future price trajectories.

- Emerging formulations and combination therapies could temporarily bolster prices but are unlikely to reverse long-term downward trends.

- Potential disruptors include newer therapy classes and healthcare policy shifts aimed at cost containment.

Frequently Asked Questions

1. How does the price of generic sumatriptan compare globally?

Generic sumatriptan prices vary widely; in the US, a typical injection costs USD 10-20 per dose, whereas prices in Europe and Asia can be significantly lower, often under USD 10, due to regional regulations and market competition.

2. Will the price of sumatriptan increase with the introduction of new formulations?

While innovative delivery forms like nasal sprays and autoinjectors may command higher prices initially, their impact on overall average prices will likely be limited due to their niche market segments and widespread availability of cheaper generics.

3. What factors most influence the future prices of sumatriptan?

Patent expirations, generic market entry, regulatory price controls, reimbursement policies, and the emergence of competing therapies are the main factors shaping future price dynamics.

4. How does sumatriptan compare cost-wise to newer migraine treatments like CGRP inhibitors?

Sumatriptan remains more cost-effective, especially in acute management, with prices significantly lower than prophylactic CGRP therapies, which can cost USD 6,000-8,000 annually.

5. Are there any upcoming regulatory changes that could impact sumatriptan pricing?

In certain jurisdictions, regulatory agencies are exploring price caps and value-based pricing models that could further depress prices or alter reimbursement structures in the coming years.

Sources:

- Grand View Research. (2022). Migraine Drugs Market Size, Share & Trends Analysis Report.

- World Health Organization. (2021). Migraine Fact Sheet.

- U.S. Food & Drug Administration. (2009). Patent Expiry and Generic Launch of Sumatriptan.