Share This Page

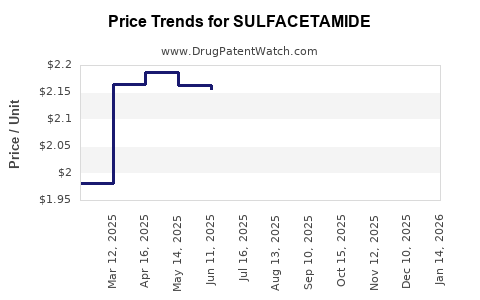

Drug Price Trends for SULFACETAMIDE

✉ Email this page to a colleague

Average Pharmacy Cost for SULFACETAMIDE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SULFACETAMIDE-SULFUR 10-5% CRM | 42192-0149-02 | 0.61797 | GM | 2025-12-17 |

| SULFACETAMIDE SOD 10% TOP SUSP | 45802-0896-26 | 0.68541 | ML | 2025-12-17 |

| SULFACETAMIDE-SULFUR 9-4% WASH | 42192-0121-16 | 0.36956 | ML | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Sulfacetamide

Introduction

Sulfacetamide, a broad-spectrum sulfonamide antibiotic, has been a staple in ophthalmic and dermatological treatments. Widely used to combat bacterial infections like conjunctivitis and certain skin conditions, it has established a niche within antimicrobial therapy. Despite the advent of newer antibiotics, sulfacetamide maintains relevance due to its efficacy, cost-effectiveness, and longstanding FDA approval. This analysis explores the current market landscape, competitive positioning, regulatory outlook, and price trends for sulfacetamide, providing strategic insights for stakeholders.

Market Landscape Overview

Global Market Dynamics

The global antimicrobial agents market is projected to reach USD 148.4 billion by 2027, growing at a CAGR of 3.8% from 2020 to 2027 [1]. Within this ambit, ophthalmic and dermatological segments retain notable shares, driven by rising prevalence of infections, dermatological disorders, and aging populations. Sulfacetamide predominantly caters to these sectors, especially in topical and ophthalmic formulations.

Therapeutic Applications and Demand Drivers

- Ophthalmic Use: Sulfacetamide eye drops are frequently prescribed for conjunctivitis, keratitis, and blepharitis. The rising incidence of bacterial conjunctivitis, especially amid increased screen time, impels consistent demand.

- Dermatological Use: Topical sulfacetamide is effective for acne vulgaris, rosacea, and seborrheic dermatitis. The expanding consumer focus on skincare and the high safety profile bolster market interest.

- Cost and Access Factors: As an off-patent, generic medication, sulfacetamide remains affordable, gaining favor in emerging markets and regions with limited healthcare budgets.

Manufacturing and Supply Chain

Major pharmaceutical companies and generic drug producers dominate sulfacetamide manufacturing. Its synthesis involves straightforward sulfonamide chemistry, ensuring stable supply chains. Patent expirations have catalyzed generic proliferation, intensifying market competition but exerting downward pressure on prices.

Regulatory and Patent Status

Sulfacetamide has long been approved by regulatory agencies globally; notably, the FDA approved it for ophthalmic use in the 1940s. The absence of recent patent protections means market control primarily resides with generic manufacturers. Nonetheless, regional regulatory variations influence market access and pricing strategies, particularly in jurisdictions with stringent clinical documentation requirements.

Competitive Landscape

Major Players

- Sanofi-Aventis: Historically supplied sulfacetamide ophthalmic formulations.

- Generic Manufacturers: Numerous companies in India, China, and other developing regions produce over-the-counter and prescription formulations.

- Emerging Biosimilar and Combination Products: Development of combination medications with other antibiotics or anti-inflammatory agents is an ongoing trend, potentially impacting standalone sulfacetamide demand.

Market Penetration and Product Differentiation

Due to its age and patent status, product differentiation largely hinges on formulation convenience, preservative-free options, and packaging innovations. Marketing strategies focus on affordability, safety, and established efficacy profiles.

Pricing Trends and Future Projections

Historical Price Trends

Since patent expiry and the proliferation of generics, sulfacetamide’s price has seen a significant decline. In developed markets like the US, the average retail price has dropped from approximately USD 20–30 per bottle (for ophthalmic solutions) a decade ago to around USD 5–10 today [2].

In contrast, in emerging markets, price points often hover below USD 2, reflecting market competition and regulatory policies favoring low-cost generics.

Factors Influencing Future Price Trajectories

- Market Saturation: Intensified generic competition is likely to sustain downward price pressure.

- Regulatory Changes: Simplified approval pathways in some regions could introduce new generic entrants, further reducing prices.

- Formulation Advances: Development of preservative-free or combination products might command premium pricing, but in general, cost competition prevails.

- Demand Stability: Continued need in ophthalmology and dermatology supports steady demand, preventing sharp price declines due to obsolescence.

Projected Price Range (2023–2030)

- Developed Markets: Anticipate stabilization around USD 3–8 per unit for ophthalmic formulations, with minor variations based on brand and formulation.

- Emerging Markets: Prices are expected to remain near USD 1–2 per unit, driven by robust generic competition and price sensitivity.

- Premium/Novel Formulations: Specialty products or combination therapies could command higher prices, upwards of USD 20, but constitute a niche segment.

Market Opportunities and Risks

Opportunities

- Expansion into Underpenetrated Markets: Increasing healthcare infrastructure and awareness in Africa, Southeast Asia, and Latin America present growth potential.

- Product Innovation: Shifting focus toward preservative-free, combination, or once-daily formulations can create premium offerings.

- Regulatory Approvals for New Indications: Expanding authorized uses can drive demand, especially if approved for antimicrobial-resistant infections.

Risks

- Pricing Pressure from Generics: The commoditized nature of sulfacetamide limits premium pricing.

- Competition from Newer Antibiotics: Resistance patterns favor newer agents like fluoroquinolones, potentially reducing the use of sulfacetamide.

- Market Saturation: Excess supply could depress prices further, especially if patent protections are uncertain or regionally limited.

Conclusion

Sulfacetamide remains a cost-effective and proven antimicrobial agent within ophthalmic and dermatological domains. Its market is characterized by widespread generic competition, stable demand, and decreasing prices, especially in mature markets. Future price trajectories are expected to stabilize at low levels, with minor variations driven by formulation innovation and regional market dynamics. Stakeholders should focus on innovative formulations and penetration into emerging markets to capitalize on growth opportunities, while remaining vigilant of competitive and regulatory developments that influence pricing and market access.

Key Takeaways

- Market Stability: Sulfacetamide’s established efficacy ensures continued demand in ophthalmology and dermatology.

- Price Decline Trajectory: Historical data indicates ongoing price reductions due to generic competition; prices are projected to stabilize at low levels.

- Opportunities for Innovation: Development of preservative-free, combination therapies, and formulations catering to regional preferences can command premium pricing.

- Regional Expansion: Emerging markets present significant growth potential, driven by lower prices and improving healthcare infrastructure.

- Competitive Edge: Cost leadership and formulation differentiation are pivotal for manufacturers to succeed in the saturated sulfacetamide landscape.

FAQs

1. What factors influence the price of sulfacetamide globally?

Market competition, regional regulatory policies, formulation innovations, and demand stability primarily dictate sulfacetamide prices. The widespread availability of generics exerts significant downward pressure, especially in mature markets.

2. Are there emerging formulations that could impact sulfacetamide prices?

Yes. Preservative-free formulations, combination products with other antibiotics, and once-daily dosing variants can potentially command higher prices, though their impact remains localized within niche segments.

3. How does patent status affect sulfacetamide pricing?

Sulfacetamide's patent expiration enables multiple manufacturers to produce generic versions, leading to increased competition and lower prices.

4. Which markets present the greatest growth opportunities for sulfacetamide?

Emerging markets in Africa, Southeast Asia, and Latin America offer substantial growth potential due to increasing healthcare access and demand for affordable antimicrobials.

5. What are the main risks facing the sulfacetamide market?

Risks include shifting treatment paradigms toward newer antibiotics, market saturation, regulatory hurdles in certain countries, and potential resistance development diminishing its efficacy.

Sources:

[1] MarketsandMarkets, "Antimicrobial Antibacterials Market," 2022.

[2] GoodRx, "Sulfacetamide ophthalmic solution prices," 2022.

More… ↓